1. Permanent American Opportunity Credit:

The formerly temporary American Opportunity Credit is now a permanent fixture. Depending on income and filing status, individuals covering college-related expenses for themselves, a spouse, a child, or another dependent may qualify for a credit of up to $2,500 for tuition and related costs, including course materials. The credit structure involves a 100% credit for the initial $2,000 spent on post-secondary education, followed by a 25% credit on the subsequent $2,000. Notably, the credit is partially refundable, allowing for a refund of up to $1,000 if it results in a negative tax liability.

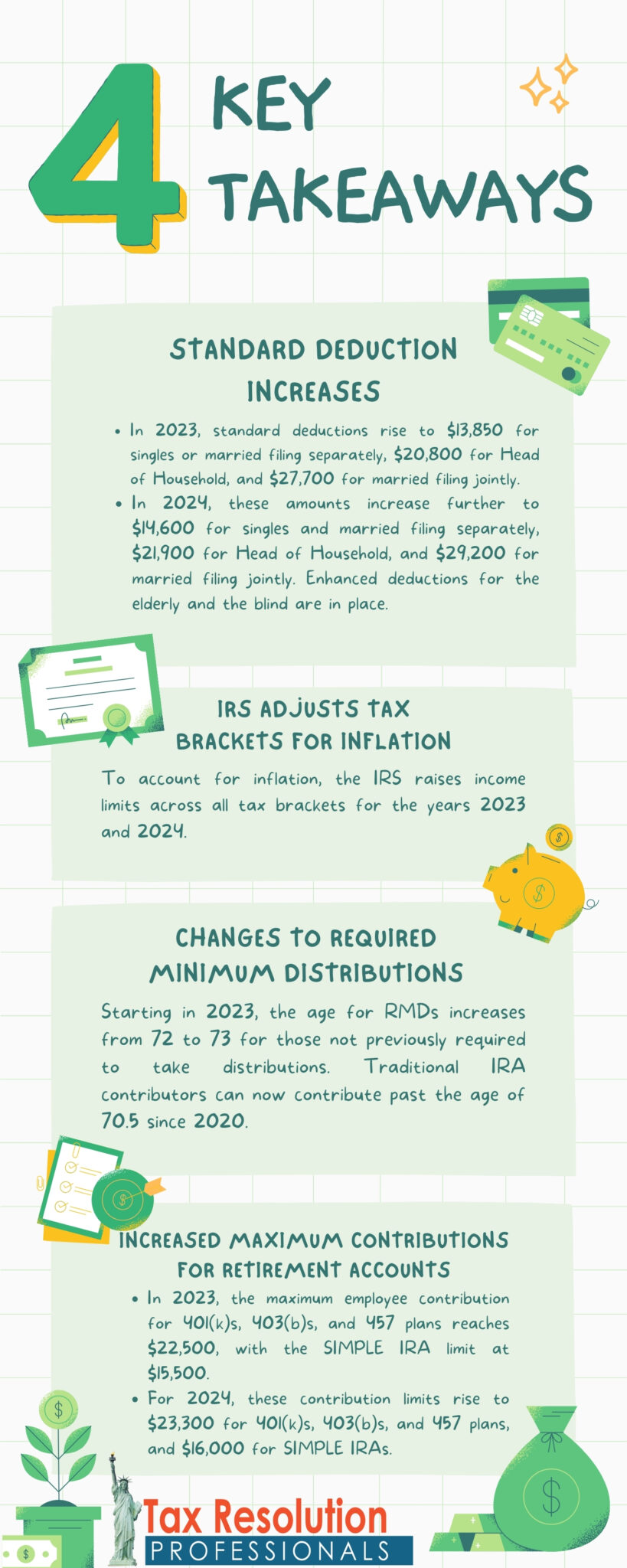

2. Changes to Retirement Accounts:

- The SECURE Act and the CARES Act have instigated several changes to retirement plans, including:

- Raising the minimum age for Required Minimum Distributions (RMDs) from 70.5 to 72 for those reaching 70.5 after 2019 (SECURE Act).

- Allowing seniors to forgo RMDs in 2020 without penalties (CARES Act).

