NYS Tax Debt Relief -Your Options In Dealing With New ...

Your Options for NYS Tax Debt Relief There are five main options when it comes to NYS tax […]

Your Options for NYS Tax Debt Relief There are five main options when it comes to NYS tax […]

As tax professionals, we understand the fear and frustration that comes along with an NYS tax warrant. Finding […]

Statute of Limitations for an NYS Tax Warrant The State of New York issues tax warrants for debts. […]

Penalty and Interest Reduction by the IRS: Harder Than Many Make it Sound Our clients often ask: Will […]

Types Of Offer in Compromise Offer in Compromise is a settlement for tax debts less than the amount […]

Business Offer In Compromise: IRS Business Debts Can Be Settled Too A business offer in compromise (“OIC”) with […]

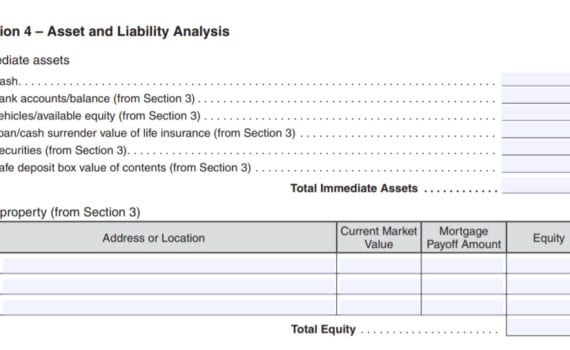

When it comes time to settle your tax debt, you need a place to start. Some agencies will tell […]

If you live in a community property state and did not file a joint return, you may be […]

FTB Offer In Compromise: Tough To Get Accepted, But Can Be Done! Below is a brief video that […]