The Consumer Cost of Trade Wars: How 2025 Tariffs Hit ...

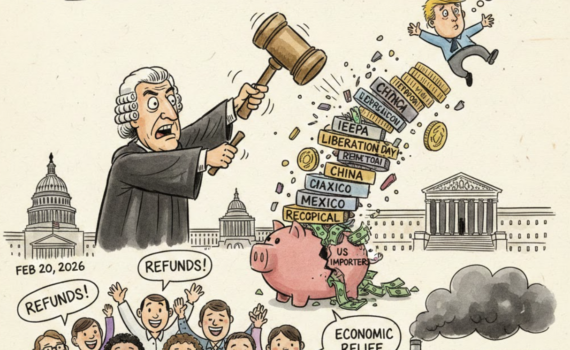

Before the Supreme Court struck down President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs as unlawful, the […]

Before the Supreme Court struck down President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs as unlawful, the […]

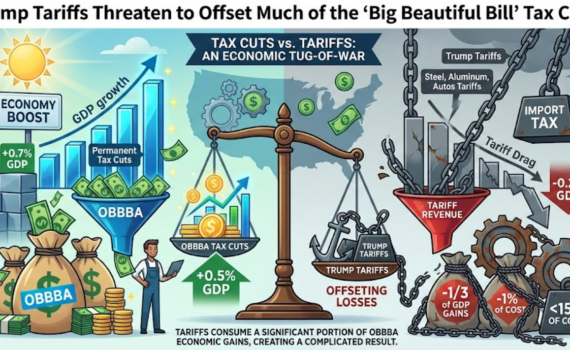

The Economic Tug-of-War: Tax Cuts vs. Tariffs The One Big Beautiful Bill Act (OBBBA) was designed to supercharge […]

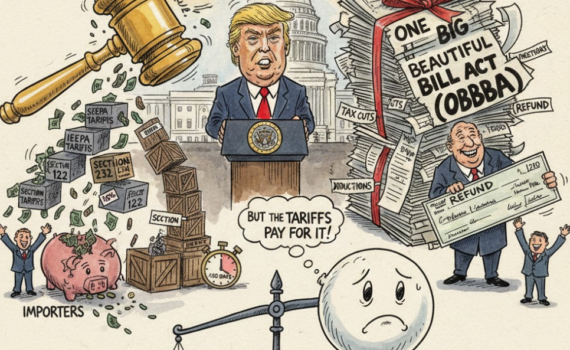

Tonight, President Trump delivers his first official State of the Union address of his second term. While his […]

In a landmark 6-3 decision on February 20, 2026, the Supreme Court ruled in Learning Resources Inc. v. […]

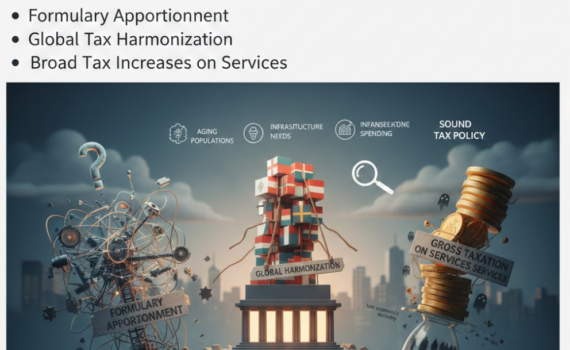

As governments scramble for revenue to fund aging populations and infrastructure, some are pivoting toward “big picture” global […]

The IRS is alerting taxpayers that Presidents’ Day week (starting Feb. 16, 2026) is historically the busiest time […]

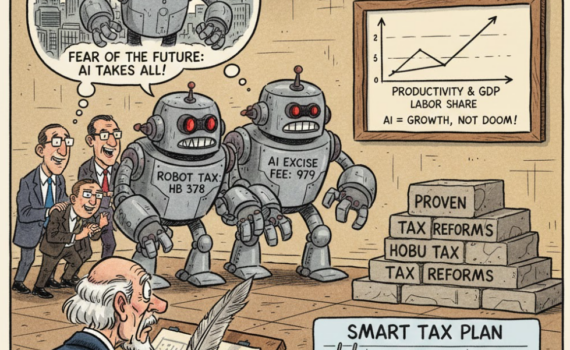

The rapid evolution of artificial intelligence has sparked a global debate, and tax policy is the latest arena […]

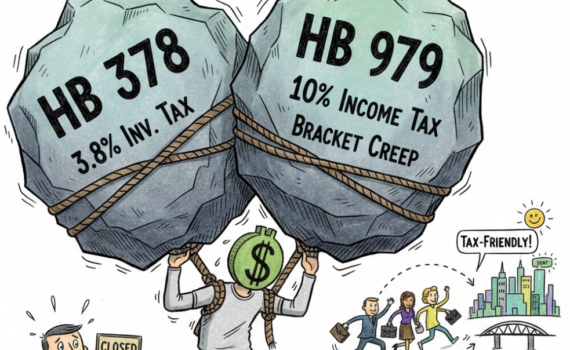

Virginia’s 2026 legislative session is in full swing, and despite campaign promises from across the aisle to prioritize […]

The latest analysis examines the Republican Study Committee’s (RSC) new policy blueprints—the 2026 Budget and the Reconciliation 2.0 […]