House Committee Unveils Tax Plan: Extends Tax Cuts and Expands ...

The House Ways and Means Committee has presented its comprehensive tax package, valued at over $4 trillion, which […]

The House Ways and Means Committee has presented its comprehensive tax package, valued at over $4 trillion, which […]

While the previous administration’s tariffs initially exempted crude oil and some energy-related minerals, these exclusions won’t shield the […]

With Congress currently focused on business investment incentives, a critical area for boosting economic growth lies in how […]

President Trump’s recurring proposal to replace the federal income tax with tariffs is riddled with practical and economic […]

Lawmakers are weighing options to generate revenue as they consider extending provisions of the 2017 Tax Cuts and […]

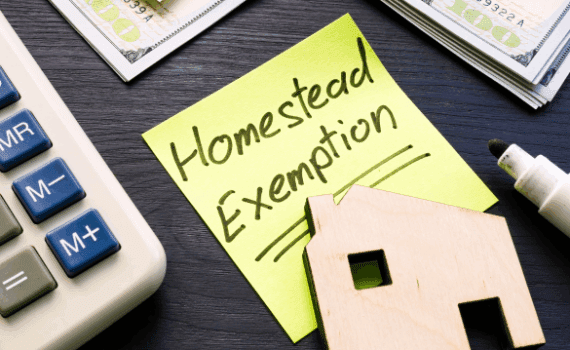

Georgia’s recent voter-approved Local Option Homestead Property Tax Exemption Amendment, designed to limit property tax assessment increases, has […]

A recent shift in leadership at the Food and Drug Administration’s (FDA) Center for Tobacco Products (CTP), spurred […]

South Carolina lawmakers are rightly pursuing tax reform to enhance the state’s economic appeal and benefit its residents. […]

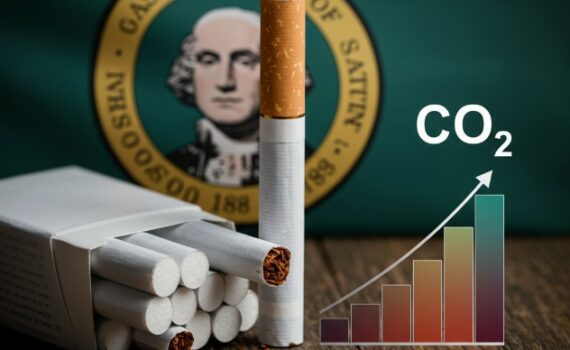

Washington State lawmakers are weighing two problematic proposals: a novel carbon tax on cigarettes and a statewide flavor […]