IRS Lock In letter – What It is and How ...

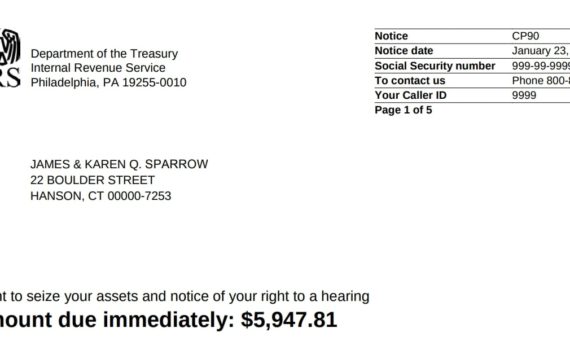

An Lock In Letter from the IRS demands that a certain amount of taxes be withheld from the employee […]

An Lock In Letter from the IRS demands that a certain amount of taxes be withheld from the employee […]

California FTB Audits ExplainedWatch this video on YouTube The California Franchise Tax Board Seldom Do Their Own Audits […]

When we research financial services and especially tax relief companies, we tend to make the rounds checking review […]

Here will discuss tax relief in the 4th quarter of 2021 for the IRS and what you should […]

You get this IRS letter 30 days before the IRS starts levying up to 15% of your Social […]

IRS Certified Mail Letters – Reasons and Responses Under certain conditions, the IRS will send letters through the […]

What happens if you ignore an IRS audit? They Continue Without You What Happens If You Ignore An […]

What Is A CP2000 Notice From The IRS? A CP2000 notice is an Underreporter Inquiry that gets issued […]

What is IRS Debt Forgiveness? IRS Debt Forgiveness Explained - Understanding Tax Debt Forgiveness Program With Free GuidesWatch […]