FTB Offer In Compromise: Tough To Get Accepted, But Can Be Done!

Below is a brief video that explains the process and from there you can judge if it is worth proceeding. The video is further down and the remaining information on the page explains the entire process step by step.

California Franchise Tax Board Offer In Compromise

California taxpayers and former taxpayers that can prove they do not have the ability to pay their past due California Franchise Tax Board (“FTB”) state income tax liability can try to settle their tax debt for less than the full amount owed through an FTB Offer In Compromise (“OIC”). The FTB is looking to see what they can collect from the taxpayer over a reasonable time period. An FTB Offer In Compromise is usually more difficult than getting an IRS Offer In Compromise accepted. IRS Offer In Compromise acceptance does not guarantee acceptance of a settlement from the California FTB.

Our firm has done a lot of Franchise Tax Board Offers In Compromise. Our tax attorneys started in California and there are many people here where our office is in Las Vegas that used to live in California who still have tax debt from the state when they lived there. We also handle cases from clients nationwide, many of them being from California.

In this guide, i will explain how the FTB Offer In Compromise procedure for individuals works, what you need, and how to do it. It should be noted, that unlike in New York State Offer In Compromise where the same entity handles sales and income tax, the FTB does not handle sales tax debts. The California Board of Equalization handles sales tax debts, and an Offer In Compromise for sales tax debt is filed on different forms with them. You can also see a video version of this guide below.

Taxpayer Scenarios the California FTB Takes Into Account

The FTB takes into account the following factors of a taxpayers financial situation when deciding to accept an Offer In Compromise:

- Ability to pay based on current finances.

- The total value of assets including real estate, vehicles, retirement accounts.

- Current and future income compared to current and future expenses. More leftover income after reasonable expenses = less chance of settlement.

- Whether the offer is in the State of California’s best interest.

- Age of the taxpayer. The younger you are the least likely they will accept it.

You can only submit an Offer In Compromise twice on the same liability.

Pre-Qualifications for an FTB Offer In Compromise

Some boxes must be checked before proceeding on an FTB Offer In Compromise. Make sure the following are complete:

- You have filed all required tax returns. There are some exceptions to this with returns from the early 90s and before. The FTB might some of the old returns to not be filed if they filed for you, but this is case by case. If you are not sure if you have to file, call and ask the FTB or hire a tax attorney.

- Current on estimated tax payments if required.

- Be OK with the FTB going through all your financials in detail. Some people do not like them going through everything and would rather pay it in a payment plan.

- Most of the time if you have more assets than the tax amount due, you are not going to qualify.

- If your income is really high, you might not qualify.

Make Sure You Know The FTB Offer In Compromise Details That May Come Up

There are a few things on FTB tax settlements that are different than the IRS and other states. We will go through these in detail so you know what to expect when you submit an FTB Offer In Compromise.

If You Have Higher Income Potential, They Might Ask For More Later

If the FTB thinks they can get more money out of you in the future, they may offer a collateral agreement. This gives the FTB the right to take a specified percentage of your income for the next five years if it exceeds a certain amount. This sometimes can be a condition of FTB Offer In Compromise acceptance. The majority of the time the FTB does not require one of these agreement types. Once approved it usually is over though.

A Very Thorough Investigation Of Your Financials

By submitting an FTB Offer In Compromise and signing the paperwork, you are consenting to the FTB doing a thorough investigation on your financial information. If you do not disclose financial information, most of the time the FTB will find it anyway. Make sure everything you report to the FTB or your tax attorney preparing your FTB Offer In Compromise is accurate and complete.

Lump-Sum Payment for Offer In Compromise by FTB

The FTB typically wants a lump sum payment for your settlement amount. You do not need to offer a certain percentage of the debt and we have settled very large debts for low amounts. An FTB Offer In Compromise was accepted for $500 on an over $200,000 debt that our firm did recently. It depends on your financial situation what kind of settlement you will get. This client only had Social Security Income.

Information Required for a California FTB Offer In Compromise

The FTB will request the following information to process your Offer In Compromise along with FTB Form 4905 PIT. All the information except for FTB Form 4905 PIT should be copied.

