Form 433A-OIC Guide: Filling It Out Completely

Updated 4/4/2016 to include the updated IRS Collection Financial Standards

Updated 6/17/2016 to include updated 2016 Version of Form 433-A(OIC)

Updated 5/21/2017 to include updated 2017 Version of Form 433-A(OIC)

Updated 06/06/2018 to include updated 2018 Version of Form 433-A(OIC)

Updated 4/3/2019 to include updated 2019 Version of Form 433-A(OIC)

Updated 5/15/2021 to include updated 2021 Version of Form 433-A(OIC)

Updated 7/15/2022 to include updated 2022 Version of Form 433-A(OIC)

Updated 12/13/2023 to include updated 2023 Version of Form 433-A(OIC)

This will be a guide on how to fill out Form 433-A (OIC), which is required for you to submit a personal Offer in Compromise to the IRS. This is part of our guide on How To Do Your Own Offer In Compromise. This form would be accompanied by Form 656. Both come in the IRS Form 656 Booklet. Please note that some of the IRS collection financial standards numbers do change over time, and this guide was last updated on December 13, 2023.

Form 433-A (OIC) is part of the Form 656 Booklet and is the more complex form in the booklet for personal tax issues. There is also a 433-B (OIC) form but this is only needed for business Offers In Compromise that are not sole proprietorships. We will go through it step by step, section by section.

“N/A” for Not Applicable should be used for any sections that are not applicable to you. The IRS agent reviewing your forms will know that you address that section and it is not applicable to you as opposed to them asking for more information.

If you have started to fill out these forms and they seem confusing and complex even after reading this guide, call our office at (888) 515-4829, and we can take care of everything for you.

Below you can see the video version of this guide with some commentary from one of our expert tax attorneys.

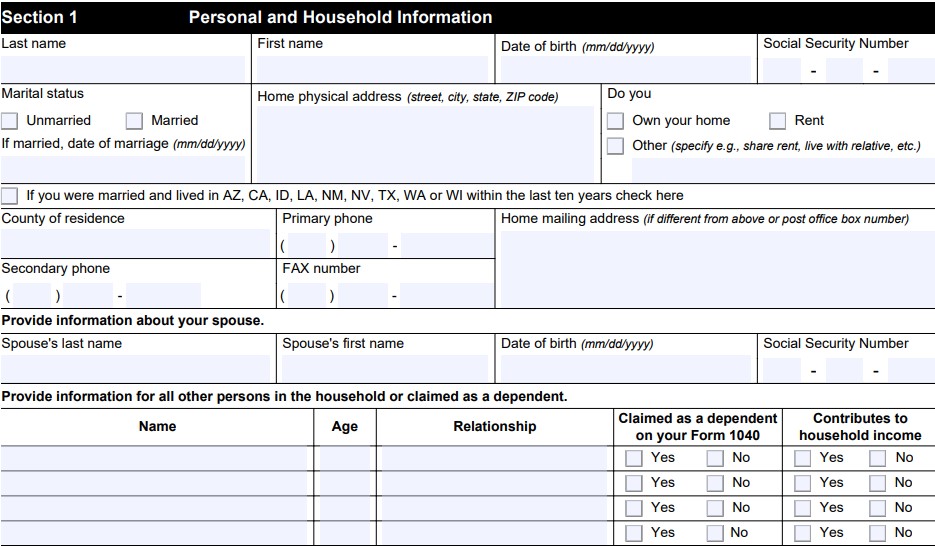

Section 1: Personal and Household Information

This section is very straightforward. Fill out the information regarding yourself and person living in your household. Make sure to list anyone claimed as a dependent on your tax return. This will result in the IRS allowing more expenses and accepting a lower offer.

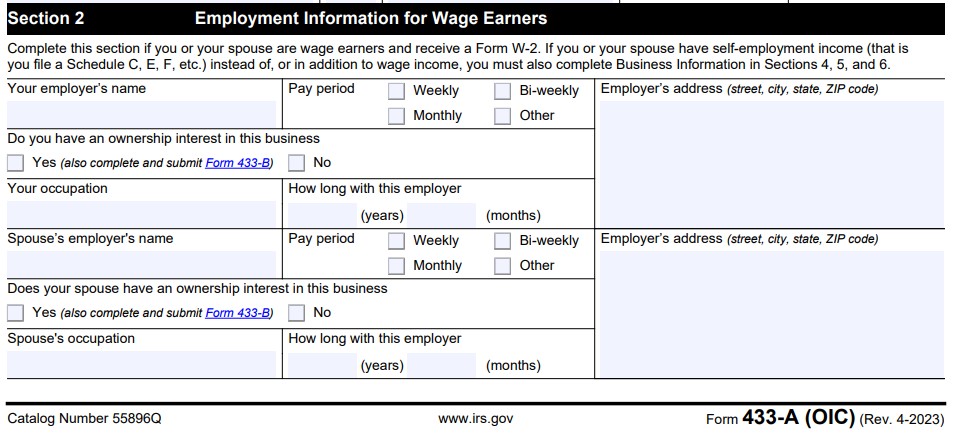

Section 2: Employment Information for Wage Earners

Enter all information regarding you and your spouse’s employer. If you are married and one spouse does not work, specifically list “N/A” in the section where you would list your spouse’s employment.

If you are self-employed, simply write “Self-Employed” at the top of this section and go to the next. Your information will be filled in later.

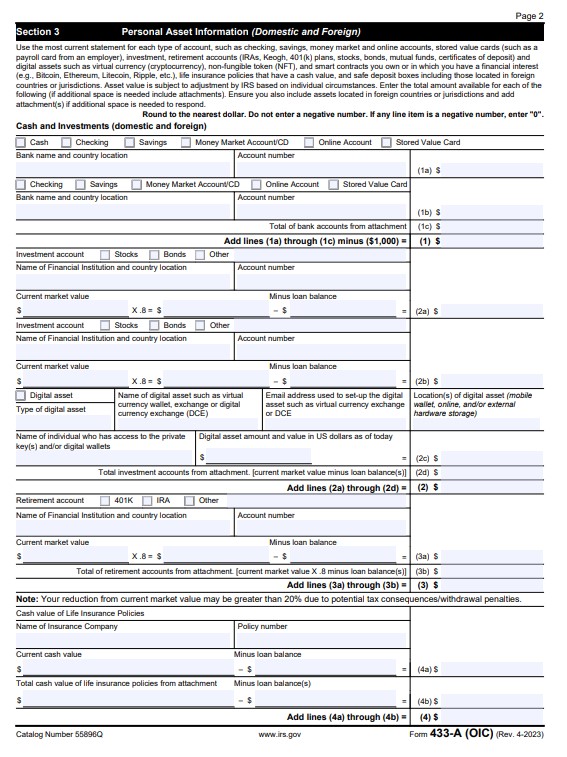

Section 3: Personal Asset Information

Cash and Investments, also known as Bank and Retirement Accounts

Fill out the details for all bank accounts, investment accounts, retirement accounts, and insurance policies that have a cash value. If your total tax debt is less than the value of 80% of your total retirement and investment accounts you probably will not get a settlement. Make sure to deduct loans against those accounts from the value also. There are some exceptions. One is if you cannot access the retirement account while you are working. Contact a tax attorney for more information.

If your total bank account balances, minus $1,000, are more than the settlement amount, you are almost certain to not get a settlement. Submitting the form could just extend the time the IRS has to collect against you, and you should consult a tax attorney prior to sending in an Offer in Compromise.

