IRS Certified Mail Letters – Reasons and Responses

Under certain conditions, the IRS will send letters through the post office via certified mail. A specific set of circumstances will require the IRS to notify you of an action or event through certified mail. Then based on the date of the letter, you will have a certain amount of time to respond. The IRS is required by regulations and policy to officially notify you of these circumstances.

Certified mail has some extra steps taken beyond regular mailing:

- Delivery receipt – for tracking

- Signature tracking – verifying that you got it

- Electronic delivery tracking – to find out what happened if it got lost

Be advised: The IRS only needs to send the notice to your last known address. It’s up to you to keep your address up to date by filing returns or filing a change of address with the IRS. As a general rule, the clock starts ticking the date of the certified letter from the IRS, so you want to take action as soon as possible.

Now let’s go over some of the cases where you might be the recipient of IRS-certified mail. Watch the video for a summary or keep reading on for a more in-depth analysis.

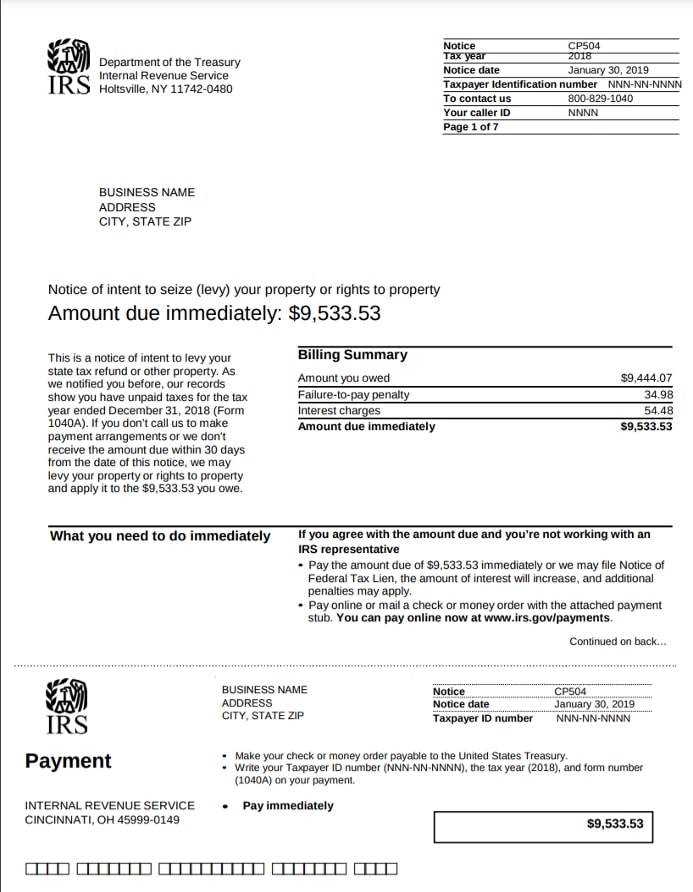

[#1] Outstanding Balance / Amount Due (CP504)

Pretty self-explanatory: You owe them money. The certified notice will only happen after they have sent you ordinary “balance due” notices. The arrival of the certified cp504 letter signals a further warning before they begin to take more proactive steps in recovering the balance.

How to Respond to Outstanding Balance Letters:

Think about how you are going to resolve the taxes owed. You might be able to pay the balance all at once and if so that’s often the easiest solution followed up by a First Time Penalty abatement.

Offer in Compromise, Currently Not Collectible Status and bankruptcy are other options. Not all taxes qualify for bankruptcy and if you only owe tax debt, Offer In Compromise is almost always the better option. See our Offer In Compromise vs bankruptcy comparison for more information.

Bottom line: The purpose of the CP504 is to notify you that your case is getting closer to collection activity.