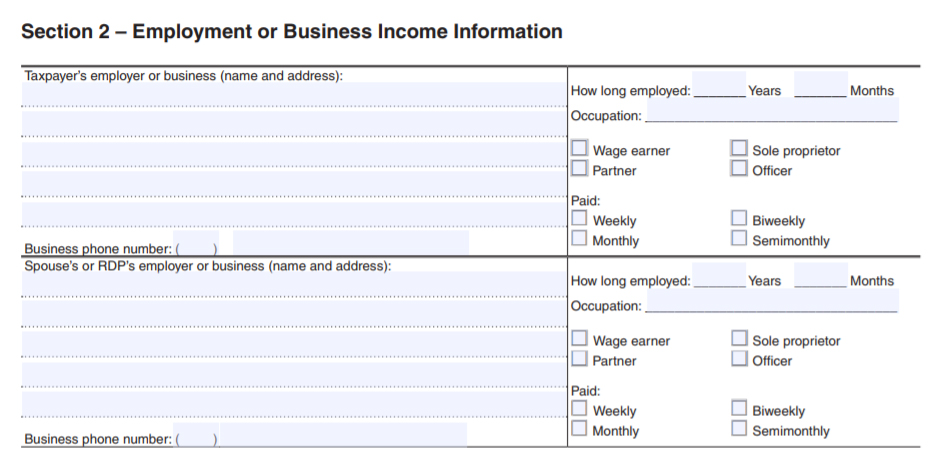

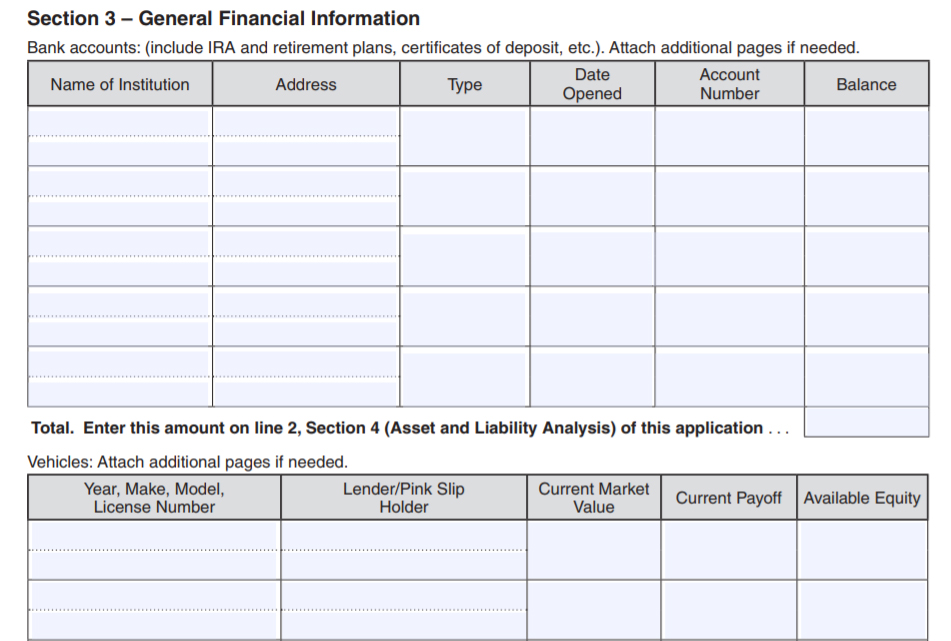

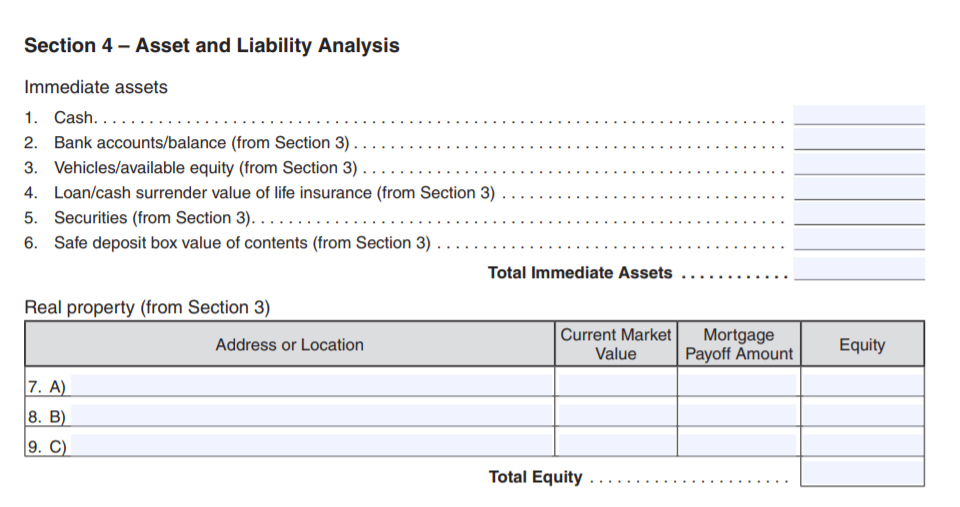

- FTB Form 4905 PIT. This is the booklet that is used to fill out your financial information. Below we will go through instructions on filling this out.