You will see the calculation in the form of valuing all your assets at 80%. This is because the IRS uses “quick sale” value. They assume you would get about 80% value for selling something quickly.

Fill out your bank names, and account numbers, and check the account type in the first two parts of this section.

For lines 1(a) and 1(b), list your actual bank balances, rounded up to the nearest dollar. If you have more bank accounts make a separate attachment to add to the OIC. Write on the top “SECTION 3 ATTACHMENT” and list the same information you listed for your other bank accounts on this page. If there are any additional bank accounts add their total on line 1(c). Then on line (1) write the total of all your bank account balances minus $1,000. If you have no bank account, write None. We differentiate this from the N/A we use in other sections.

In the second two parts of this section, you will fill in your Investment Account financial institution name and account numbers. If you do not have any investment accounts just write N/A. Check off the type of account. Then enter the current market value, then 80% of the current market value, and finally the leftover equity in lines 2(a) and 2(b).

If you have more investment accounts make a separate attachment to add to the OIC. Write on the top “SECTION 4 ATTACHMENT” and underneath it “INVESTMENT ACCOUNTS” and list the same information you listed for your other investment accounts in this section. If there are any additional investment accounts add their Value x 0.8 – Loan Balances (available equity) on line 2(c). Then on line (2) write the total of all your investment accounts.

The third subsection is retirement accounts. If you do not have any retirement accounts just write N/A. Check off the type of account. Then enter the current market value, then 80% of the current market value, and finally the leftover equity in lines 3(a) and 3(b). If you are unable to withdraw from retirement before you leave your employer, make sure to notate this in your cover letter. Also, include written proof from your employer or fund management company that you are unable to withdraw from it.

If you have more retirement accounts add them to the same “SECTION 4 ATTACHMENT” page mentioned above, and make another subsection labeled “RETIREMENT ACCOUNTS” and list the same information you listed for your other retirement accounts in this section. If there are any additional retirement accounts add their Value x 0.8 – Loan Balances (available equity) on line 3(c) (80% of value minus loans against it). Then on line (3) write the total of all your retirement accounts.

The last subsection is for life insurance. If you do not have life insurance put N/A. In the case you have life insurance, enter the name of the insurance company and the policy number. If you have term life insurance, there is generally no cash value. Term life insurance is what most people have and pays out only if you die. Whole life insurance has a cash value that is cashable while you are alive and is what the IRS is looking for.

Enter in the cash value of your life insurance if it is whole life insurance. Enter the amount of any loans against it, $0 if nothing. Then on line 4(a) enter the available cash from the policy. If you have a second policy do the same in the area below the first life insurance policy, and put the available equity on line 4(b). Put the total equity for all whole life insurance policies online 4. Follow the same attachment procedure if needed.

It is recommended to only get a term life insurance policy before you apply for an Offer In Compromise or if you decide to get life insurance while your OIC is pending.

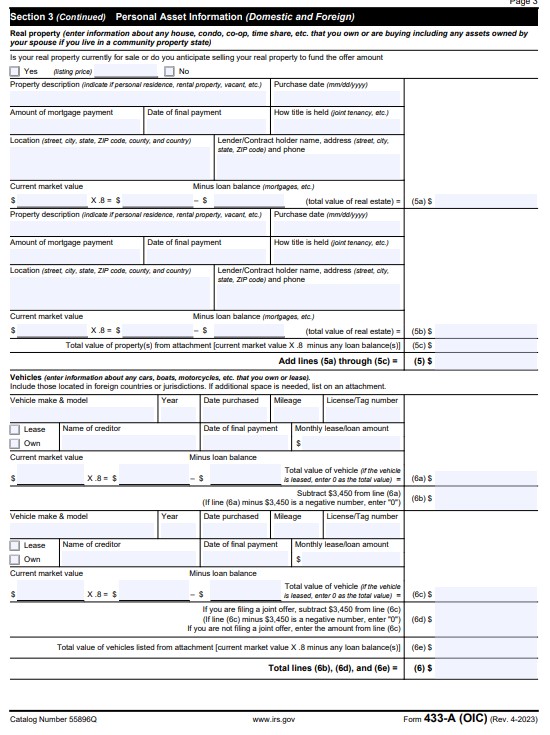

Real Estate

After line (4), you will come to the Real Property section. If you rent and have no real property, write “N/A” for this section. If you do have real property fill out the figures and the IRS will assess your equity based on 80% of the property’s actual value, minus any mortgages on the property. The total equity of your real estate will be put into the sections to the right. These figures will then be totaled online (5).

If your real estate equity exceeds your tax balance when the real estate is valued at 80%, you may likely not get a settlement. You should contact a tax attorney for further guidance. We have had some exceptions to this rule. A good example is a case we had where the client was close to retirement age. We argued that if he sold his home he would not get a substantial sum. In turn, he would only be able to afford the rent for a couple of years before being unable to afford a place to live. The IRS did not consider his paid-off home in the settlement.

Vehicles

The vehicle section is similar to the property section. I recommend inputting the trade-in value of your vehicle. This can be found using kbb.com or edmunds.com. I recommend using whichever figure is the lowest. If you have a payment on your vehicle, usually you have no equity. If it is a lease, there is no equity by default. You will also be asked to input your mileage as well. These figures will be put into the columns next to each vehicle, and the total equity in vehicles will be input into line (6).

Pro Tip: Sometimes the IRS will argue that your car payment is about to drop off so you can pay more towards the settlement. A good counterargument is a car will then have high mileage, be unreliable, and needs to be replaced.

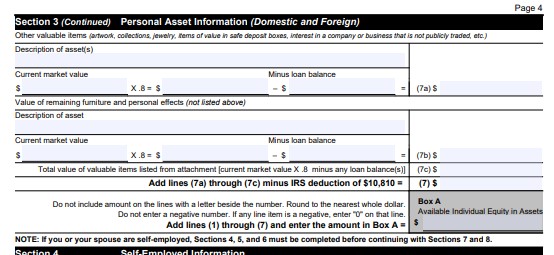

Other Valuable Items

This final section of personal asset calculation is left blank for most clients. Unless you have something specifically of high value (ie: a watch worth more than $10,000, a paid-off RV, etc), just write N/A in this section. If there is any equity here, input this into line (7).

Box A: Available Individual Equity in Assets

Add the totals up from line (1) through line (7), and enter them into Box A. If this amount exceeds your total tax due, you will most likely not qualify for an Offer in Compromise.

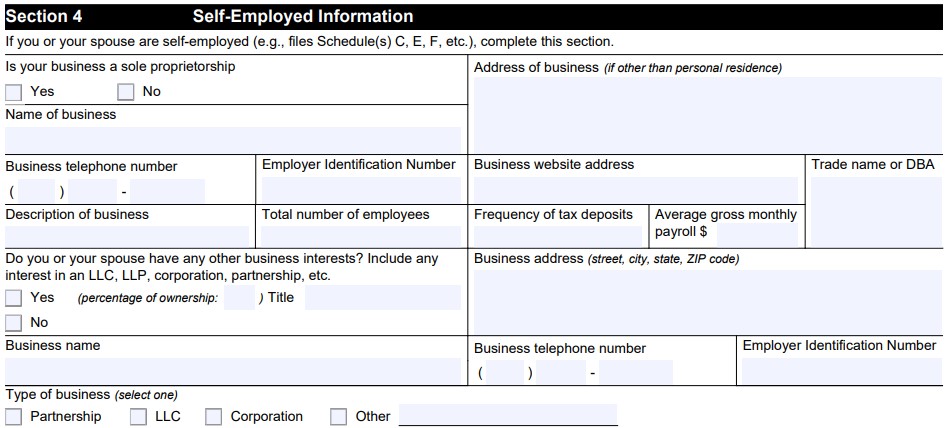

Section 4: Self-Employed Information

Only fill out this section if you or your spouse is self-employed. You may not have an EIN, and if so put “N/A.” Also if you do not have any employees, mark “N/A” in the Frequency of Tax Deposits section.

