See our video explanation below, then keep reading for more information:

How much can the California FTB garnish?

The FTB can garnish up to 25% of your disposable income. Your disposable income is your personal earnings after lawful deductions such as federal income tax, social security, state income tax, and state disability. The FTB can also calculate the garnishment by the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage (which is currently $11.00 per hour).

For example, if you earn $12 per hour and work 40 hours per week so that your weekly wage is $480. After deductions, your weekly income is $460. Under California law, the FTB can garnish you the following amounts:

- 25% of $460 = $115.50

- $460 – (40 x $11.00) = $20

In the given example, the California FTB could garnish no more than $115.50. There are cases when the FTB modifies the garnishment amount. When this happens, they mail a garnishment modification notice to inform the taxpayer.

Know how an FTB wage garnishment takes place

There are certain procedures that the California Franchise Tax Board has to make first before they can send an FTB wage garnishment or what others refer to as an Order To Withhold (OTW). First, they must send a notice to the employer or business entity. The notice to garnish wages should contain the following information:

- Nature of the wage garnishment

- Amount to be garnished and a summary of how this amount was derived

- A statement indicating your right to an exemption in certain circumstances

- Instructions on how to claim an exemption

The receiver of the notice also is given an opportunity to request for a hearing. In any case that the Order to Withhold was sent to a financial institution like a bank, they must hold funds for 10 days from the notice was received before remitting funds to the FTB. During that time period, you can try to claim hardship to get money back, but it is difficult.

The California Franchise Tax Board isn’t always right

Sometimes, mistakes are made when sending out a notice of wage garnishment. When you receive the notice, make sure that you read this thoroughly and do research as well to know if what the FTB is charging you is fair. Double-check if the calculation of the amount you owe is correct. Other common mistakes for receiving wage garnishment are that if you already paid the debt and if the FTB did not follow proper procedures.

Once you realize that the wages are improperly garnished, you can contact the FTB and have them fix it.

An FTB lien might have also been filed

If you are already receiving FTB wage garnishments, it’s likely alien was also filed in your case. See our page on Franchise Tax Board tax liens for more detailed information, but the basics of a lien are as follows: The FTB files a lien in the county in which you live in on any property or vehicles you own. It may get picked up by the credit reporting agencies as well.

What can you do to stop an FTB wage garnishment?

File for bankruptcy

One option you can go for to stop FTB wage garnishment is to file for bankruptcy. When filing for bankruptcy, most or all of your assets will be liquidated, and the money earned will be used to pay off your outstanding debt. Filing for bankruptcy is a big decision to make. To help you decide if bankruptcy is the right way to go for you, consider the following:

- The alternatives you have to file for bankruptcy

- What type of bankruptcy is best for your type of situation.

- What debts will be eliminated in the bankruptcy (the bankruptcy proceeding might not be able to cover all of your debt)

Once you file for bankruptcy, collection activities will be put on hold which means your wage garnishments will stop until the bankruptcy process is completed. Bankruptcy is often not the best option if your only debt is from taxes, especially if you are over 50. The Offer In Compromise option discussed below is similar to a bankruptcy, but just for tax debts, and is much better for your credit.

For cases of wage garnishments that are classified as priority debts such as for the purpose of child support or alimony, garnishments will continue.