- Verification of Income. Complete pay stubs for the past three months, or financial statements for the past two

years if self-employed. Include any investment or ownership in any business entity or

trust, and the income derived from these sources (dividends, K-1 income, distributions, etc .). For self-employed you usually can use your last to Schedule C’s if filing as a sole proprietorship. We often recommend sending a Year to Date profit/loss statement as well. They do not require this, but it helps show the current financial state. - Verification of Expenses. Billing statements for the last three months. (Include copies of revolving charge card

statements, bills from other creditors, and personal loan statements .) Try to get as much of this together if you can. If there is one or two items missing but the expense is reasonable, get it sent out. Make sure to save copies of the next statements so when your case is assigned to an FTB agent, you can give them the proof if needed. - Bank Information. Complete bank statements for savings and checking accounts for the last six months.

If self-employed, provide bank statements for the last twelve months. Include accounts

that have been closed during that period. You probably will have to go into the local branch to get bank statements from a closed account. Often there is a fee of about $5 per statement. - Securities. Investment account statements showing the value of stocks, bonds, mutual funds,

and/or retirement or profit-sharing plans, e .g ., IRA, 401(k), Keogh, or Annuity. - Current Lease or Rental Agreements. Provide a copy of the lease of your residence if renting. Provide a copy of any rental agreements for the property you own that you are renting out. Also, include any lease agreements for storage facilities or related expenses.

- Real Property Information. Mortgage statements and escrow statements for the property you currently own, sold, or

gave away in the last five years. - IRS Information. IRS Offer In Compromise application and acceptance letter or other IRS arrangements. If you do not have any IRS issues, disregard this. If your case is in a pending Offer In Compromise or another arrangement with the IRS, send the last correspondence you received. I also recommend writing in the cover letter the current status of your IRS case. Most cases that can settle with the FTB can settle with the IRS. The IRS is usually easier to get a settlement from.

- Legal Documents. Marital settlement agreements, divorce decrees, marital property settlements, trust

documents, and bankruptcy documents. I add to this proof of court order for any court-ordered payment, for example, child support or restitution. - Medical Information. Physician’s letter including diagnosis and prognosis and/or other documents to show

any medical condition that should be considered. Get a recent one if you can. - Power of Attorney. Include an FTB Power of Attorney if a designated representative submits this offer. If a tax attorney is handling your case they already will submit this when submitting your FTB Offer In Compromise. If you are sending it in yourself, do not send in a Power of Attorney.

Filling Out FTB Form 4905 PIT: California Tax Settlement Form

I will go section by section through the FTB Offer In Compromise form. Much of it is self-explanatory and will be noted as such.

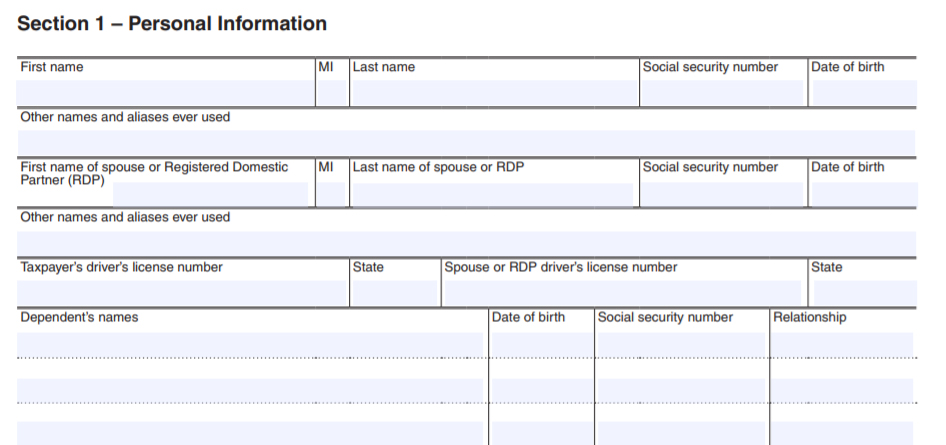

Section 1 – Personal Information

Just basic information on this part of the FTB Offer In Compromise

Current liabilities including judgments, notes, and other charge accounts

Please note the FTB misspelled judgment here, but that is the title of this section. Here is what you put in:

Total owed for lines of credit: Total amount due for credit cards and lines of credit from Section 3.