If you are self-employed it is strongly recommended to have a tax attorney handle your case unless you have extremely low income. The IRS looks much harder at self-employed cases and they are more difficult to get accepted. However, if you cannot afford an attorney it is still recommended to submit a settlement. Make sure to keep up on estimated tax payments.

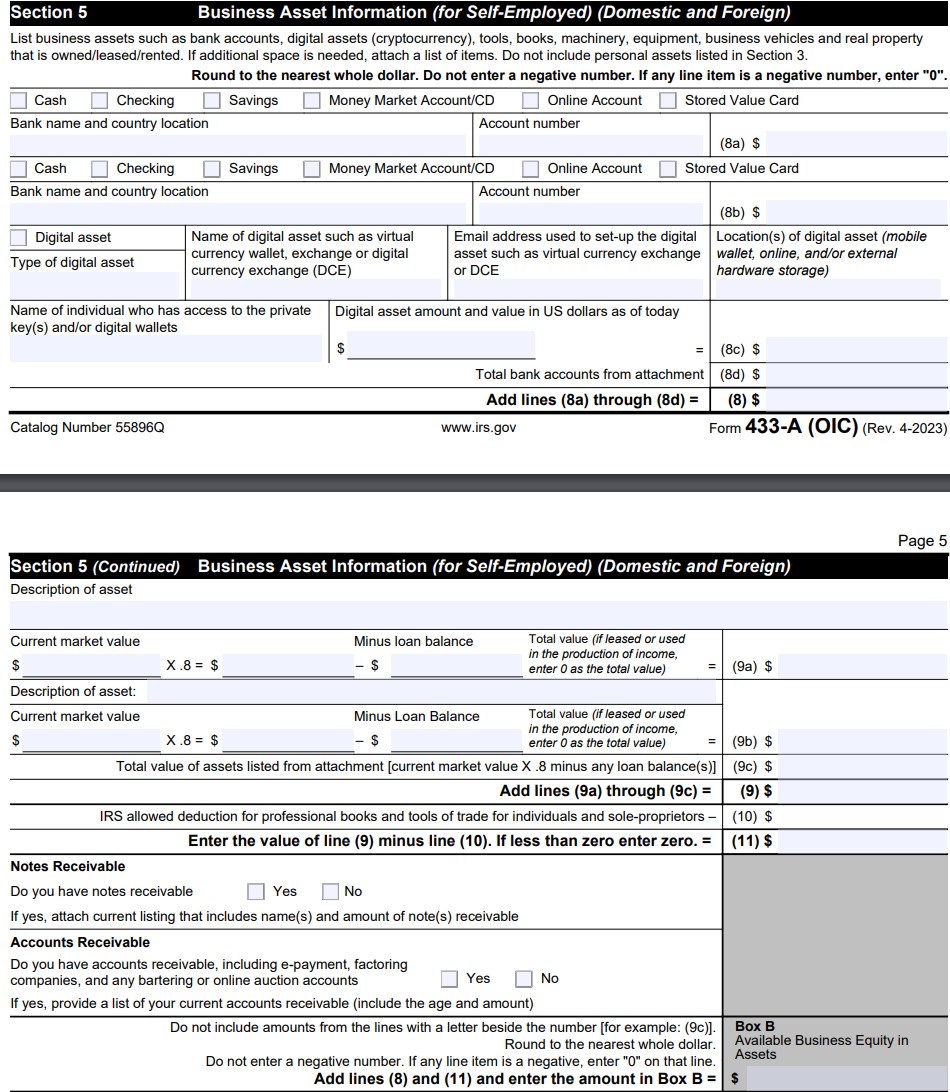

Section 5: Business Asset Information (for Self-Employed)

Line 8 – Business Bank Accounts

In this section, you will fill out your business bank account and assets information. For bank accounts, only put your business bank accounts if any. If you are self-employed and have been using your personal bank account up until this point, go get a business bank account. The IRS hates to see you mix business and personal, and it’s much easier for the IRS to process your offer when the business expenses are separate.

If you have more than two bank accounts, to the same “SECTION 5 ATTACHMENT” page mentioned above, and make another subsection labeled “BUSINESS BANK ACCOUNTS” and list the same information you listed for your other business bank accounts in this section. List the total of the bank accounts for this attachment in c.

Add up the total of your business bank accounts and enter the total from boxes a, b, and c, in Box 8.

Line 9 – Business Assets

As for business assets, only include assets of substantial value as in vehicles, real estate, or machinery. Put the value at $0 if those assets are used to produce income for the business (this applies to almost all business assets in most cases). Do not include basic office fixtures like desks or computers. If there are any assets that are not used to make income input those as well. Put the figure at 80% of their values.

If you have more than two bank business assets, to the same “SECTION 5 ATTACHMENT” page mentioned above, and make another subsection labeled “BUSINESS ASSETS” and list the same information you listed for your other business assets 9a and 9b in this section. List the 80% value of the business assets for this attachment in 9c. Add lines 9a, 9b, and 9c together and put that figure on line 9. Subtract $4,600 (Update: this was lowered from $4,650 in 2016) from line 9 and input that figure on line 11. If it is a negative number, put zero.

Accounts Receivable and Notes Receivable

Many businesses will not have accounts or notes receivable, so just check no if you do not. If you have notes and accounts receivable, attach a list of each to the back of the 433-A (OIC) once you have completed it, and make sure it is labeled at the top of the page. If you only have one type attach only that type. This is the IRS’ determination of your Available Business Equity in Assets.

Box B: Available Business Equity in Assets

For this box add up line 8 and line 11 and enter the total in Box B.

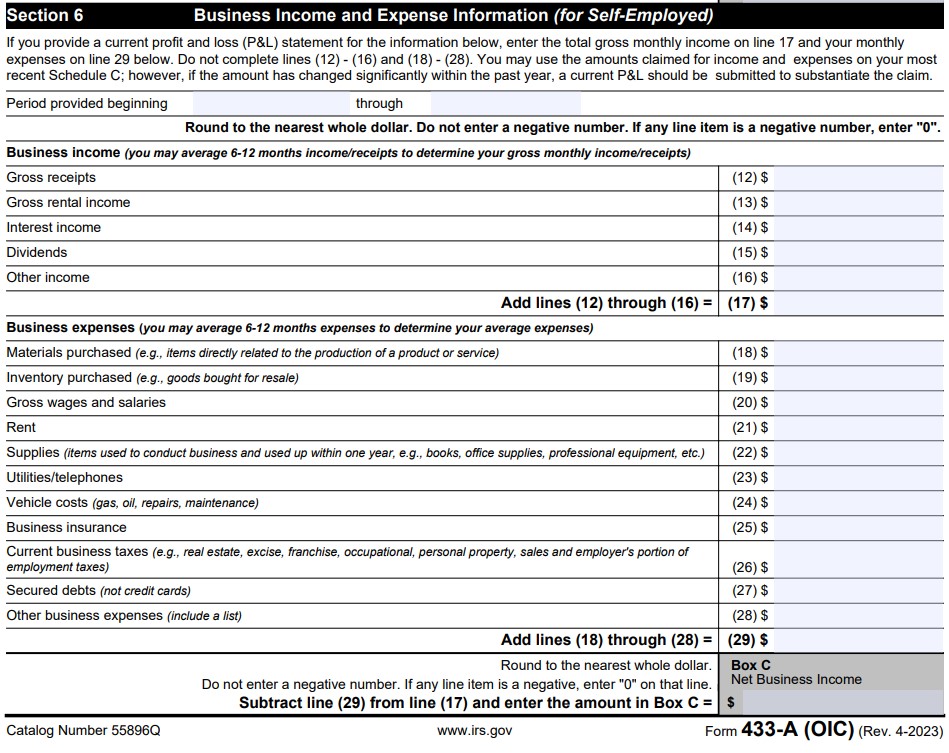

Section 6: Business and Expense Information (For Self-Employed)

