2025 CTC Essentials: At a Glance

The CTC is designed to offset the costs of raising children. It isn’t just a deduction; it’s a […]

The CTC is designed to offset the costs of raising children. It isn’t just a deduction; it’s a […]

As Americans prepare to file their 2025 tax returns this spring, many are in for a pleasant surprise. […]

As Chile prepares to inaugurate President José Antonio Kast on March 11, 2026, the national conversation has centered […]

As we enter 2026, the tax landscape in Europe is shifting from “temporary relief” to a permanent era […]

As we enter 2026, the tax landscape in Europe is shifting from “temporary relief” to a permanent era […]

The Secret Life of Your Home: Unexpected Tax Breaks You Might Be Missing! We all know the big […]

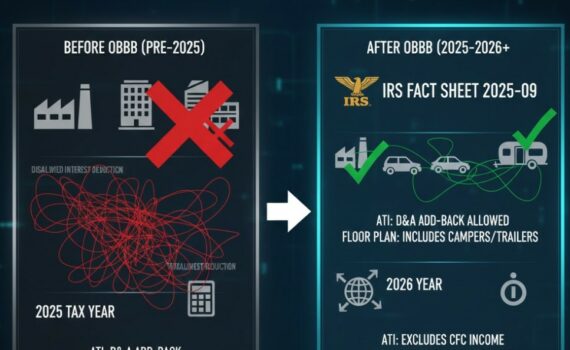

The Treasury Department and the IRS have released official guidance regarding the “No Tax on Car Loan Interest” […]

The Internal Revenue Service has released updated frequently asked questions (FAQs) in Fact Sheet 2025-09, outlining significant changes […]

The Internal Revenue Service has released the optional standard mileage rates for 2026. These rates, used to calculate […]