File for Hardship status and get it approved

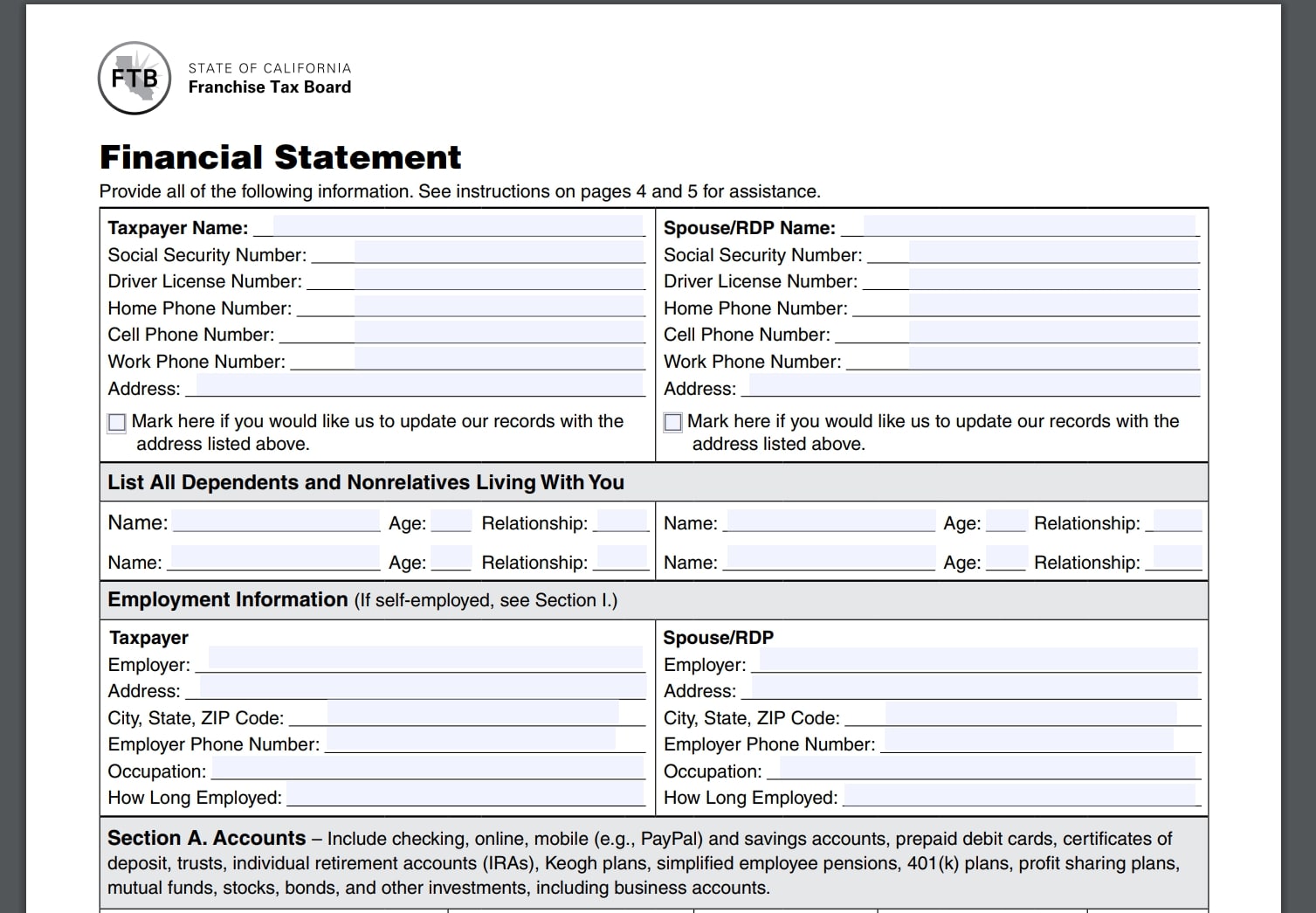

The new version of FTB Form 3561 that you file to get hardship status.

Filing for hardship status can stop the garnishment if the hardship is approved. This is approved if you can show that you need the money to support yourself or your family for basic necessities and the garnishment would prevent you be being able to cover basic expenses.

To file for hardship status, you or your representative need to contact the FTB collections area or individual that is assigned to your case. Most of the time they are going to want an FTB financial statement, Form 3561-PC. Don’t have a rep or are not sure where your case is assigned? Call (916) 845-4470 and if they are not assigned to it they should be able to give you the correct number.

The hardship is usually good for a year

Hardship status lasts for one year in most cases. After that year you have to submit documents to renew the status or send in another resolution. The FTB generally has 20 years to collect on debt but they always find ways to extend the collection period. If you are in a case of financial hardship, often Offer In Compromise discussed below is a better option.