There are two simple ways to complete this section:

1) Input the figures from your Schedule C on your most recent tax return.

2) If you are making less money recently, do a profit/loss statement for the last 6 months or 12 months, whichever shows more favorable figures to you. Divide the income and expense figures into monthly amounts. Enter total gross monthly income on line 17 and total monthly expenses on line 29.

After completing 1 or 2, subtract line 29 from line 17 and enter this figure in Box C. Box C should show your net business income on a monthly basis.

Pro Tip: It’s best to use whichever shows lower-income, however, if you already can get a settlement using Schedule C, just use that and save yourself the time of making a new Profit/Loss statement. Keep in mind the IRS might ask for an update on your financials at a later date. This usually does happen in self-employed tax cases. If you show more income, you might not get a settlement or get a higher one.

Box C: This should show your monthly profit from self-employment.

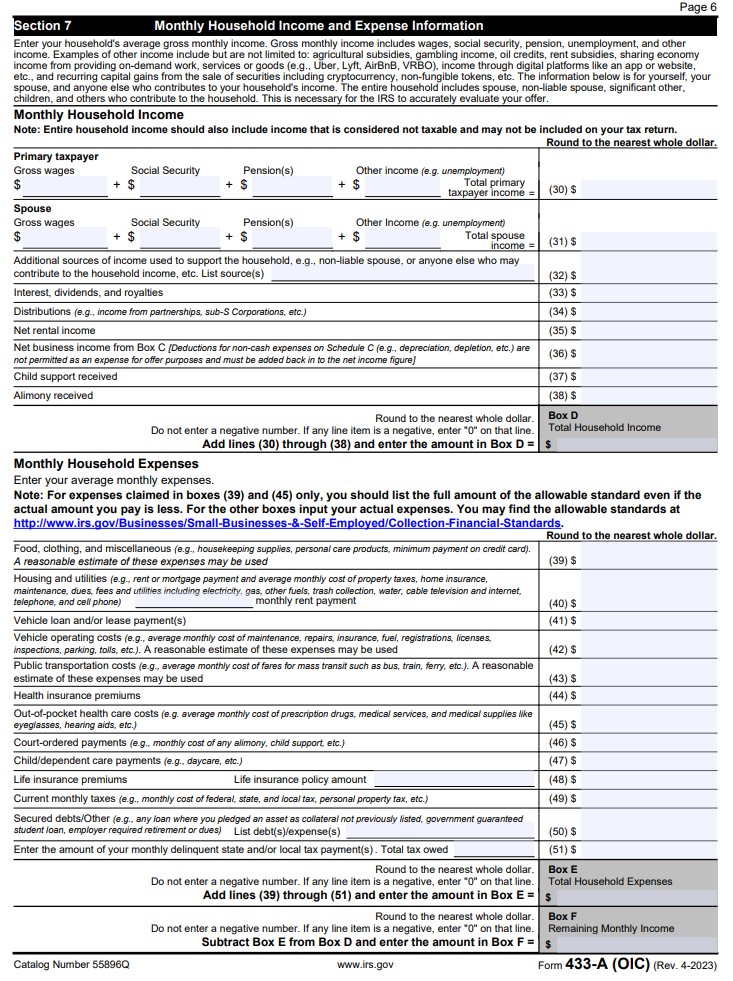

Section 7: Monthly Household Income and Expense Information

In this section fill out income in the corresponding sections. Make sure to add in addition to employment income, income from any Child Support or Alimony that is received. The total income figure for the household will be put into Box D. You want to enter the income received on a monthly basis.

To figure your monthly wages, if you are paid bi-weekly, multiply the gross amount paid by 2.167. If you are paid weekly, multiply the gross amount paid by 4.33.

If you are paid by wages and your pay varies, use year-to-date figures on the paycheck to figure your monthly payments. For example, Your year-to-date payments total $10,000 and the final workday for that pay period was 3/5/2016. March 1-5 is 16% of a month (5 days out of 31). Therefore you would take $10,000 divided by 2.16 and get per month wages of $4,629.63 per month to be entered as monthly wages. You would use the same 2.16 figure to also find out what you pay monthly for taxes.

Add the total of all your monthly incomes and enter the figure in Box D.

Now the following subsection can be more tricky. The IRS is going to use pre-determined figures for many items, so we will go line by line through this section.

Food, Clothing, and Miscellaneous: Input the IRS figures for this item found here. This should be based on how many persons are living in your household. If you have higher food costs due to gluten-free or an allergy, or something similar, use your actual food costs. Otherwise input the IRS amount based on the number of people claimed as dependents, including yourself. Make sure to include a doctor’s note with your offer stating why you need more expensive food if you are claiming above the IRS Collection Financial Standards amount. Put the total figure in the column on the right.

Housing and Utilities: Put your actual housing and utility costs. Double-check this item with the IRS’ National Standards, which can be found here. In the case the IRS housing and utility figures are very close to your own, go ahead and use the IRS figures. If your home expenses are much higher, use your actual figures. If you are using your own figures that are more expensive than the IRS, attach proof to your offer. Proof of a lease agreement or mortgage statement, and copies of utility bills for the last three months. Put the total figure in the column on the right. If your expenses are lower than what the IRS sets as the standard, this is one section you should put your own figures.

Vehicle Loan and/or Lease Payments: Put your actual figures here. If your car payment is over $471 per vehicle, include proof of payment for the last three months with your offer. Put the total figure in the column on the right.

Vehicle Operating Cost: Fill in this figure based on your county. This data can be found here.

Pro Tip: If you spend more than the IRS figure, list proof of the higher expense. If you drive far for work, include a copy of a map showing how far you drive using Google Maps. Put the total figure in the column on the right.

Pro Tip: If your vehicle has more than 75,000 miles or is over 6 years old, add an additional $200 per month per vehicle as an expense. The IRS accepts this due to the additional maintenance that may be needed on older cars. However, they may only accept one vehicle per spouse, unless you can prove a work purpose for the vehicle. I will submit offers with expenses for all vehicles, sometimes the IRS just accepts them as is.

Public Transportation Costs: For each person in your household using public transportation, input $173 on the column on the right.

Health Insurance Premiums: Input your actual amount paid for health insurance. If it is deducted from your paycheck, and you are paid bi-weekly, multiply the figure by 2.15 and input. If the items are not deducted from your paycheck, make sure to include proof of payment for the last three months and a copy of your most recent health insurance statement. In the case it is deducted from your paycheck, the IRS will see it with the other information you are going to send in with Form 433(A) OIC. Put the total figure in the column on the right.