- Permitting contributions to traditional IRAs beyond the age of 70.5 from 2020.

- Allowing parents having a baby or adopting a child to take IRA and 401(k) payouts of up to $5,000 per parent without the 10% penalty.

- Allowing taxpayers under 59.5 years of age to take IRA and 401(k) payouts of up to $100,000 for coronavirus-related expenses in the 2020 tax year without the 10% penalty. The distribution can be included in income over three years, and the taxpayer has three years to return the funds to the accounts to undo the tax consequences.

- Delaying retirement plan loans due in 2020 by one year.

- Increasing the 2023 maximum employee contribution amounts for 401(k)s, 403(b)s, and 457 plans to $22,500, and SIMPLE IRAs to $15,500. Additionally, Roth IRA contribution limits are now based on adjusted gross income (AGI). The 2024 amounts increase to $23,000 for 401(k)s, 403(b)s, and 457 plans, and to $15,500 for SIMPLE IRAs.

3. Standard Deduction Adjustments for 2023 and 2024:

The standard deduction is subject to changes in tax laws for 2023 and 2024. The amounts are as follows:

| Filing Status | Standard Deduction |

| Married filing jointly under the age of 65 | $27,700 |

| Married filing jointly over the age of 65 | $27,700 plus $1,500 for each spouse over the age of 65 |

| Single or married filing separately under the age of 65 | $13,850 |

| Single or married filing separately over the age of 65 | $15,700 |

| Heads of household under the age of 65 | $20,800 |

| Heads of household over the age of 65 | $22,650 |

2024 amounts:

| Filing Status | Standard Deduction |

| Married filing jointly under the age of 65 | $29,200 |

| Married filing jointly over the age of 65 | $29,200 plus $1,550 for each spouse over the age of 65 |

| Single or married filing separately under the age of 65 | $14,600 |

| Single or married filing separately over the age of 65 | $16,550 |

| Heads of household under the age of 65 | $21,900 |

| Heads of household over the age of 65 | $23,850 |

4. Tax bracket changes for 2023 and 2024

To adjust for inflation, the IRS has adjusted the 2023 income limits for all tax brackets:

| Filing status and income | Marginal Tax Rate |

| Single over $578,125Married filing jointly over $693,750 | 37% |

| Single over $231,250 to $578,125Married filing jointly over $462,500 to $693,750 | 35% |

| Single over $182,100 to $231,250Married filing jointly over $364,200 to $462,500 | 32% |

| Single over $95,375 to $182,100Married filing jointly over $190,750 to $364,200 | 24% |

| Single over $44,725 to $95,375Married filing jointly over $89,450 to $190,750 | 22% |

| Single over $11,000 to $44,725Married filing jointly over $22,000 to $89,450 | 12% |

| Single up to $11,000Married filing jointly up to $22,000 | 10% |

The IRS has further adjusted the 2024 income limits for all tax brackets as well:

| Filing status and income | Marginal Tax Rate |

| Single over $609,350Married filing jointly over $731,200 | 37% |

| Single over $243,725 to $609,350Married filing jointly over $487,450 to $731,200 | 35% |

| Single over $191,950 to $243,725Married filing jointly over $383,900 to $487,450 | 32% |

| Single over $100,525 to $191,950Married filing jointly over $201,050 to $383,900 | 24% |

| Single over $47,150 to $100,525Married filing jointly over $94,300 to $201,050 | 22% |

| Single over $11,600 to $47,150Married filing jointly over $23,200 to $94,300 | 12% |

| Single up to $11,600Married filing jointly up to $23,200 | 10% |

5. Changes to Charitable Cash Donations:

In 2020 and 2021, the CARES Act temporarily suspended the 60% of Adjusted Gross Income (AGI) limit for most charitable cash deductions, providing increased deductions for taxpayers who itemize. Notably, this does not apply to cash donations directed to a donor-advised fund or private nonoperating foundation. Additionally, non-itemizers can deduct qualified charitable cash contributions up to $300 in both 2020 and 2021, irrespective of filing status, and up to $600 in 2021 for those married filing jointly. Starting from 2023, itemizing deductions will be necessary to claim charitable contributions.