Taxes Owed to IRS: Put the total amount due and a copy of the most recent notices. If nothing put $0.

Other Liabilities, Line 24-27: Put any other liabilities that are not car loans or mortgages.

Total Liabilities: Add all the liabilities up in this section and put the total.

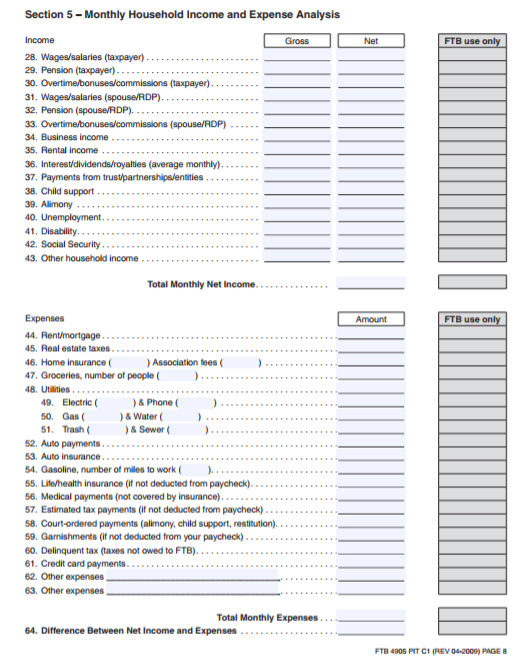

Section 5 – Monthly Household Income and Expense Analysis

Enter figures on a monthly basis in this category. FTB Offer In Compromise acceptance is more likely the less income you have available at the end of the month.

Section 5 is a little long but make sure you include everything.

Income

List all types of income you receive in the appropriate category for you and your spouse. It is recommended to state the income type on a cover letter and include proof if you fill in the other category. They ask for gross and net. For some of these categories, gross and net may be the same. Add all the net income together and put it under “Total Monthly Net Income.”

Use a monthly figure based on last year’s income if it is at the beginning of the year if you are self-employed and do not have an exact monthly figure. If it is halfway or later through the year, make a year-to-date profit/loss statement and divide the total income by how many months have passed. Do this for both gross and net, and you will have your self-employed income figure for this part of the form.

Expenses

List all your expenses. Put exact figures for everything. The only exception is groceries, where you can put your best-educated guess on the monthly amount. It should be a reasonable amount. IRS collection financial standards are not automatically accepted for this, but the amount they put for food in there has been accepted by some agents as reasonable. You can even put a bit higher if you still live in California. California is a bit more expensive than most of the country, so you might be able to spend more than that standard as well.

Add all your expenses up and write the total in the box next to “Total Monthly Expenses.”