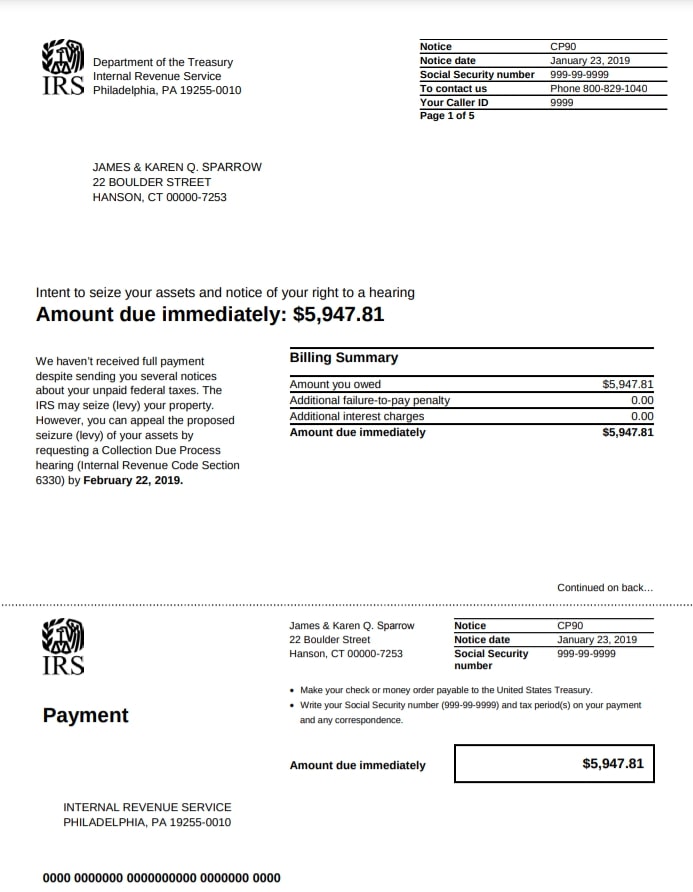

[#2] Final Notice of Intent to Levy (CP90)

A CP90 Final Notice of Intent to Levy letter is an IRS certified mail letter letting you know the IRS will try to levy or garnish you 30 days from the date of the letter.

A levy is an attempt at a forcible collection of debt through legal means – garnishing a paycheck, filing a lien on the property, seizure of property, confiscating a bank balance, or whatnot.

How to Respond to a Final Notice of Intent to Levy:

Set up arrangements with the IRS to deal with the issue, or hire someone to act as your intermediary, such as a tax attorney. The resolutions you would seek are the same as those above listed for #1, the CP504 notice. You are just now further along in the collections process and it’s time to take action quickly.

If you are mailing in an Offer In Compromise and have received a CP90, it’s strongly recommended to call the IRS collections number listed on your letter, often it’s (800) 829-7650, or the Revenue Officer assigned to your case if there is one.

Let them know you are submitting an Offer and ask for a hold on collection activity to ensure levies and garnishments do not go out while you are waiting for your Offer to get into processing status.

Bottom line: Start getting your case resolved or collection attempts are coming soon.

