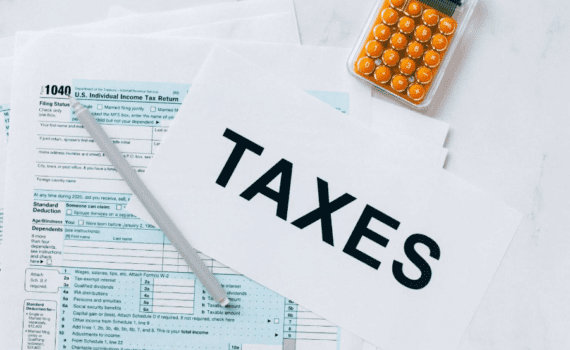

Oregon Measure 118: A Hidden Sales Tax

Oregonians have a long-standing aversion to sales taxes, having rejected them at the ballot box ten times since […]

Oregonians have a long-standing aversion to sales taxes, having rejected them at the ballot box ten times since […]

What is Form 1098-T? IRS Form 1098-T is a document issued by your U.S. school to report the […]

Utah’s unique tax structure, heavily reliant on earmarking, is facing a potential overhaul. A proposed constitutional amendment on […]

The rise of remote work has been a defining trend of the 21st century, with millions of employees […]

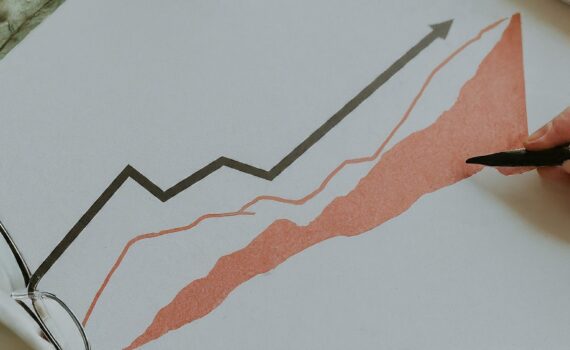

The federal government faces a pressing challenge: how to increase revenue without significantly harming economic growth. This is […]

The Changing American Diet Over the past half-century, Americans have increasingly turned to restaurants and prepared foods. While […]

Understanding the Impact of Tariffs Import tariffs, taxes levied on goods entering a country, are often implemented to […]

The outcome of the 2024 U.S. election could significantly impact the current corporate tax rate of 21 percent. […]

On Friday, Vice President Kamala Harris unveiled key elements of her economic agenda as part of her rapidly […]