Out of Pocket Healthcare Costs: Add $49 for each person in your household under 65, add $117 for each person over 65. These are the figures as of 5/21/2017. See here for the most updated figure to input. The IRS gives you these figures whether or not you actually spend that much. If you spend more add up the average amount spent monthly over the last 3 months, 6 months, or 12 months, whichever figure is more favorable to you. Then include copies of proof of payment for that time period you choose. Put the total figure in the column on the right.

Court Ordered Payments: Add any payments you are making that are under a court order. Judgments, bankruptcy payments, spousal support, child support, restitution, or any other type of payment which is ordered by the court. Put the total figure in the column on the right. Make sure to include proof of the court order with your OIC.

Child/Dependent Care Payments: Figure out your average monthly expense on child care. If you are paying for any elderly care, that should be included as well. Put the total figure in the column on the right. Generally private school is not accepted as an expense. However, if the child stays at the school longer than they would at public school you can argue that it’s essentially paying for child care services you would have had to pay anyway to try and get this included.

Life Insurance Premiums: Input the actual amount paid for life insurance on a monthly basis on the column in the right. If life insurance is not deducted from your pay stub, make sure to include a copy with your settlement package.

Current Monthly Taxes: Figure out the total amount of taxes you pay out monthly for federal income tax, state income tax, medicare, social security, and personal property tax (if applicable). If you are salaried at the same consistent rate and paid bi-weekly, simply multiply your taxes taken out by 2.167, and input that figure. If your pay varies, figure out the average paid by using the year-to-date figure for your total taxes on your last paystub and include that figure using the same division method used to figure your monthly income mentioned above.

In the case of self-employed, input the amount you pay for estimated tax payments on a monthly basis. If paid quarterly, divide by 4 and input that figure. If you are not yet paying estimated tax payments and are self-employed, get that started before you submit your offer or the IRS will reject it. We recommend our clients to pay monthly even if they had previously paid quarterly, at least while your settlement is pending. See our guide on how to make estimated tax payments.

Secured Debts: Input payments made monthly to any secured debts (ie: Student Loans or anything else that is secured). Credit cards would not be input here.

Delinquent State and Local Tax Payments: Input the monthly amount you are paying back due to state or local taxes (Could be income taxes, sales taxes, or others). If you owe both the IRS and State, sometimes it is better to set up the state in a payment plan first, then submit a settlement an IRS Offer In Compromise. It is advised to consult a tax attorney regarding this if you owe both the IRS and State.

Box E

You are going to add up all the Section 7 expenses and input them into Box E.

Box F

Subtract Box D (total household income) from Box E (total household expenses). Input this figure into Box F. If it is a negative figure, input a zero. If this figure is not zero, go back and think if there are any other legitimate expenses you can add. It is ideal to submit a settlement with this figure being 0. This will get you the lowest dollar amount settlement.

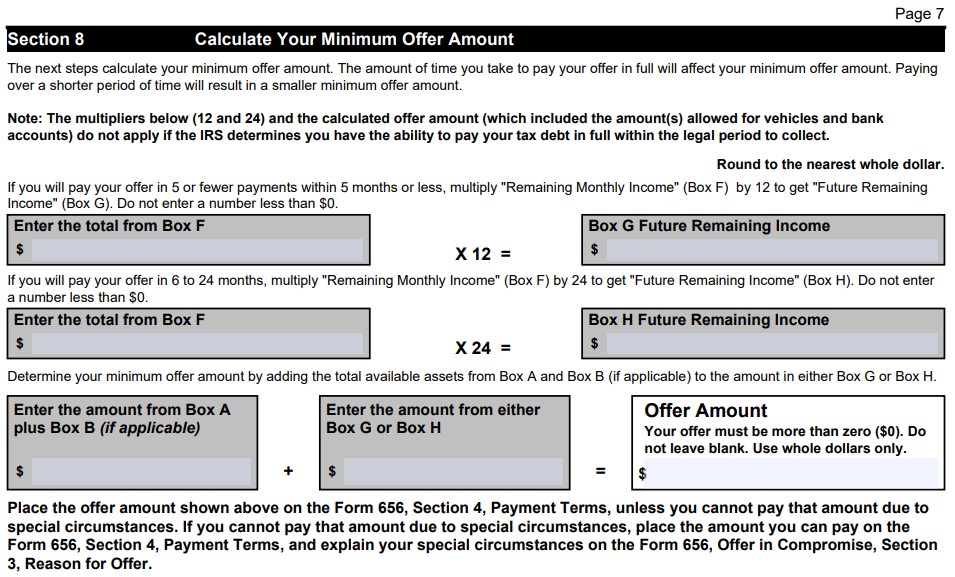

Section 8: Calculate Your Minimum Offer Amount

You will be given two options to calculate your offer. If you are to pay it off within 5 months, you will input the total from Box F, multiply by 12, and you are given a figure which should be input into Box H. If you are to pay if off within 2 years, the total from Box F will be multiplied by 24 and put into Box G.

You then will add the total from Box A to either the total from Box G or Box F. This will equal your total offer amount. My goal in doing these offers is to try and get Box F to zero dollars, so the multiplier is then $0, and then submit for a settlement that is paid off in five (5) months, rather than 24 months.

If all figures come out to $0, I will input the offer for $100. Some IRS agents “won’t accept an offer for $100” although I have settled debts over $100,000 for $100. The amount your offer gets settled for is mostly based on financials and partially based on how picky the IRS examiner is that is assigned. However, it is always better to submit a lower offer higher, rather than get stuck with paying more unnecessarily.

You probably will not get an IRS Offer In Compromise if your potential settlement figure is larger than your tax balance.