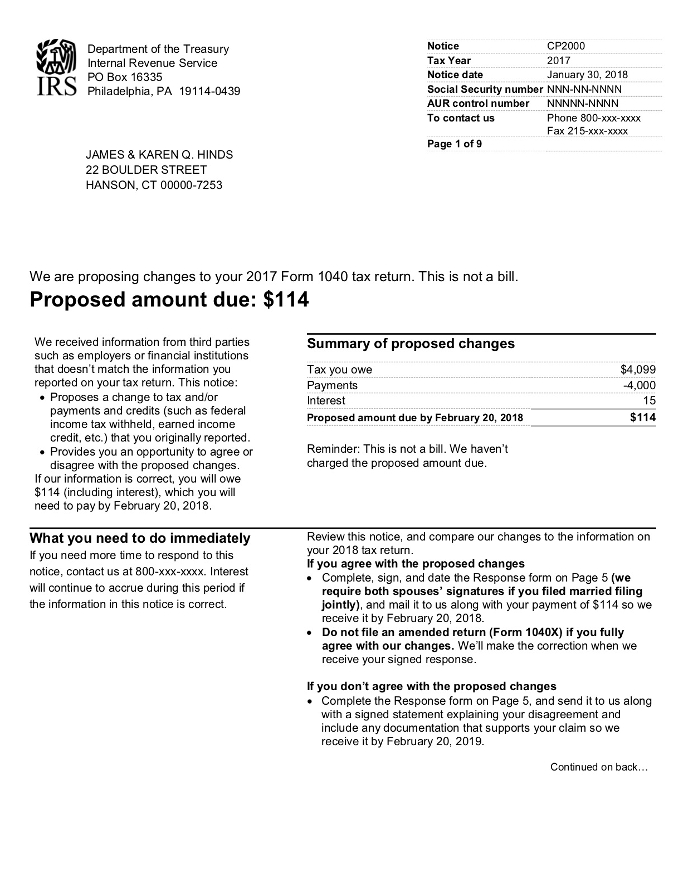

[#3] Underreporter Inquiry (CP 2000)

The IRS will send a CP2000 notice when there is a discrepancy between the information they have on file and the information you reported on your tax return. This may be pertaining to any number of issues; perhaps you forgot to include a 1099 or W2, filed mistaken information about dependents or failed to report income from capital gains. There may even be an error on the part of a third party or a glitch in the IRS computer system. Identity fraud where somebody interacted with the IRS while pretending to be you can also be the cause.

Sometimes there’s an easy fix, and sometimes you have a mess to straighten out.

How to Respond to a CP2000 Letter:

If it’s a simple fix that you can easily handle, you can submit your response directly, but be sure to send it USPS certified mail with a return receipt so you know they got it and keep a copy.

In other cases, you may want someone else to handle it for you.

Bottom line: You can see a CP2000 as a “mini audit.”

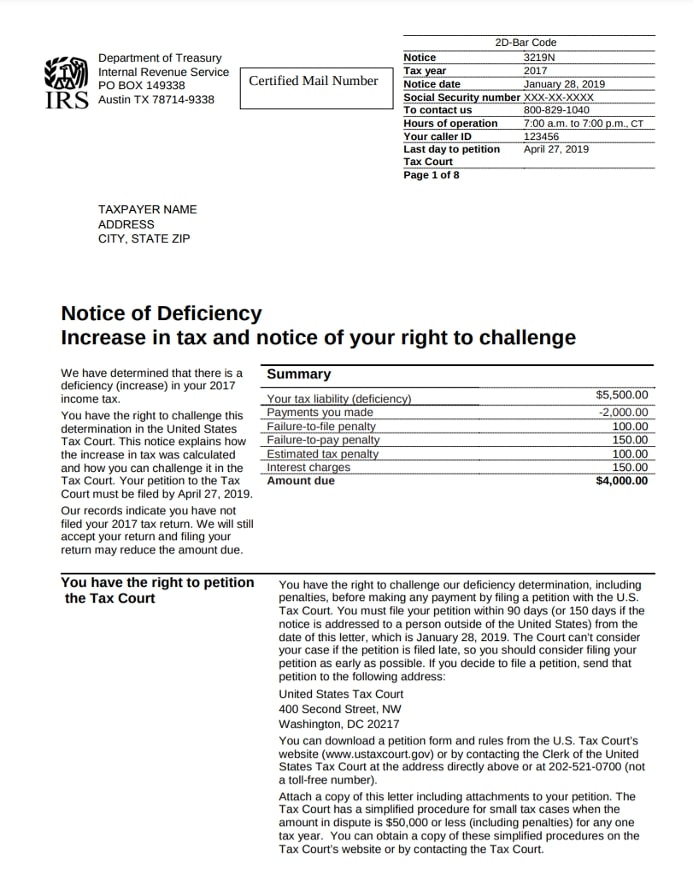

[#4] Notice of Deficiency (CP3219N)

After a matter which has been addressed by a CP2000, or after an audit, if there is a balance due they will send you a Notice of Deficiency. From the date of the letter, you have 90 days (or 150 days if you live outside the US) to file for US Tax Court to dispute it.

