186

186 Senate Finance Committee Unveils Major International Tax Overhaul: What Businesses ...

The Senate Finance Committee has released its draft bill, proposing significant and largely permanent changes to U.S. international […]

186

186 The Senate Finance Committee has released its draft bill, proposing significant and largely permanent changes to U.S. international […]

Senator Ted Cruz (R-TX) recently reintroduced the Cost Recovery and Expensing Acceleration to Transform the Economy and Jumpstart […]

61

61 A recent move by the Senate is set to provide significant relief for pass-through businesses navigating the State […]

11

11 Florida, the Sunshine State, beckons with its beautiful beaches, vibrant cities, and a promise of perpetual summer. Yet, […]

44

44 Ah, tax season! For many, it conjures images of overflowing shoeboxes, late-night number crunching, and a gnawing sense […]

34

34 The recent House reconciliation bill includes a new fee on electric vehicles (EVs) intended to bolster the struggling […]

46

46 The highly anticipated “One, Big, Beautiful Bill” aiming to extend and modify the 2017 Tax Cuts and Jobs […]

90

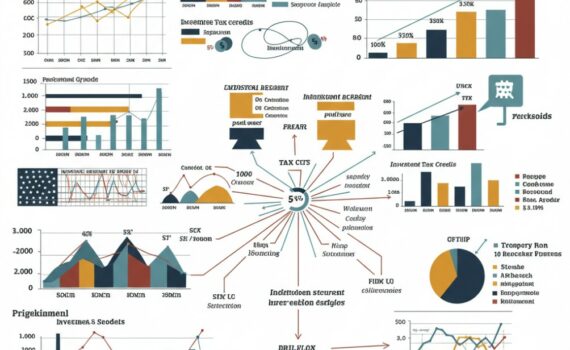

90 The House Ways and Means Committee has presented its comprehensive tax package, valued at over $4 trillion, which […]

14

14 While the previous administration’s tariffs initially exempted crude oil and some energy-related minerals, these exclusions won’t shield the […]