In general, credit scores falling within the range of 670 to 739 on the commonly used 300-850 credit score scale are considered good. Credit scores of 720 or higher are deemed excellent, whereas scores ranging from 630 to 689 are considered fair. Scores that are lower than 630 are categorized as bad credit.

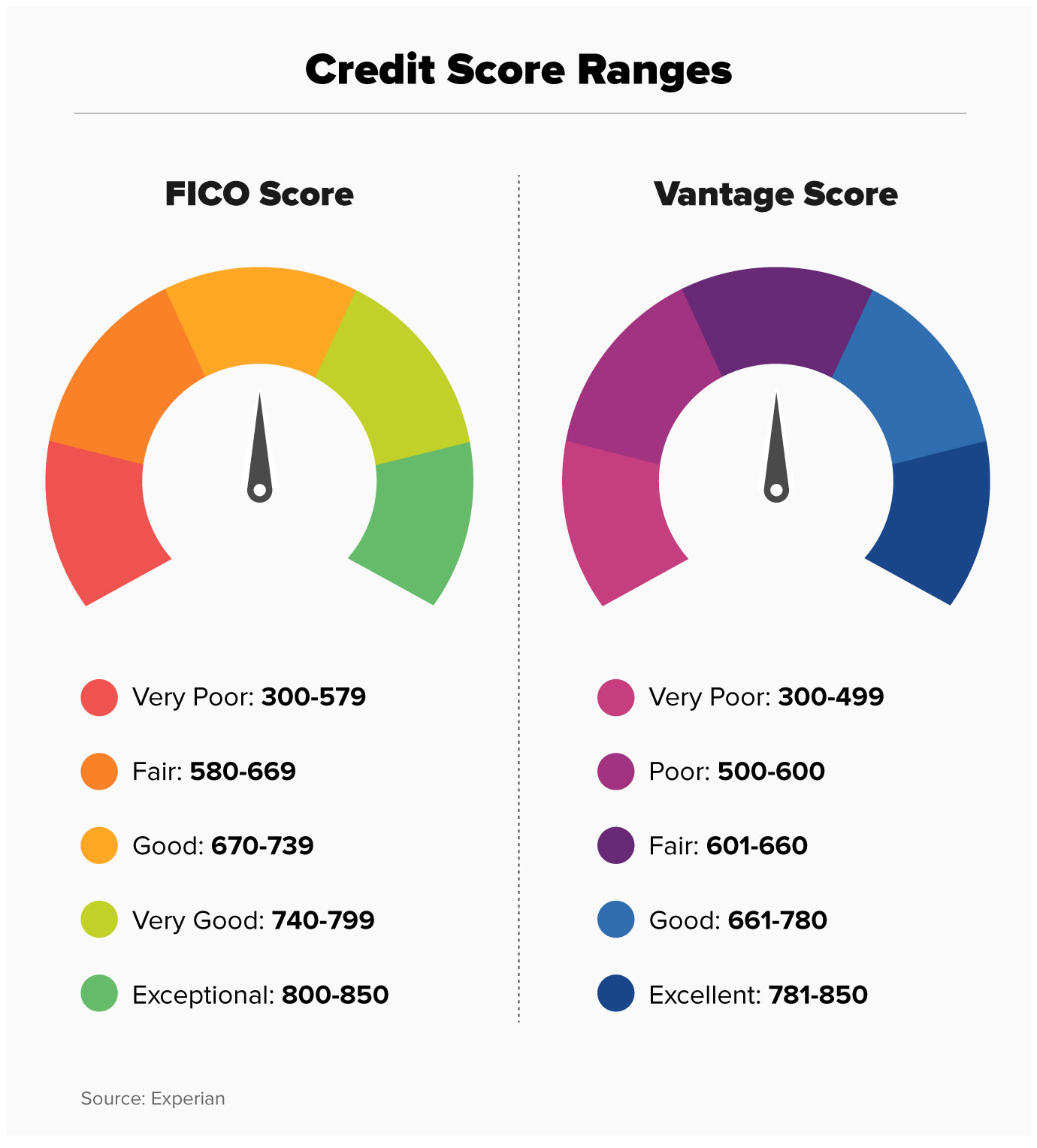

The 300-850 range is utilized by FICO, the most widely recognized credit scoring system. VantageScore uses a similar scoring system.

FICO

According to the FICO website, a good FICO score ranges from 670 to 739. Scores between 580 and 669 are considered “fair,” and scores between 740 and 799 are classified as “very good.” Anything above 800 is deemed “exceptional.” NerdWallet’s credit score bands are also provided for general guidance.

As of August 2022, the average credit score, according to FICO, was 716, which falls within the good range. FICO was developed by Fair Isaac Corp. and utilizes data from the three major credit reporting bureaus: TransUnion, Equifax, and Experian.

VantageScore

VantageScore, FICO’s competitor, produces a similar score using the same credit report data from the three bureaus. A good VantageScore, according to the company, is between 661 and 780, categorized as a “prime” credit tier. Scores between 780 and 850 are considered “superprime,” while those between 601 and 660 are classified as “near prime.” Scores below 600 are deemed “subprime.”

The average VantageScore 3.0 during the second quarter of 2021 was 695. NerdWallet provides a free credit score using VantageScore and your TransUnion credit report.

Benefits of having a good credit score

Having a good credit score is crucial because it determines your ability to borrow money and the amount of interest you’ll pay on those loans. Here are some of the benefits of having a good credit score:

- Access to unsecured credit cards with reasonable interest rates, or balance-transfer cards.

- Qualification for desirable car loans or leases.

- Approval for a mortgage with favorable interest rates.

- Ability to open new lines of credit in emergency situations if you don’t have an emergency fund or it’s depleted.

- In many states, individuals with higher credit scores pay less for car insurance.

- Landlords may use credit scores to screen tenants, so having a good score can increase your chances of getting approved.

Overall, having a good credit score is advantageous, whether you intend to apply for credit or not.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.