U.S. Expats and Foreign Trusts: A Guide to Reporting, Tax ...

Living abroad as a U.S. citizen comes with unique tax challenges, especially when you own or are a […]

Living abroad as a U.S. citizen comes with unique tax challenges, especially when you own or are a […]

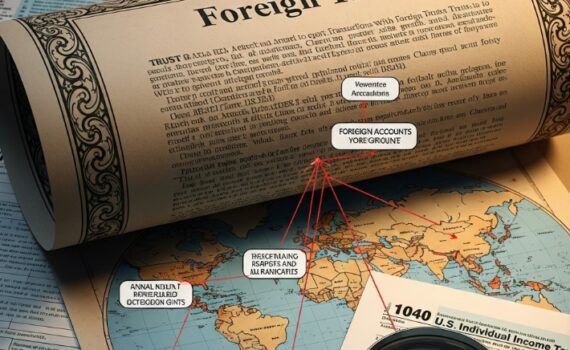

Despite claims that the wealthy pay lower effective tax rates (ETRs) than other Americans, a new analysis of […]

In the world of IRS paperwork, Form 8832 is small but mighty. This two-page form decides how your […]

Key Changes on the Draft Form The draft 2026 Form W-2, also known as the Wage and Tax […]

Dr. Mosquera Valderrama describes the EU’s tax policy as “a little confusing,” citing the multitude of projects and […]

Identity theft victims are facing significant delays in receiving their tax refunds, with average wait times stretching to […]

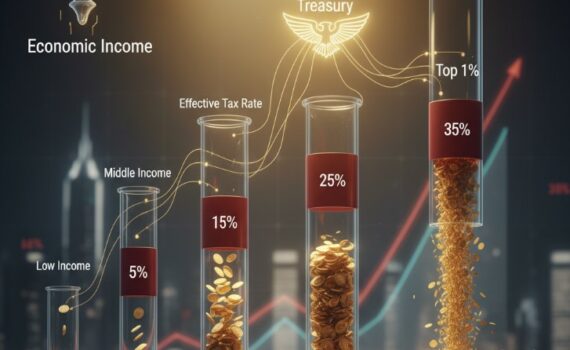

The IRS terminated thousands of probationary employees early this year without following its own performance review policies, a […]

In recent years, the international community has been working to change global tax rules for multinational corporations. In […]

President Donald Trump has proposed a new policy that would impose tariffs of up to 250% on imported […]