Alabama’s 2025 Legislative Session: A Boost for Pro-Growth Tax Reforms

The 2025 legislative session in Alabama proved to be a pivotal period for tax policy, with the enactment […]

The 2025 legislative session in Alabama proved to be a pivotal period for tax policy, with the enactment […]

167

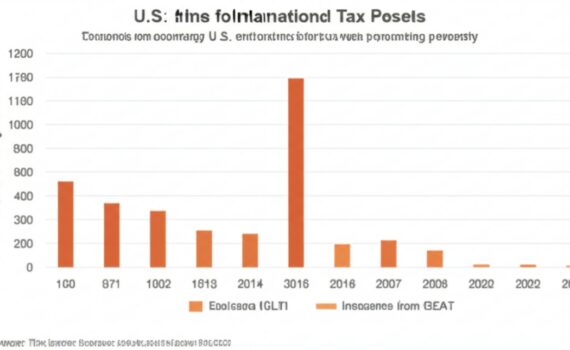

167 The “One Big Beautiful Bill” (OBBB) is significantly changing how international income is taxed at the federal level, […]

97

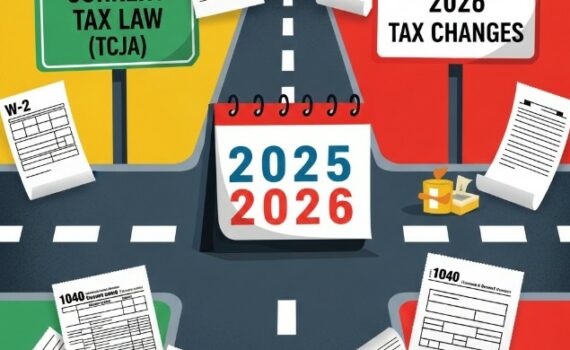

97 The Looming Sunset: What Americans Can Expect as 2017 Tax Cuts Expire As the calendar turns to 2025, […]

36

36 Shifting Sands: A Closer Look at the Badger State’s New Budget and Its Tax Implications Wisconsin’s latest budget, […]

296

296 Washington, D.C. – As the “One, Big, Beautiful” (OBBB) reconciliation bills move through Congress, lawmakers are proposing a […]

71

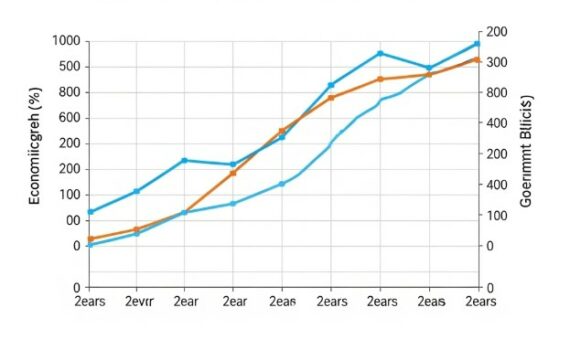

71 The OBBB aims to boost the economy, primarily by preventing large tax increases that would otherwise occur due […]

95

95 In a June 16 letter to key members of the U.S. Senate Finance Committee and Colorado’s congressional delegation, […]

189

189 The Senate Finance Committee has released its draft bill, proposing significant and largely permanent changes to U.S. international […]

Senator Ted Cruz (R-TX) recently reintroduced the Cost Recovery and Expensing Acceleration to Transform the Economy and Jumpstart […]