File for an FTB Offer In Compromise

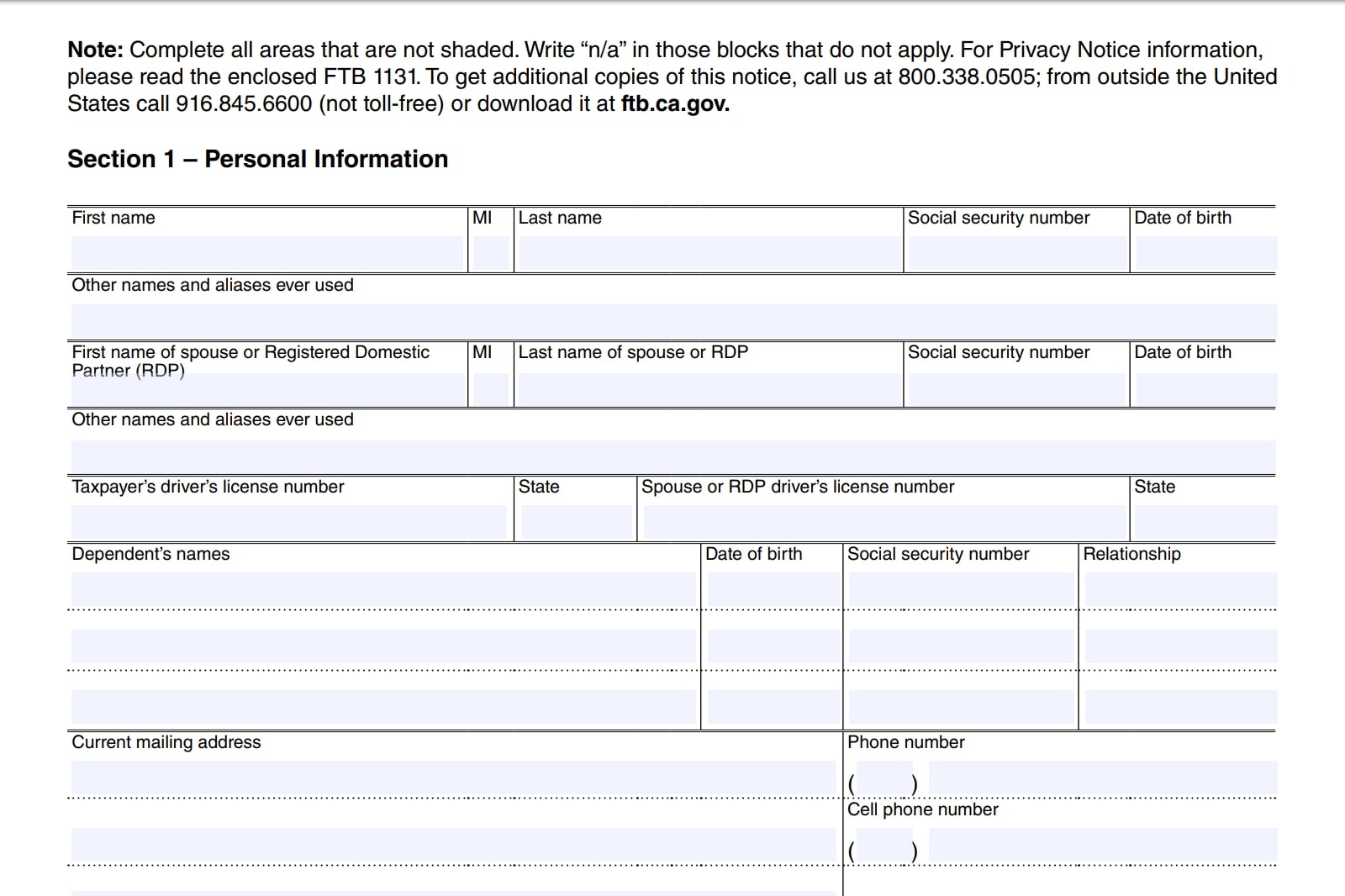

Another way to settle your debt with the California Franchise Tax Board for the amount less than what you owe is through an Offer In Compromise. Generally speaking, an FTB OIC is more difficult to get accepted compared to an IRS OIC, but it’s not impossible. The FTB looks at the following factors of a taxpayers financial situation when deciding to accept an Offer In Compromise:

- Ability to pay based on current finances.

- The total value of assets including real estate, vehicles, retirement accounts.

- Current and future income compared to current and future expenses. More leftover income after reasonable expenses = less chance of settlement.

- Whether the offer is in the State of California’s best interest.

- Age of the taxpayer. The younger you are the least likely they will accept it.

First page to fill out for FTB Offers.

Feel free to read our guide on submitting an FTB Offer In Compromise for more information. Although an Offer In Compromise will resolve the tax debt and eventually take off the garnishment, most people are better off filing for hardship first to get the wage garnishment off ASAP, then proceed on an Offer.

Setup an FTB payment plan

If you can’t pay your debt in full right now, you can set up a payment plan with the FTB. You can request a payment plan to make monthly payments. The FTB may offer a payment plan over a certain amount of months that avoids a tax lien if one has not yet been filed. That type of payment plan will be over a certain set of months, not based on financial data.

If you fall somewhere in between hardship and the FTB’s monthly payment plan proposal, a financial statement will be required and your payment will be based on your ability to pay. Sometimes the garnishment can be lower than this so you may want to consult a tax attorney to get the best results.

Pay In Full

Paying your FTB debt in full, it will take off your garnishment. You or your rep should still call the FTB and let them know you paid it off and have the proof ready to fax in. If you just let the garnishment sit it might hit you on another paycheck. However, any additional funds taken beyond what you owe should get returned to you.

Concluding our guide on stopping an FTB wage garnishment

The best option for getting off an FTB wage garnishment is dependent on your financial situation. At our firm if we can use hardship to get the garnishment off quickly then submit an Offer In Compromise that has a high chance of acceptance, that is the route we take.

Not sure about your FTB wage garnishment? Drop us a line at our tax help form or call us at (888) 515-4829 and we can help you resolve it quickly!

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.