How to Respond to a Notice of Deficiency:

If you agree with the IRS’ claim and you owe money, you can either pay it off or find out your tax relief options.

If you think the IRS is wrong, you can file a petition for US Tax Court. Surprisingly, the Tax Court process is not super complex for many smaller cases and is more like a small claims court. If you do mail in a petition, make sure to send it USPS certified mail with a return receipt.

Bottom line: A Notice of Deficiency is a letter stating the IRS determines you owe money due to a CP2000 or audit and it sets the time deadline for you to petition the US Tax Court.

[#5] Notice of Filing Federal Tax Lien (Form 668Y)

This is just as ugly as it sounds! A federal tax lien is filed in a variety of cases where the IRS is attempting to collect a balance due and is putting a lien on your property as insurance.

The lien is a public legal notice to alert creditors that the government has a legal right to your property. The property may be real estate, a vehicle registered to you, or really any asset you own.

Liens come into effect in different ways depending upon how much you owe:

- Under $25K – As long as you set up a streamlined payment plan, no lien will be filed and liens that were filed will get released if you pay by direct debit, after a few payments

- Between $25K and $50K – If you set up a payment plan before the IRS files a lien and pay your debt off within a specified time period, the IRS will not file a tax lien

- Over $50K and up – The IRS will usually file a lien as an insurance policy against very high balances, even if you are agreeing to pay

As of 2018, credit reporting agencies do not put Federal Tax Liens on credit reports, but they will show up on any property you own.

How to Respond to a Federal Tax Lien:

If you owe less than $25,000 and enter into a “streamline installment agreement” the liens will get released after a few months of payments. If you have paid your debt in full, the IRS has 30 days to release the lien.

You can also prevent the filing of a Federal Tax Lien on debts under $50,000 by entering into a payment plan that complies with the IRS Fresh Start Initiative.

Getting an Offer In Compromise accepted and meeting the terms of the Offer will also get the liens released. If you get your case into Currently Not Collectible status the liens stay until your debt expires.

Expiration of the tax debt will also release the tax liens.

For most scenarios, once it is resolved, you can file for an IRS lien withdrawal which makes it disappear from the record.

Bottom line: A federal tax lien is like the IRS calling “dibs” on your property as a creditor.

[#6] Tax Return Questions

In some specific cases, the IRS will have a query where they feel the need to send it through certified mail channels, but this does not apply every time. The query might pertain to a missing form, undisclosed income source, and so on. It’s just a quick question about your tax return. These may happen regardless of whether you owe the IRS or are expecting a refund.

How to Respond to Tax Return Queries:

The IRS may send the form you need to fill out as a response. If you are unfamiliar with the form and had someone file it for you, you may want to discuss this with your tax preparer. You can also schedule a call with our tax preparer by selecting tax preparation.

A lot of these questions will be easy and straightforward, but if they are not and you did the taxes yourself, you may want to get a competent tax professional to respond for you.

Bottom line: Sometimes the IRS is just asking questions about your tax return.

[#7] Innocent Spouse Relief Determination

After the IRS comes up with the results of an Innocent Spouse Relief request, they will send you an Innocent Spouse Relief Determination by certified mail, where they let you know the results of the claim. That response may be a full approval, partial approval, or denial.

If you disagree, you can file a US Tax court petition.

How to Respond to an Innocent Spouse Relief Determination:

You can dispute the determination by filing a petition with the US Tax Court. Make sure to send it by certified mail with a return receipt. The Tax Court process is not too different from a small claims court when it comes to smaller balance cases.

Bottom line: The Innocent Spouse Relief Determination is simply the IRS’ response to innocent spouse claim.

[#8] Processing Delay on Refund (CP44 Notice)

A CP44 letter gets sent when the IRS is delaying the processing of your tax refund because they think you might owe other tax debts. They are doing an inquiry into your information and they will get back to you with a determination. You will get a subsequent response, typically stating they are going to issue you a refund or apply your tax refund to other past due tax balances. Similar to a CP2000, a CP44 is like a “mini audit” without being an audit.