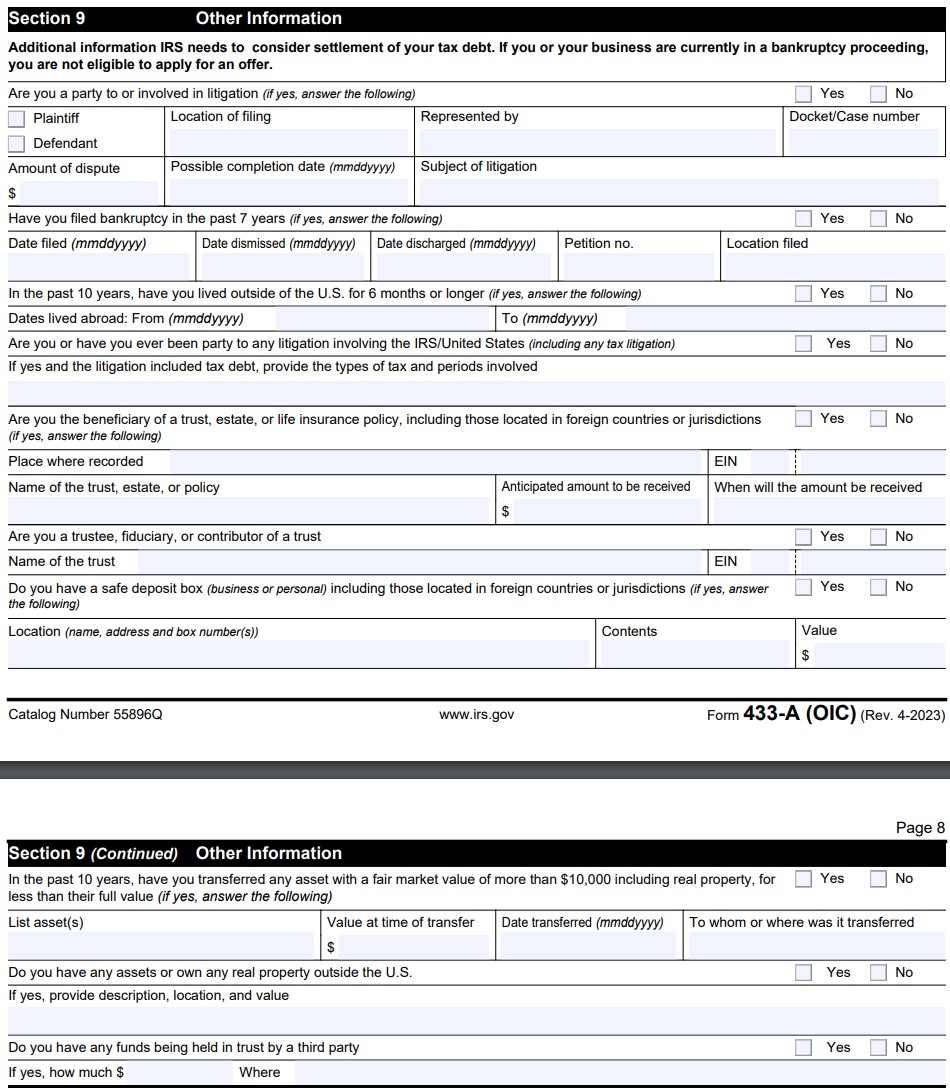

Section 9: Other Information

These are simple questions you should answer yes/no to and fill out any corresponding information. If you were in bankruptcy and do not have all the details, just write “info unavailable” in that section and the IRS usually accepts that.

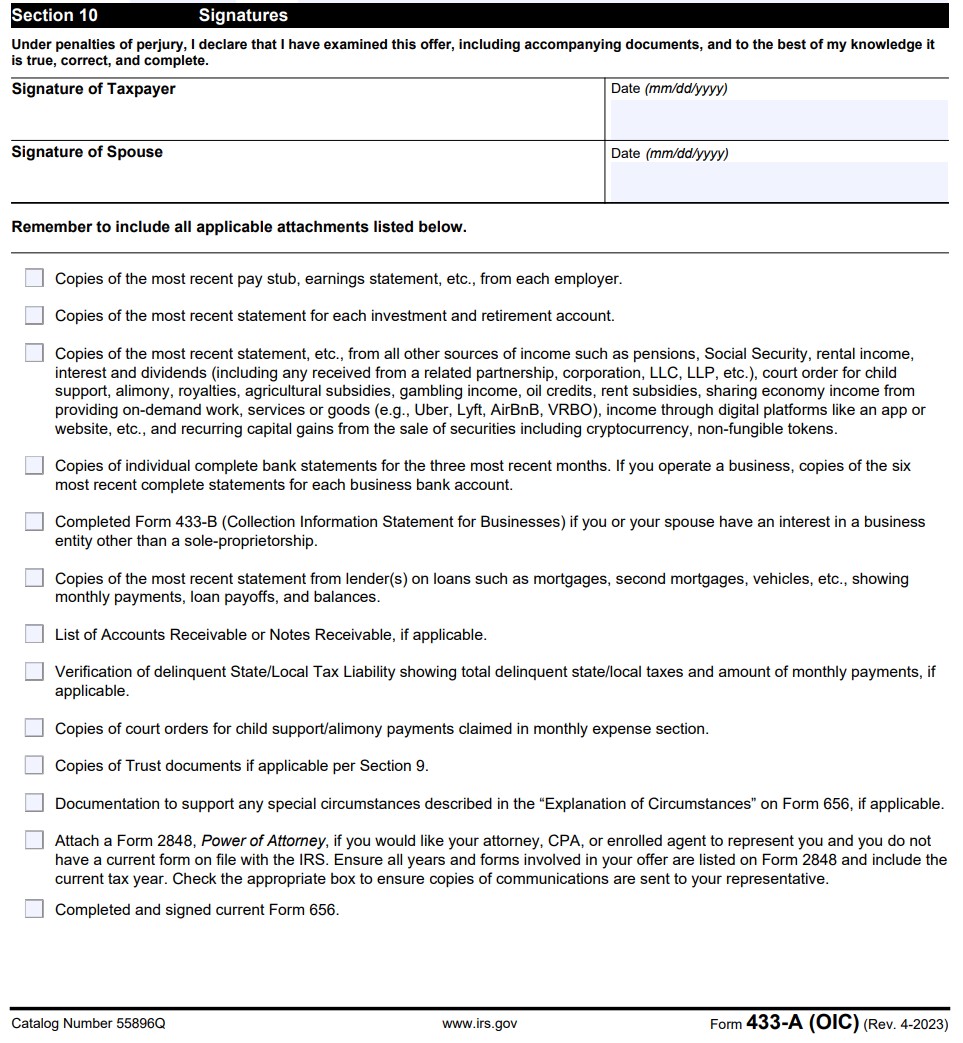

Section 10: Signatures

Sign and date the offer form. If you are filing joint and married, have your spouse sign and date as well.

Information to Attach

You should attach the following copies of the information to your offer:

The most recent pay stub, earnings statement, etc., from each employer.

The most recent statement for each investment and retirement account.

The recent statement, etc., from all other sources of income such as pensions, Social Security, rental income, interest, and dividends (including any received from a related partnership, corporation, LLC, LLP, etc.), court order for child support, alimony, and rent subsidies.

Bank statements for the three most recent months for all personal and business bank accounts.

The recent statement from lender(s) on loans such as mortgages, second mortgages, vehicles, etc., shows monthly payments, loan payoffs, and balances.

Court order showing required court-ordered payment.

Proof of payment to the state for state tax debt and proof of debt. A copy of a transcript from the state will usually work.

List of Notes Receivable, if applicable

Verification of State/Local Tax Liability, if applicable ( most recent statement from your state works)

Documentation to support any special circumstances described in the “Explanation of Circumstances” on Form 656, if applicable (if there are any special reasons besides you are requesting a settlement, send proof of these reasons).

Completed and signed form 656.

Notes and Summary

Filing an offer in compromise can be quite complex. If you fill this guide you should find it not as hard as you think. Make sure when you file to is as complete as possible. The more complete your offer, the more likely you will get it accepted without any further document requests from the IRS. If you fill out an incomplete offer, it will lag the process.

If you would like help to settle your tax debt or are unsure if you qualify for a settlement at all, fill out our tax resolution application form or call us at (888) 515-4829 and you will get a free 15-minute consultation with a licensed tax attorney.

thanks this was an excellent guide

Pingback: How To Do Your Own Offer In Compromise | Tax Resolution Professionals News Blog

this was very helpful

Would you be able to explain how to get the $3450 vehicle allowance in section 6 of the revised 433-a? There seems to be an error on the form. For example, I enter $5999 as current market value, then times 80% equals $4799, less $0 loan balance, yielding $4799 for line 6a Then lines 6b says to subtract $3450 from 6a which I do and enter $1349 on line 6b. Then the instructions say to total lines 6a to 6e, which give me a total value in line 6 of $6148. This is more than the original value of $5999, before any 20% reduction or $3450 allowance.

This substantially raises the OIC minimum amount.

