The Qualified Small Business Stock (QSBS) exclusion (Section 1202 of the Internal Revenue Code) was intended to encourage investment in small, early-stage companies. However, this policy is fundamentally flawed. It severely undermines the principles of sound tax policy, introducing unnecessary complexity and distorting core business decisions.

Rather than rewarding efficient capital allocation, the QSBS exclusion favors investors with access to complex legal planning. A far simpler, more neutral, and pro-growth approach would be to expand and make permanent full expensing for capital investments.

📌 The Flaws of the QSBS Exclusion

The QSBS exclusion allows taxpayers to exclude up to 100% of the capital gains from the sale of qualifying stock, subject to certain limits. While recent tax reforms like the One Big Beautiful Bill Act (OBBBA) improved the treatment of capital investment (e.g., permanent expensing of R&D and short-lived assets), OBBBA also unfortunately maintained and expanded the QSBS exclusion.

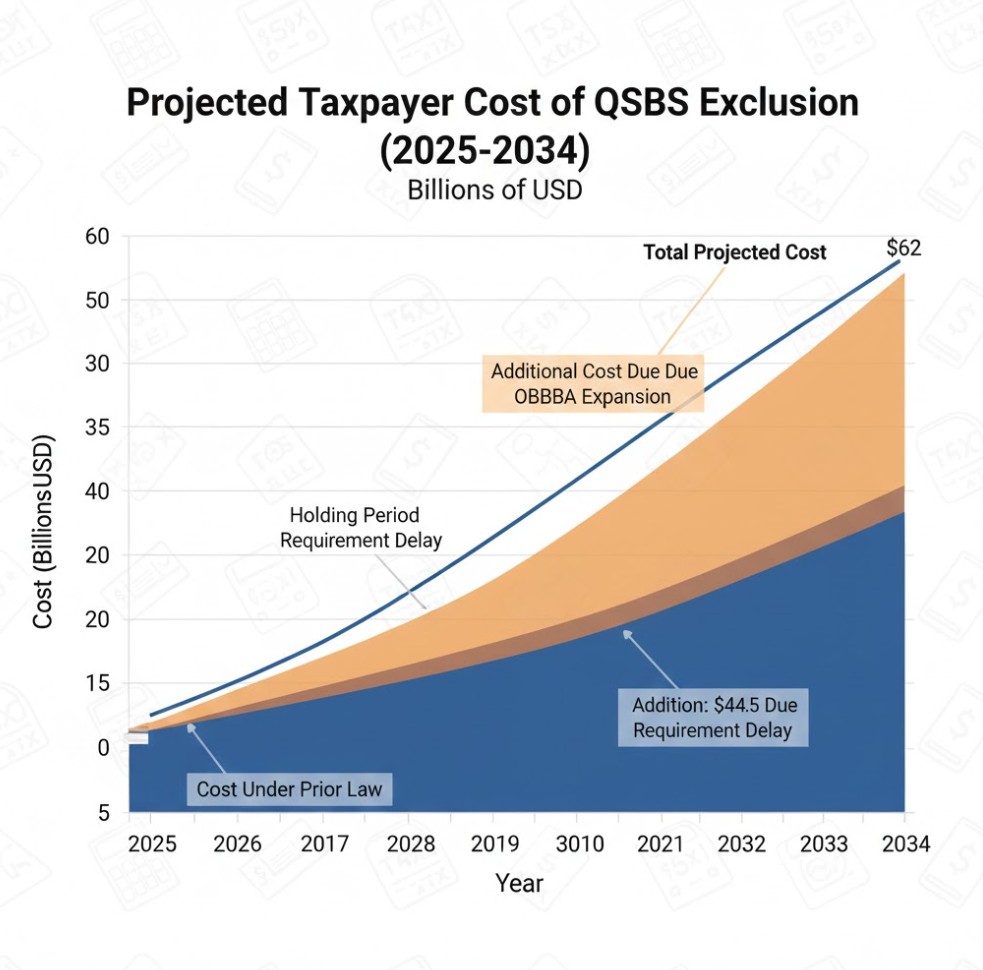

The provision is costly. The US Department of Treasury projected the exclusion would cost taxpayers $44.5 billion over the 2025-2034 period under prior law, with the OBBBA expansion adding an estimated $17.2 billion more.

The QSBS exclusion fails on two main counts: neutrality and simplicity.

1. QSBS Betrays Neutrality

A neutral tax system should not steer economic decisions. The strict eligibility rules of the QSBS exclusion directly influence investor and company behavior in ways that often prioritize tax benefits over sound business fundamentals.

-

Distorted Business Structure: The exclusion only applies to domestic C-corporations. This requirement disadvantages other common structures like LLCs and S-corps. It pressures firms to choose a C-corp structure—which is often more complex and expensive to maintain—solely to qualify for the tax benefit, rather than choosing the optimal structure for their business needs.

-

Skewed Expansion Timing: To qualify, a company’s gross assets cannot exceed a certain limit (now $75 million under OBBBA). This asset test can incentivize businesses to delay expansion plans to allow investors time to acquire eligible stock. Investment decisions become driven by the tax calendar, not by the best possible return on investment.

-

Locked-in Capital: The requirement to hold the stock for a set period (a phase-in starting at 3 years, reaching 100% exclusion at 5 years) can incentivize investors to hold assets longer than is economically justified. This ties up capital in potentially less productive ventures, weakening economic dynamism and preventing funds from being deployed in more promising, newer businesses.

-

Favored Industries: Section 1202 explicitly excludes many types of businesses (determined by §1202(e)(3)). This is a severe erosion of neutrality, as it means tax policy, not market fundamentals, dictates which industries receive preferential investment flows.

2. QSBS Is Highly Complex

Beyond non-neutrality, Section 1202 is notoriously complex.

-

Compliance Burden: A single failure to meet any of the detailed requirements (e.g., C-corp status, asset test, 80% active business requirement, holding period) disqualifies the stock. This complexity forces businesses and investors to divert time and resources toward compliance instead of focusing on maximizing returns.

-

Ambiguous Definitions: The rules for what constitutes an “excluded business” are often vague, creating uncertainty and the potential for costly legal disputes.

-

Rewarding Sophistication: Due to these complex rules, a specialized industry of tax practitioners focuses solely on QSBS compliance and developing intricate strategies (using trusts, gifting, partnerships, etc.) to maximize the exclusion limit ($15 million or 10x basis). This system rewards investors who can afford sophisticated legal help, rather than those who are the most efficient allocators of capital.

💡 Expensing is the Superior Policy Choice

The QSBS exclusion fails to effectively incentivize investment because it distorts business structure, expansion timing, and capital allocation. It adds complexity that disproportionately benefits the wealthy and legally sophisticated.

Policymakers should consider scaling back or repealing the QSBS exclusion. The resulting savings should be redirected toward policies that align with sound tax principles, particularly full expensing.

Full expensing, which was partially made permanent under OBBBA, is one of the most effective pro-growth policies available. It:

-

Directly reduces the cost of capital for all businesses.

-

Is simpler and more neutral than the complex web of QSBS rules.

A starting point for reform would be to make expensing for manufacturing structures permanent, further eliminating the tax penalty on capital investment and promoting broader, more neutral economic growth.