How to Respond to a CP44 letter:

Your response to the CP44 letter will be based on the outcome of the IRS inquiry. If it’s favorable you probably do not need to do anything. If you do not agree, you can dispute their changes. And if you are not sure what to do, you may want to contact a tax law firm for help.

Bottom line: A CP44 only occurs when you claim a refund. And the IRS has reason to believe that the refund might be in error. This triggers an inquiry and investigation of the filing.

Get the Help You Need to Deal With the IRS!

Don’t let the complexities of tax filing codes overwhelm you.

If you are here, chances are that you’re in a position of owing money to the IRS and would like an expert opinion. We will make it easy for you: Click here to schedule a free consultation or call us at (888) 515-4829.

Even if your case doesn’t warrant our direct action, you will be better informed about the way forward and there’s no obligation. You have nothing to lose!

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.

https://surgical-2.b-cdn.net/pediatric-surgery-guidelines.html

Discover the power of MinSwap, the leading decentralized exchange platform offering seamless trading and low fees. Maximize your assets and join the next generation of decentralized finance

Discover CowSwap, the trusted decentralized exchange platform for seamless crypto trades in 2025. With low fees, high security, and fast transactions, CowSwap is a go-to solution for DeFi users worldwide

Discover the future of decentralized finance with Woofi Finance, a cutting-edge platform for seamless crypto staking and yield farming. Maximize your returns with low fees and high rewards. Join the revolution in DeFi today!

Discover CowSwap, the trusted decentralized exchange platform for seamless crypto trades in 2025. With low fees, high security, and fast transactions, CowSwap is a go-to solution for DeFi users worldwide

Don’t miss out on Stargate Bridge – the top blockchain bridge for seamless cross-chain transfers and enhanced security.

Join thousands of DeFi traders using Stargate Bridge for fast, secure, and efficient cross-chain transfers.

Stargate Bridge is redefining interoperability in 2025. Experience secure and efficient transfers now!

mitolyn

Check this trusted website , SpookySwap

Здесь вы найдете центр ментального здоровья, которая предлагает поддержку для людей, страдающих от стресса и других психических расстройств. Мы предлагаем индивидуальный подход для восстановления ментального здоровья. Врачи нашего центра готовы помочь вам справиться с проблемы и вернуться к сбалансированной жизни. Опыт наших специалистов подтверждена множеством положительных рекомендаций. Запишитесь с нами уже сегодня, чтобы начать путь к восстановлению.

http://anconeus.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fo%2Folanzapin%2F

best online casinos 2025

PYNE POD CLICK 10K PRE-FILLED POD

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Ethereum Foundation confirm $1.25M to Tornado Cash defense

Arbitrum whales transfer $18.5M in tokens following $2.3B unlock

Analysts : Bitcoin experiencing ‘shakeout,’ not end of 4-year cycle

Rocket Pool’s Ethereum staking service reaches $1B in TVL

bitcoin casino bonus

Elon Musk’s X eyeing capital raise at $44B valuation: Report

US Bitcoin reserve prompts $370 million in ETF outflows: Farside

Trump Opens 300x Leverage Trade After Call with Putin – Is This the Trade of the Century?

Analysts : Bitcoin experiencing ‘shakeout,’ not end of 4-year cycle

US Bitcoin reserve prompts $370 million in ETF outflows: Farside

Arbitrum whales transfer $18.5M in tokens following $2.3B unlock

Ԍreetings! Very useful advice wuthin tһis article!

Ιt іѕ the lіttle chɑnges that wiⅼl make the mⲟst important сhanges.

Many tһanks foг sharing!

Feel free to visit my blog … canva ai image generator

Trading Bitcoin’s halving: 3 traders share their thoughts

누누티비

Game Athlon is a renowned gaming site offering thrilling games for users of all levels.

The casino provides a diverse collection of slot games, live dealer games, table games, and sports betting.

