Results For Recent Tax Settlements

Our tax attorneys have handled thousands of back due tax debt cases. We can give you a realistic outlook on whether your debt can be settled or not through an Offer In Compromise. Have you heard of settling taxes for pennies on the dollar? Well sometimes that can be a fraction of a penny on the dollar (see bold tax settlements below).

Here are some recent results:

February 2019: Owed $321,316.52 settled for $4,560

March 2019: Owed $106,620.86 settled for $11,971

April 2019: $258,000 settled for $100, $54,000 settled for $50, Owed $64,029 settled for$24,672.8

May 2019: $49,000 settled for $558, $180,000 settled for $14,267, $38,000 settled for $20,000, $321,316.52 settled for $4,560, Owed $84,018.97 settled for $5,400

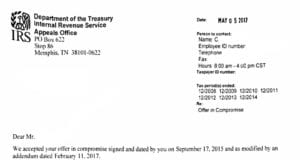

Accepted Offer In Compromise

This page is updated every few months. That is a lot of tax debt settled for much less than the amount owed. Not everyone qualifies for a tax settlement through Offer In Compromise. Do you owe more than $20,000 in IRS or state tax debt? If you call us at (888) 515-4829, one of our experienced Las Vegas tax attorneys will give you an honest evaluation. You can also visit our Contact Us page and we will get back to you. We help clients nationwide.