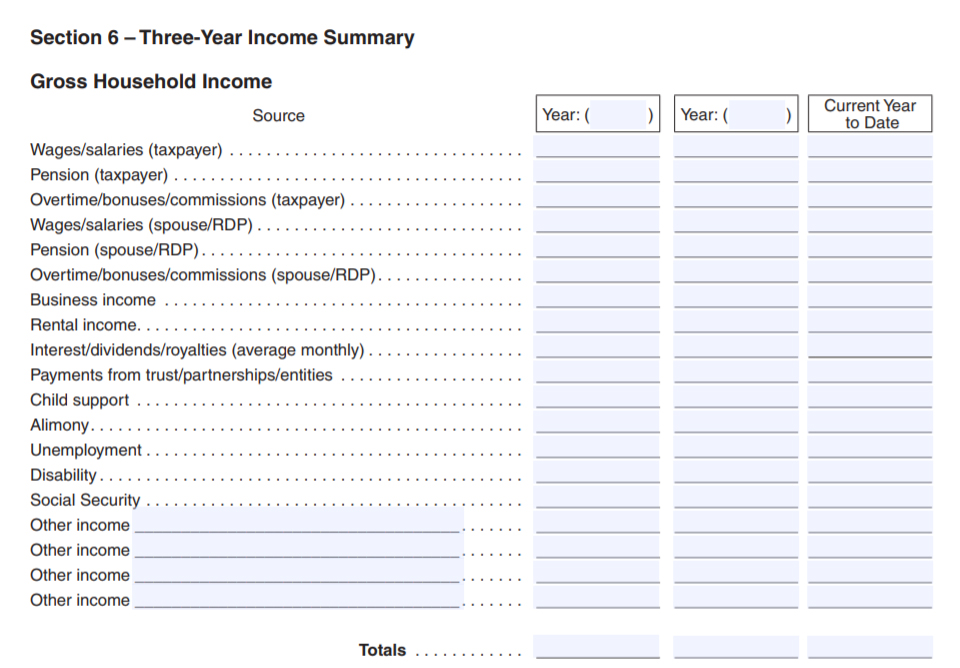

Section 6 – Three-Year Income Summary

They want to know household income

Here they are looking for the details on your income over the last three years. The items are self-explanatory. On top of the parenthesis sections, write in the last two years. IE: If it is 2017, you would write 2015 and 2016, left to right. List all the income totals from each labeled source for the entire year in each column. Make sure to include details for the “Other Income” section and include copies of any documentation related to it. Add up and input the totals for each year in the appropriate Totals section below.

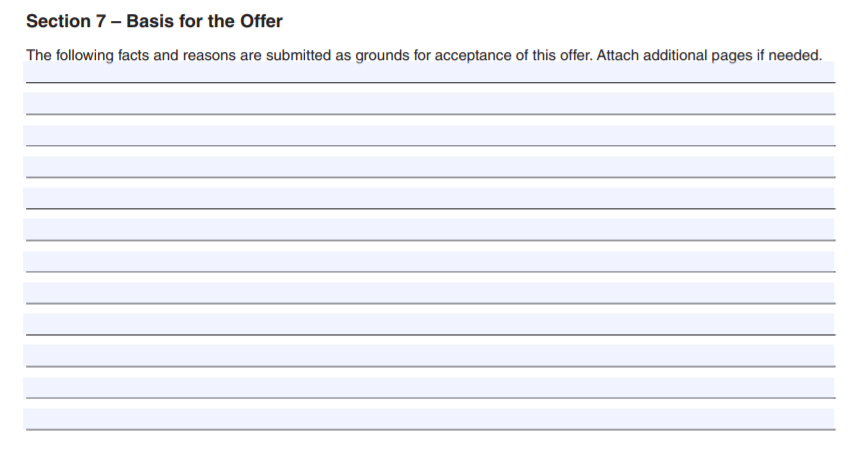

Section 7 – Basis for the Offer

Give the best truthful sad story you can give.

The most common explanation here is that you do not have enough money to pay the tax debt. You should also list any medical conditions, age-related issues, and other reasons that would help the FTB agent feel sorry for you. Make the picture look as bleak as possible, but put what really is happening. Include copies of paperwork that support any of the points you are arguing in this section.

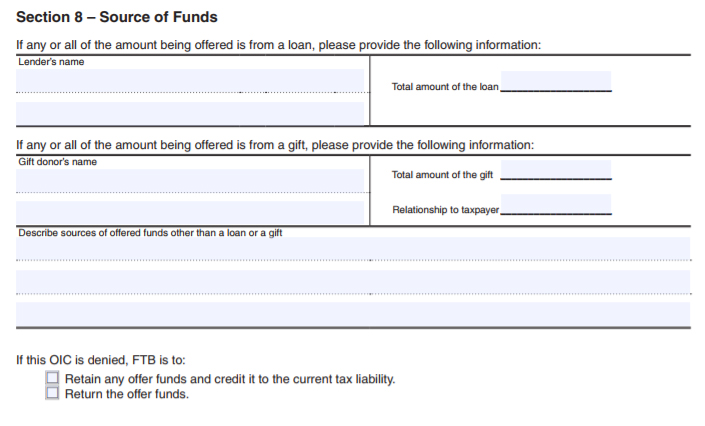

Section 8 – Source of Funds

Where are you getting that settlement money? The FTB wants to know!