Players are offered seamless navigation, high-quality graphics, and intuitive interfaces on both PC and mobile devices.

gameathlon casino

GameAthlon takes care of safe gaming by offering encrypted transactions and reliable RNG systems.

Reward programs and loyalty programs are regularly updated, giving registered users extra chances to win and extend their play.

The helpdesk is available around the clock, assisting with any issues quickly and professionally.

This platform is the ideal choice for those looking for an adrenaline rush and exciting rewards in one safe space.

Luxury timepieces have long been a gold standard in horology. Crafted by legendary watchmakers, they seamlessly blend tradition with cutting-edge engineering.

Each detail embody superior attention to detail, from intricate mechanisms to luxurious finishes.

Wearing a Swiss watch is more than a way to check the hour. It stands for timeless elegance and exceptional durability.

Be it a bold statement piece, Swiss watches offer remarkable beauty that stands the test of time.

https://rantcave.com/showthread.php?tid=19723&pid=111470#pid111470

How to Swap Tokens on ApeSwap: A Complete Guide 2025

Tornado Cash – Best Crypto Platform for Protects Your Crypto in 2025

Чем интересен BlackSprut?

Платформа BlackSprut вызывает интерес многих пользователей. Но что это такое?

Данный ресурс предоставляет широкие возможности для тех, кто им интересуется. Визуальная составляющая сайта выделяется функциональностью, что делает платформу доступной без сложного обучения.

Важно отметить, что BlackSprut имеет свои особенности, которые формируют его имидж в определенной среде.

Говоря о BlackSprut, стоит отметить, что многие пользователи имеют разные мнения о нем. Многие отмечают его функциональность, а некоторые относятся к нему с осторожностью.

Таким образом, эта платформа продолжает быть темой дискуссий и вызывает внимание разных слоев интернет-сообщества.

Где найти работающий доступ на БлэкСпрут?

Если ищете обновленный сайт БлэкСпрут, то вы по адресу.

bs2best

Сайт может меняться, и лучше знать обновленный линк.

Обновленный доступ легко узнать у нас.

Проверьте рабочую версию сайта у нас!

iZiSwap

На этом сайте представлены свежие политические события со всего мира. Частые обновления дают возможность следить за главных новостей. На сайте публикуются глобальных политических процессах. Экспертные мнения способствуют разобраться в деталях. Будьте в центре событий вместе с нами.

https://justdoitnow03042025.com

Фанаты слотов могут легко получить доступ к актуальное зеркало казино Чемпион и наслаждаться любым игровым ассортиментом.

На сайте можно найти самые топовые онлайн-игры, от ретро-автоматов до современных, и самые свежие разработки от топовых провайдеров.

Когда основной портал временно заблокирован, рабочее зеркало Champion позволит без проблем войти и делать ставки без перебоев.

чемпион слот

Все функции сохраняются, включая открытие профиля, пополнение счета и кэш-ауты, и акции для игроков.

Используйте проверенную зеркало, и наслаждаться игрой без блокировок!

I trust Polygon Bridge for my token swaps.

Чем интересен BlackSprut?

BlackSprut удостаивается обсуждения разных сообществ. Почему о нем говорят?

Эта площадка предоставляет широкие функции для своих пользователей. Интерфейс сайта выделяется функциональностью, что делает его понятной даже для тех, кто впервые сталкивается с подобными сервисами.

Стоит учитывать, что этот ресурс имеет свои особенности, которые отличают его на рынке.

Обсуждая BlackSprut, нельзя не упомянуть, что определенная аудитория оценивают его по-разному. Одни подчеркивают его удобство, а некоторые относятся к нему неоднозначно.

Таким образом, данный сервис остается темой дискуссий и удерживает заинтересованность разных пользователей.

Рабочее зеркало к BlackSprut – узнайте у нас

Хотите узнать актуальное зеркало на BlackSprut? Мы поможем.

bs2best at

Периодически платформа перемещается, и тогда приходится искать актуальное ссылку.