Thanks for any help

Hi Stanley,

This is actually an error by the IRS. The total they want is minus $3,450. I would just go ahead and put $1,349 on line six if $5,999 is the car’s value.

What I would really do first is see if that is the car’s value. You should be going with the trade in value in average or fair condition to get the lowest figure.

Additionally, even if the value total for line 6 is $1,349, if my other numbers were low, I still would not offer that much. I would instead offer $100-500 if my expenses exceed my income. Then in Form 656 in Section 3 write (if the statement is true) “I am unable to sell my car because it is my only form of transportation. Therefore it should not be included in the total asset calculation as I am unable to liquidate it.”

This works a lot, and I have saved people tens of thousands with it so far. Most people just submit the standard and pay the standard. Always go for the lowest. Let the IRS bring the numbers up if they want to later and battle it down from there.

Better than the IRS’ own instructions.

I have prepared a few OIC’s and was scratching my head a bit on the the line 6b error – thank you for the clarification.

It is a good guide and I am grateful for the posting. I would have liked to have read about your experience with valuing the real esate. For the current OIC I am working on I am using the mid-point between tax and market value on the property tax statement.

Also, the client has a state tax levy on the townhouse – I am planning on using section 3 of the 656 to explain that the client cannot access the equity (minimal – about 10-20k) due the lack of financing alternatives due to the state levy. Is this a realistic approach?

Hi Brent,

I would recommend the following:

1) Go ahead and explain it in Section 3

2) Use the quick sale value of the home, not the regular retail value. It should be considered the IRS sells the house at auction, and auction homes can go for 1/3-1/2 the regular price. Use the lowest number that is legitimately possible. This most likely would wipe out the 10-20K anyway.

3) If that still does not work, get a loan denial letter from any lender. Have the client apply for a loan against the equity and get denied. Send a copy of the application and denial letter with the offer and mention it in your cover letter. Make sure they save the application, most people forget this (but really at 10-20K you should be fine using #2)

A lot of the time when you have a loan denial letter they will let the home equity slide and the state situation you described will only help more. If they deny your offer based on home equity I would appeal it.

Good luck and let me know if you have other questions!

Great article! Question: I have a 14K tax debt and a Federal Tax Lien against me for that amount and I am currently in Non-Collectible status with the IRS. I am a recovering alcoholic and I live in a converted shed on my parents property (and have for the past 3 years). I take my meals with my parents and they pay all of my expenses. Their health is not great and I help around the house quite a bit. My only actual monetary income is from them and is $250/mo, which goes into my checking acct to cover my vehicle insurance and a couple of other expenses which come out automatically. My ONLY asset is a ’94 pickup with 283K miles on it and a bent frame. In other words, I have nothing of any value whatsoever. Now, when they receive my 433-a with just numbers on it (mostly zero’s), it seems to me that they are going to wonder how in the world I am surviving. Should I explain my situation to them in some sort of cover letter? Or is it better to just wait for them to ask any questions they might have? Any advice would be much appreciated. 🙂

Hi Matt,

I would explain that in the cover letter. Pretty much the standard food expensive is more than the $250 you are getting per month, so this settlement should go through. It is best to explain in the cover letter how you are living in situations like this as they will likely process the settlement faster, and possibly just accept it without any follow up information.

Also, please take note that the IRS OIC forms have changed to 2016 forms, and I will be updating this guide this week to reflect any changes.

The IRS Offer In Compromise Guide has been updated for 2016 and can be seen here:

http://www.taxresolutionprofessionals.com/news/how-to-fill-out-irs-form-656/

Pingback: How to Fill Out IRS Form 656 Offer In Compromise | Tax Resolution Professionals Guides and Information

Thank you. Wow. This was extremely helpful. Can you please explain if i need to include my NYS Deferred compensation balance as part of income. These are pre-tax monies that go into an account from my pay check. If i do need to include them, how do I include the fact that I’ve already borrowed again it, rendering it untouchable until the loan is paid back. When I include it in the retirement section of the OIC and using the calculations given, I end up with 18,864 as the offer a the end. My expenses are over 10,000. Please tell me what I’m doing wrong?

Also, my pension was not included because, I pay nothing into it and am not allowed to take anything from it. It is totally paid by my employer. Do I need to explain that or include there is a pension.

Hi Mona,

Yes make sure to include that, and they probably will see it on your pay stub. I recommend telling them in a cover letter what the payment is listed as on your paycheck, if its shown on your paycheck, and explain that there is a loan against it. On the calculations to determine its value if it has a cash value, make sure that any loans against it are included. However, if the loans against it are less than the full amount, ie: you have a $3000 loan out and its worth $10000, the IRS is still going to try and tap into at least 80% of the value of non-loaned amount and include that in your offer amount. You can always shoot for a lower offer first and explain in the cover letter you cannot get to it, and see what they come back with and negotiate form there.

If your monthly expenses are over $10,000, usually you need a good amount of dependents to get it through and still be within the IRS Collection Financial Standards. Good luck and post any other questions you may have!

Thanks a bunch. I’m so grateful for your advice. I do have another quesiton. I have 3 dependents including myself and yes the monthly w taxes is a little over $10,000. Will that be enough to get it through. Also I filed my return in April and took the loan amount to get me out of heavy debt, kids schools, credit cards, pay back money borrowed and college needs for my children. I read somewhere, that if the loan was taken when I should have know about the tax debt, they will not give me the offer. Reality is the previous debt existed before the taxes were filed but the loan could only be taken after I borrowed money from someone to pay off the first loan to get the current and be able to pay for the kids schooling and get the creditors off me. Anyhoo, what do you recommend? All else is simple. Just how to handle this loan against the deferred comp I see as an issue.

Hi Mona,

Yes if taxes are included in those expenses, it might be possible to get it through if you have car payments, high rent or mortgage, and live in a more expensive county per the IRS standards.

If you take out money from an investment and use it to pay off other loans when the tax debt was there, they will usually treat your settlement as if you had that actual money. Since you are taking out a loan to pay off other debts and you should have paid them in their eyes, then there is a good chance these amounts will get factored into your settlement figures and make the Offer much higher.

However, if the debt is large you still might get some kind of settlement. Also, its best to submit as a Lump Sum offer, but often the IRS agent assigned will let you change it later to a 24 month periodic payment plan offer. If you show no available income each month, then you would most likely end up spreading out that loan amount you got, plus whatever assets they think you have, into 24 payments.

I would probably give it a shot, but it is ultimately up to you. Keep in mind though, if you have really old tax debts some of these might be coming close to expiring, and filing an Offer In Compromise extends the amount of time the IRS has to collect on the debts. In some of these cases, Currently Non Collectable status is best.

Some more information can be found here about Currently Non Collectable status:

http://www.taxresolutionprofessionals.com/news/currently-non-collectible-status-offer-in-compromise/

Thank you again. My filing tax years are 2011-2015. I was on a payment plan of $500 a month for 2011 n 2012 until May 2016. When I filed the years that hadn’t been filled which were 2013-2015, its defaulted my agreement bcuz the total of all 5 years pushed me over 50k.

My earliest tax year owed is 2011 which wouldn’t expire till 2021..,,5 years from now.

For future wages- how do I show that in a year, I’ll be in a lesser paying position at work if it hasn’t happened yet. I wanted to explain this in a cover letter upfront but shoukd I wait till I hear back after the initial offer is made?