FTB wants to know where you will get that money to pay for your Offer In Compromise. Put your description in the bottom text box for this section if it is not a loan or gift. You can say something like “bank account” or “earned wages.”

On the check box select what you want them to do if the FTB rejects your Offer In Compromise. They do not ask for money right away. They will ask for it prior to final acceptance. For this reason, most people are going to want to check to Return the offer funds.

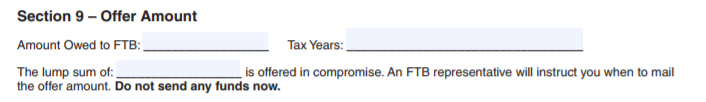

Section 9 – Offer Amount

Short and simple.

List the total amount you owe. You (or your tax attorney) can get this total by calling the FTB. List all the years for which you owe. While the IRS will automatically make you include all years and send you an amended Offer if you miss something, the FTB will not. It is very important to include all years here. Enter the lump sum you are offering. If you have no income or assets, offer $100-500. The FTB may come back with a higher figure, but I say start low go higher. I have only seen it go the other way once. A very nice agent let one of our clients who was taking care of disabled children not pay anything towards the settlement and forgave the debt completely when we had offered $100.

Do not send any funds with the Offer. FTB will tell you to submit the settlement funds. It still then is subject to review. The FTB Offer In Compromise is not complete even if recommended for acceptance by the agent, but it is a pretty good sign. The case must pass the final review.

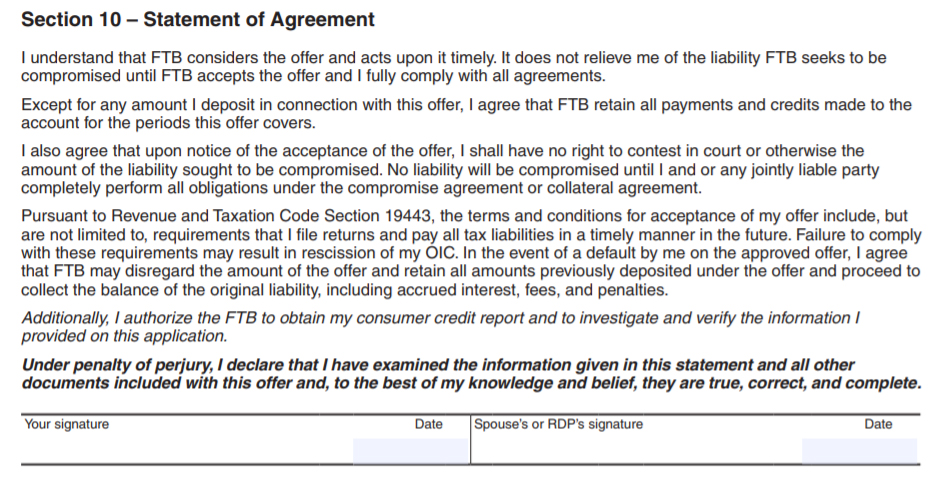

Section 10 – Statement of Agreement

The offer terms are pretty fair.

This is where you agree to the offer terms. Sign and date at the bottom if you agree and note that debts cannot be contested later in court. You agree that you will file on time and keep current in the future on taxes due. Note that the IRS requires you to keep current on taxes due and file on time for five (5) years. The FTB does not specify a time limit on this.

Sign and date on the bottom. Have your spouse sign and date as well if you have joint FTB tax debts.

Sending Out Your FTB Offer In Compromise And Final Notes

Include a cover letter explaining anything that cannot be explained by the FTB Offer In Compromise forms in addition to the above-referenced information . Your tax attorney will most likely put a cover letter on it for you if they are preparing it. The offer should be sent by certified mail with a return receipt. You or your tax attorney should contact FTB collections if your case is in collections (or if you are unsure) and let them know you have submitted an FTB Offer In Compromise. Most of the time they put a collection hold on the case until the Offer In Compromise evaluation is over. The FTB however, unlike the IRS, does reserve the right to proceed with collection action while the Offer is pending.

After submission, you should get a response within 90 days. FTB settlements are often faster than the IRS, the average being 3-5 months time. We hope this guide helps explain the process and can help you to get your own FTB Offer In Compromise even if you cannot afford professional help.

Don’t want to do it yourself? Prefer to have our expert tax attorneys do it for you? Fill out the contact form here or call us at (888) 515-4829. One of our tax attorneys will call you for a free, no-obligation consultation.