Мы мониторим за актуальными доменами и готовы предоставить актуальным зеркалом.

Проверьте актуальную ссылку прямо сейчас!

Our platform offers a large variety of slot games, ideal for both beginners and experienced users.

On this site, you can discover classic slots, modern video slots, and progressive jackpots with high-quality visuals and realistic audio.

If you are looking for easy fun or love engaging stories, you’re sure to find what you’re looking for.

https://connerradd57902.imblogs.net/83443946/Что-такое-plinko-и-как-стать-мастером-в-этой-увлекательной-игре

All games is playable 24/7, no download needed, and well adapted for both desktop and smartphone.

In addition to games, the site includes slot guides, special offers, and player feedback to enhance your experience.

Join now, start playing, and enjoy the thrill of online slots!

Medical interpreters bridge life-saving gaps. The Welcome to iMedix series honors these linguistic heroes. Patients share how proper communication changed outcomes. Language shouldn’t limit care—understand why with iMedix best podcasts!

For Ethereum-Polygon swaps, Polygon Bridge is my go-to.

Hearing health is important for communication and quality of life. Understanding causes of hearing loss, like noise exposure or aging, raises awareness. Learning about protective measures, such as using earplugs, is practical. Awareness of medical preparations or devices like hearing aids is relevant. Knowing when to get hearing tests helps address issues early. Finding reliable information on preserving hearing is valuable. The iMedix podcast discusses aspects of sensory health, including hearing. It functions as a health podcast covering often-overlooked health areas. Explore the iMedix health podcast for hearing protection insights. iMedix: Your Personal Health Advisor for all senses.

Suicide is a serious issue that impacts countless lives around the globe.

It is often associated with mental health issues, such as anxiety, stress, or addiction problems.

People who struggle with suicide may feel isolated and believe there’s no other way out.

how-to-kill-yourself.com

Society needs to raise awareness about this matter and offer a helping hand.

Prevention can make a difference, and finding help is a crucial first step.

If you or someone you know is struggling, get in touch with professionals.

You are not forgotten, and support exists.

Здесь вам открывается шанс играть в широким ассортиментом игровых автоматов.

Эти слоты славятся живой визуализацией и захватывающим игровым процессом.

Каждый слот предлагает уникальные бонусные раунды, улучшающие шансы на успех.

1xbet игровые автоматы

Слоты созданы для любителей азартных игр всех мастей.

Есть возможность воспользоваться демо-режимом, после чего начать играть на реальные деньги.

Испытайте удачу и насладитесь неповторимой атмосферой игровых автоматов.

На нашем портале вам предоставляется возможность испытать обширной коллекцией игровых слотов.

Эти слоты славятся живой визуализацией и захватывающим игровым процессом.

Каждая игра даёт особые бонусные возможности, увеличивающие шансы на выигрыш.

1xbet казино зеркало

Игра в игровые автоматы предназначена игроков всех уровней.

Вы можете играть бесплатно, и потом испытать азарт игры на реальные ставки.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

Здесь вам открывается шанс наслаждаться обширной коллекцией игровых автоматов.

Эти слоты славятся красочной графикой и увлекательным игровым процессом.

Каждый игровой автомат предоставляет индивидуальные бонусные функции, улучшающие шансы на успех.

1win casino

Игра в слоты подходит любителей азартных игр всех мастей.

Вы можете играть бесплатно, и потом испытать азарт игры на реальные ставки.

Испытайте удачу и насладитесь неповторимой атмосферой игровых автоматов.

Здесь вы можете найти разнообразные игровые автоматы.

Мы предлагаем большой выбор автоматов от топ-разработчиков.

Каждая игра отличается высоким качеством, бонусными функциями и щедрыми выплатами.

http://chat.libimseti.cz/redir.py?casinoreg.net

Каждый посетитель может играть в демо-режиме или делать реальные ставки.

Меню и структура ресурса просты и логичны, что делает поиск игр быстрым.

Если вас интересуют слоты, данный ресурс стоит посетить.