Relative to the loan against investments. Does the filing date vs the IRS notice dictate knowing when you knew of debt? Or does the fact that I didn’t file for 3 years automatically indicate knowledge? And lastly, since I was paying an installment agreement for 2 of the years owed when the loan on investment was taken, would they feel that those 2 years should have been paid as well? If attempting to show how we live pay Che k to paycheck to paycheck, should I send it credit card statements with monthly transactions for food, kids tuition, Monty bills etc, since my expenses are higher than my income ? They were being included as supporting documentation to my expenses anyway. I was thinking a separate cover letter to arrest to the paycheck to paycheck reference. Again is this too something I should wait to include after I hear back from them. Thank you

Not sure why it says anonymous. Previous post is from Mona

For some reason it will not let me reply to your other post, but here are the answers:

I’ll be in a lesser paying position at work if it hasn’t happened yet. I wanted to explain this in a cover letter upfront but shoukd I wait till I hear back after the initial offer is made?

Explain this in the cover letter.

Relative to the loan against investments. Does the filing date vs the IRS notice dictate knowing when you knew of debt? Or does the fact that I didn’t file for 3 years automatically indicate knowledge?

Most likely on those whichever way it happened, since you had the money and did not pay them its possible this could be factored into the total. I would not include it and write in the cover letter a good explanation. Not totally sure how they will come out in your case.

And lastly, since I was paying an installment agreement for 2 of the years owed when the loan on investment was taken, would they feel that those 2 years should have been paid as well?

If they determine that, they will factor it into the settlement total.

If attempting to show how we live paycheck to paycheck, should I send it credit card statements with monthly transactions for food, kids tuition, Monty bills etc, since my expenses are higher than my income?

Only for the expenses that exceed the IRS Collection Financial Standards. For everything within the standards, they accept it without paperwork.

If the food is more they do not allow it as an expense unless you or your kids need special food like gluten free for example. Then you would need to show proof of the expense (Receipts, bank statements, or credit card statements) and a note from the doctor. School tuition is generally not accepted as an expense for purposes of Offer In Compromise calculations, but if they stay longer for daycare at the private school, sometimes it can be argued that these expenses can go under childcare expenses.

Thank you Very much.

Do you think I’d be OK doing the Offer in Promise in my own?

Yours sounds pretty complex and might be worth it to have someone do it, but if you feel you have a good shot and got all the info, you might wanna try yourself too.

Most people making more than $9-10K/mo don’t get an offer unless the balance is very large (usually $500,000 or more) or they have a lot of kids. You might be kind of on the border so submitting it might just delay things and expose you to a possible (although unlikely) lien. If we were to do it for you, we would know within the first month if you had a good chance at an offer or not. Since our billing is is done hourly, you do not pay very much if we cannot get an offer. If we find your case can’t get into a settlement, well usually be done with your case in 1-3 months as long as all tax returns are filed.

Whichever, you choose, good luck!

has much changed since the 2017 version?

Not much has changed, just a few items on the form but it is all covered in the post.

When filling out this form, when at the end asking for settlement amount is this going to be a one time payment? Also then do I need to continue onto the 656 form as well? I’m so lost at times.

I have a question, if I have rental property and income where do I place the property – under the Business Assets or under Real Estate?

This would go under real estate

Actually this can be split up into 6 payments or 24 payments – I would go ahead and fill out the 656 Form, and from there you will see how you calculate the settlement payment.

for a self employed business does a 433B form need to be made also if the taxes are personal debts?

You only need to file a 433-B(OIC) for the following entity types:

Corporation

Partnership

Limited Liability Company (LLC) classified as a corporation

Other multi-owner/multi-member LLC

Single member LLC

For self employed with a Schedule C, fill out the self-employed business portion on the 433-A(OIC)

If you have payroll debt that was from a separate entity listed above and it was personally assessed to you, make sure to fill out the Trust Fund Recovery Penalty portion on Form 656.

I live by myself on a normal daily basis. Would I be able to list my 3 kids as in the household if I don’t claim them as a dependent on the 1040? While they don’t live with me everyday I do get them on a normal basis and of course provide for them while they’re with me which is usually weekends, holidays, and for most of the summer. I still also pay child support for them. Thanks for any assistance

Hi Jared,

Make sure to add the child support for sure. For the other expenses, technically they may not accept them. If your leftover income is already $0 (income vs. expenses) then don’t add extra info they do not need. However, if adding these extra expenses makes or breaks your settlement, list it out and add it in. Make the list on an attached sheet and put the expense in the “other expenses” section of the 433A-OIC.

Also, I would mention in a cover letter the percentage of time they spend with you on average over the course of the year.

Great. Thanks for answering. Help is appreciated.

Wow this is a great set of instructions! Thank you very much!!!

Hello! My question is on section 7 for income. I am filing out this form for my uncle and we have listed all his taxable income but unsure if we should list his money he receives from the VA for disability.

Hi April, add these as “Other Income” in Section 7 and mention in the cover letter that it is disability. Even though its not taxable, its considered income for the purpose of the IRS seeing if they will settle the debt.

Hello I am in the process of completing Offer in Compromise but have a few questions. I currently co-habitat with boyfriend. He is listed on rental agreement however my funds cover pretty much all the monthly bills due to him paying child support and his car note/insurance. Would his information need to be included in my offer and if so how would I enter into offer being able to include what he pays for his car as well?

Hello – this one answered above

Hello I am in the process of completing Offer in Compromise but have a few questions. I currently co-habitat with boyfriend. He is listed on rental agreement however my funds cover pretty much all the monthly bills due to him paying child support and his car note/insurance. Would his information need to be included in my offer and if so how would I enter into offer being able to include what he pays for his car as well?

The IRS request to see household income and we have done the cases in one of two ways:

1) Separate out all the expenses and clearly show what you pay per month

2) Include both income and expenses together

When it gets to the IRS agent, they may ask for total household income or just process it as is. When the person you are living with makes more money than you, they might try to use this to disqualify the offer. We have been able to get around this by separating out the expenses and arguing that although you live together, this is not really the same “household” and everything is separate. Its kind of case by case, but I would submit whichever version makes your financials more dismal.

If you end up including his income and expenses in the calculation, add his car to the payment section as well in the same section where car payments are added for you.

My husband is self employed and his gross monthly looks high prior to expenses. Do I list gross monthly prior to expenses under section 7 or can I list after expenses? Seems pointless to calculate all those monthly expenses if it’s not taken into consideration when determining out remaining monthly income in box F

In the self employed section it also deducts expenses so what you net at the end of the day is what matters. They are looking for what the average monthly net from self employment is.

The total the IRS is looking for is after expenses.

Thanks, it is very informative, but how long will an Offer In Compromise take?

I just made a guide that discusses the timeframe for IRS offer in compromise, and you can see that here: https://trp.tax/how-long-irs-offer-in-compromise-take/

Usually 4 to 9 months. See our guide on how long will an offer in compromise take for more detailed info.

The other guides you have are good too thanks for getting these on the internet.

Great guide on offers and the settlement process, better than all the clickbait i see elsewhere.

What is the success rate?

Pretty good if you got the right financials most people get it who do

Hi….where should real estate commission (p/l) amount be placed as additional income…I work for a broker.

Thanks.

Under self employment income

Since I didn’t really understand how this works, I will just call you guys about offer in compromise

I have client who lives with her boyfriend who pays all expenses relating to the household. Do I include his income and offset that with the expenses he pays or leave it out and use my clients income and her expenses?

Thanks

Just read post from earlier question that is similar to mine and basically answers my question.

Thank you.