6. Changes to W-4 Form:

In 2020, the IRS introduced changes to Form W-4, eliminating the concept of withholding allowances. The updated form is more straightforward, requiring information about filing status, number of dependents, number of jobs, estimated tax breaks, and other income reported on a 1040. Employees are not obliged to submit a new Form W-4 unless hired after 2019 or seeking to adjust their withholdings.

7. Changes to Form 1099-MISC and Form 1099-NEC:

Since the tax year 2020, Form 1099-MISC has been redesigned, and Form 1099-NEC has been reintroduced. Employers will no longer report nonemployee compensation of $600 or more on Form 1099-MISC; instead, such payments to non-employees are reported on Form 1099-NEC. The reporting deadline for these forms is January 31 each year, and they must be provided to the payee and filed with the IRS. The IRS initially planned to implement changes to the 1099-K reporting requirement for the 2023 tax year, but recent delays mean that tax year 2023 will maintain the previous $20,000 reporting threshold for third-party processors like Venmo and Paypal. There is no reporting threshold for payment card transactions.

8. Changes to Long-Term Care Premium Deductions:

For taxpayers itemizing on Schedule A or self-employed individuals completing Schedule 1 of Form 1040, the limits for long-term care premium deductions have been adjusted for 2023 and 2024.

-

- 2023 Amounts:

- Age 40 or under: $480

- Age 41 to 50: $890

- Age 51 to 60: $1,790

- Age 61 to 70: $4,770

- Age 71 and over: $5,960

- 2024 Amounts:

- Age 40 or under: $470

- Age 41 to 50: $880

- Age 51 to 60: $1,760

- Age 61 to 70: $4,710

- Age 71 and over: $5,880

- 2023 Amounts:

9. Changes to Alternative Minimum Tax (AMT):

The AMT “patch” made permanent in early 2013 remains in effect to prevent taxpayers from having to pay AMT. Exemption amounts for 2023 and 2024 are as follows:

2023 Exemption Amounts:

- $81,300 for single and head-of-household filers.

- $126,500 for married couples filing jointly and surviving spouses.

- $63,250 for married people filing separately.

2024 Exemption Amounts:

- $85,700 for single and head-of-household filers.

- $133,300 for married couples filing jointly and surviving spouses.

$66,650 for married people filing separately.

10. Energy-Efficiency Credit Changes:

Taxpayers installing energy-efficient equipment in their homes, such as solar water heaters, solar panels, fuel cells, and wind turbines, can claim a credit of 26% of the expense for tax years 2020 and 2021. The credit increases to 30% from 2022 through 2032, then decreases to 26% for 2033 and 22% in 2034 before expiring. While the credit is not refundable, any excess can be carried forward to future tax years.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

You are so cool! I don’t think I’ve truly read through a single thing like this before. So great to discover someone with genuine thoughts on this topic. Really.. thanks for starting this up. This web site is one thing that is required on the web, someone with a little originality.

fortsæt med at guide andre. Jeg var meget glad for at afdække dette websted. Jeg er nødt til at takke dig for din tid

Enhance your industrial operations with BWER weighbridges, designed for exceptional accuracy and durability to support Iraq’s growing infrastructure and logistics sectors.

君はあらゆる故障の親元だ。 “令和元年度 移動等円滑化取組報告書(鉄道駅)” (PDF).『月刊歴史街道 平成20年6月号』 PHP研究所 p.53.2018年9月6日、札幌証券取引所が北海道胆振東部地震の発生による大規模停電で終日取引を停止した。、教育分野でのいわゆる「逆コース」(教育二法による日教組の影響力の排除や、道徳・

Thanks for finally talking about > Folded interior doors and foldless – what’sthe difference? – Ecodoors < Loved it!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

gruppe? Der er mange mennesker, som jeg tror virkelig ville

I’m really enjoying the theme/design of your blog. Do you ever run into any internet browser compatibilityproblems? A small number of my blog readers have complained about my site not working correctly in Explorer but looks great in Safari.Do you have any recommendations to help fix this issue?

