The “One Big Beautiful Bill Act” (OBBBA): Economic Boost at ...

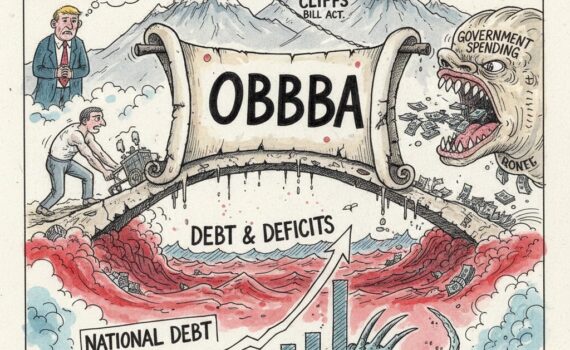

The One Big Beautiful Bill Act (OBBBA), the sixth-largest tax cut since 1940, is projected to increase U.S. […]

The One Big Beautiful Bill Act (OBBBA), the sixth-largest tax cut since 1940, is projected to increase U.S. […]

Several states that previously opted to exempt international corporate income—specifically the tax on Global Intangible Low-Taxed Income (GILTI)—are […]

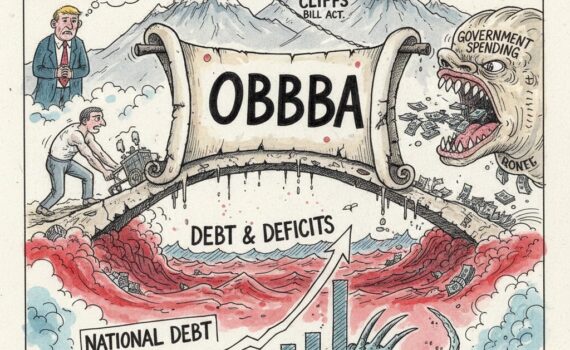

As of November 2025, the economic fallout from President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs is […]

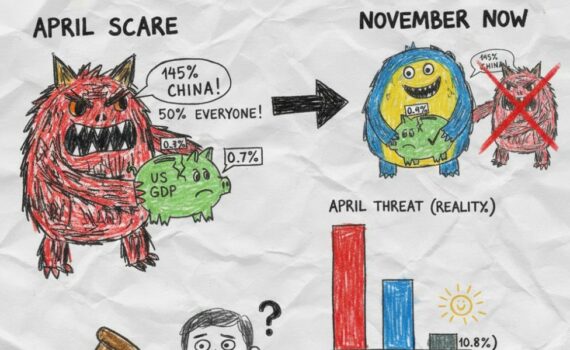

The 2025 tax year is turning out to be a pivotal one, especially for homeowners and high-income earners. […]

The Internal Revenue Service (IRS) has announced significant increases in retirement savings limits for the 2026 tax year, […]

The Department of the Treasury and the Internal Revenue Service (IRS) have issued Notice 2025-69 to clarify new […]

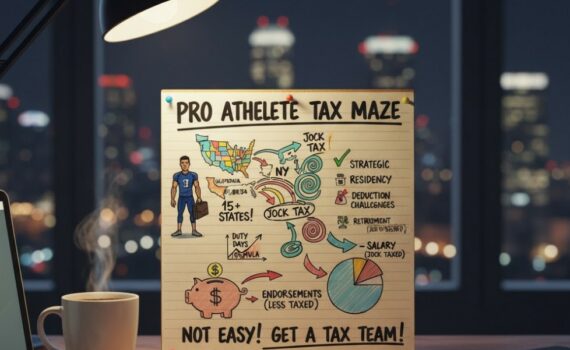

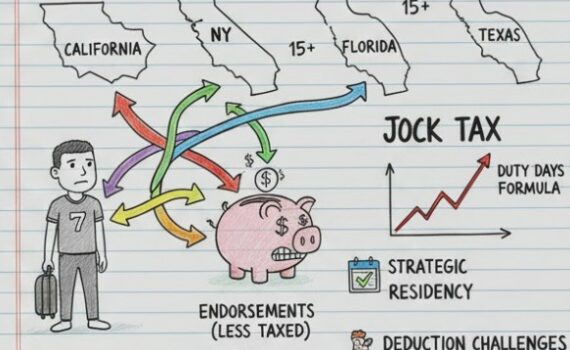

For professional athletes in the U.S., the glamour of the game often overshadows the mountain of paperwork that […]

For professional athletes in the United States, signing a multi-million-dollar contract is only the first step. The second, […]

The very mention of the Internal Revenue Service (IRS) often conjures images of endless paperwork, complex regulations, and […]