242

242 Senior Tax Relief: Comparing a New Deduction to Eliminating Social ...

Washington, D.C. – As the “One, Big, Beautiful” (OBBB) reconciliation bills move through Congress, lawmakers are proposing a […]

242

242 Washington, D.C. – As the “One, Big, Beautiful” (OBBB) reconciliation bills move through Congress, lawmakers are proposing a […]

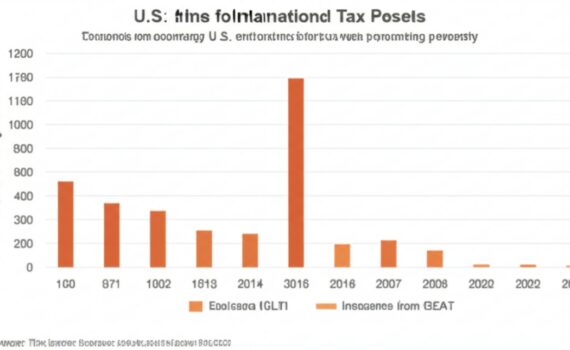

186

186 The Senate Finance Committee has released its draft bill, proposing significant and largely permanent changes to U.S. international […]

3

3 The House-passed tax bill proposes three significant Section 199A Deduction Changes aimed at making the deduction permanent and, […]

25

25 The world of finance, much like a vibrant ecosystem, is constantly evolving, with new regulations and policies emerging […]

45

45 Ah, tax season! For many, it conjures images of overflowing shoeboxes, late-night number crunching, and a gnawing sense […]

34

34 The recent House reconciliation bill includes a new fee on electric vehicles (EVs) intended to bolster the struggling […]

46

46 The highly anticipated “One, Big, Beautiful Bill” aiming to extend and modify the 2017 Tax Cuts and Jobs […]

5

5 With Congress currently focused on business investment incentives, a critical area for boosting economic growth lies in how […]

3

3 Maryland Governor Wes Moore has proposed a $1 billion tax increase package to address the state’s chronic budget […]