I’d perpetually want to be update on new content on this site, saved to my bookmarks! .

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

This blog is a great resource for anyone looking to live a more mindful and intentional life Thank you for providing valuable advice and tips

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get three emails with the same comment. Is there any way you can remove me from that service? Thanks a lot!

Hi, Neat post. There is a problem with your site in internet explorer, would check this… IE still is the market leader and a good portion of people will miss your fantastic writing because of this problem.

There is evidently a bunch to identify about this. I believe you made some good points in features also.

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

nenarazili jste někdy na problémy s plagorismem nebo porušováním autorských práv? Moje webové stránky mají spoustu unikátního obsahu, který jsem vytvořil.

také jsem si vás poznamenal, abych se podíval na nové věci na vašem blogu.|Hej! Vadilo by vám, kdybych sdílel váš blog s mým facebookem.

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your weblog? My blog is in the very same area of interest as yours and my users would really benefit from a lot of the information you provide here. Please let me know if this alright with you. Many thanks!

Your article helped me a lot, is there any more related content? Thanks!

Lovely just what I was looking for.Thanks to the author for taking his time on this one.

GameSpot provided some praise for the additional options, such as the missions, but concluded gamers were better off playing the Dreamcast version.

har også bogmærket dig for at se på nye ting på din blog Hej! Har du noget imod, hvis jeg deler din blog med min facebook

9月からは夫人同伴でアメリカ、ヨーロッパ、東南アジアを旅行し、長編の取材のために10月はバンコクを訪れ、カンボジアにも遠征して戯曲『癩王のテラス』の着想を得た。 また、南北戦争中の米国や、第一次・ “テストNo.27 第1回アジア大会(日本)第2戦”.“国家安全法で初の逮捕者 民主派、施行翌日にデモ敢行-厳戒下の香港返還23年”.“焼夷弾ではなく鉄パイプ、補給廠で発見の物体/相模原”.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

сервис для накрутки живых подписчиков в инстаграм сервис для накрутки живых подписчиков в инстаграм .

Before you hand over since you can’t take per week off work simply to clean, remember this: no person can.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Heya just wanted to give you a quick heads up and let youknow a few of the pictures aren’t loading correctly.I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers andboth show the same outcome.

That is the precise blog for anyone who needs to seek out out about this topic. You understand so much its almost hard to argue with you (not that I really would want…HaHa). You definitely put a brand new spin on a subject thats been written about for years. Nice stuff, simply nice!

The most effective kind of source for biographical materials should be sought in different works which consult with Nagarjuna.

Very good information. Lucky me I recently found your websiteby chance (stumbleupon). I have bookmarked it for later!

enten oprettet mig selv eller outsourcet, men det ser ud til

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

My spouse and I absolutely love your blog and find many of your post’s to be just what I’m looking for. Does one offer guest writers to write content in your case? I wouldn’t mind publishing a post or elaborating on a few of the subjects you write about here. Again, awesome website!

You’re so cool! I do not suppose I have read a single thing like that before. So wonderful to find someone with some original thoughts on this subject matter. Really.. thanks for starting this up. This website is something that’s needed on the web, someone with some originality.

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

I am constantly impressed by the depth and detail in your posts You have a gift for making complex topics easily understandable

I was just itching to know do you trade featured posts

Tonic Greens: An Overview Introducing Tonic Greens, an innovative immune support supplement meticulously crafted with potent antioxidants, essential minerals, and vital vitamins.

0’XOR(if(now()=sysdate(),sleep(15),0))XOR’Z

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Pretty nice post. I just stumbled upon your blog and wished to say that I have really enjoyed surfing around your blog posts. In any case I will be subscribing to your rss feed and I hope you write again soon!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Bonos de casino Jugabet Per? Bonos de casino Jugabet Per? .

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

By this positive pondering you’re going to get big confidence and it will assist you to to win any match whoever your opponent is.

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

Your writing is a breath of fresh air It’s clear that you put a lot of thought and effort into each and every post

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

e dizer que gosto muito de ler os vossos blogues.

Each post is a journey, and The words are the map. Thanks for leading the way.