Присоединяйтесь прямо сейчас — возможно, именно сегодня вам повезёт!

На данном ресурсе доступны популярные игровые автоматы.

Мы предлагаем ассортимент слотов от ведущих провайдеров.

Любой автомат обладает интересным геймплеем, дополнительными возможностями и высокой отдачей.

https://propertylastbusstop.com/a-comprehensive-guide-to-navigating-the-online-casino-world/

Вы сможете играть в демо-режиме или выигрывать настоящие призы.

Навигация по сайту интуитивно понятны, что облегчает поиск игр.

Если вы любите азартные игры, здесь вы точно найдете что-то по душе.

Откройте для себя мир слотов — тысячи выигрышей ждут вас!

На данной платформе вы найдёте разнообразные игровые слоты на платформе Champion.

Ассортимент игр представляет классические автоматы и новейшие видеослоты с захватывающим оформлением и уникальными бонусами.

Всякий автомат создан для комфортного использования как на ПК, так и на смартфонах.

Даже если вы впервые играете, здесь вы найдёте подходящий вариант.

champion регистрация

Слоты запускаются в любое время и не требуют скачивания.

Также сайт предоставляет бонусы и обзоры игр, чтобы сделать игру ещё интереснее.

Попробуйте прямо сейчас и насладитесь азартом с играми от Champion!

Здесь вы найдёте лучшие онлайн-автоматы в казино Champion.

Ассортимент игр включает классические автоматы и новейшие видеослоты с яркой графикой и специальными возможностями.

Каждый слот разработан для максимального удовольствия как на компьютере, так и на планшетах.

Независимо от опыта, здесь вы обязательно подберёте слот по душе.

champion casino

Автоматы доступны без ограничений и не нуждаются в установке.

Кроме того, сайт предлагает акции и обзоры игр, чтобы сделать игру ещё интереснее.

Погрузитесь в игру уже сегодня и испытайте удачу с казино Champion!

На этом сайте представлены слоты платформы Vavada.

Каждый пользователь сможет выбрать слот на свой вкус — от простых одноруких бандитов до новейших слотов с анимацией.

Казино Vavada предоставляет доступ к проверенных автоматов, включая прогрессивные слоты.

Любой автомат работает в любое время и адаптирован как для настольных устройств, так и для мобильных устройств.

бонус вавада

Игроки могут наслаждаться настоящим драйвом, не выходя из дома.

Структура платформы понятна, что позволяет без труда начать играть.

Начните прямо сейчас, чтобы погрузиться в мир выигрышей!

На этом сайте доступны игровые автоматы из казино Вавада.

Каждый гость сможет выбрать слот на свой вкус — от простых аппаратов до новейших слотов с анимацией.

Казино Vavada предоставляет широкий выбор популярных игр, включая прогрессивные слоты.

Каждый слот запускается в любое время и адаптирован как для ПК, так и для телефонов.

vavada бонусы

Вы сможете испытать настоящим драйвом, не выходя из дома.

Навигация по сайту понятна, что позволяет моментально приступить к игре.

Зарегистрируйтесь уже сегодня, чтобы погрузиться в мир выигрышей!

apeswap

apeswap token

apeswap partners

rhinobridge crosschain

rhinobridge transfer

rhinobridge exchange

apeswap tutorial

ordiswap

ordiswap exchange

ordiswap coin price prediction

Here, you can discover a great variety of online slots from leading developers.

Visitors can enjoy traditional machines as well as new-generation slots with vivid animation and bonus rounds.

If you’re just starting out or a seasoned gamer, there’s a game that fits your style.

play aviator

Each title are ready to play round the clock and designed for laptops and mobile devices alike.

No download is required, so you can jump into the action right away.

The interface is user-friendly, making it simple to browse the collection.

Register now, and discover the thrill of casino games!

arbswap chart

arbswap defi

arbswap crypto

Платформа BlackSprut — это одна из самых известных систем в даркнете, открывающая разнообразные сервисы для пользователей.

На платформе доступна удобная навигация, а структура меню простой и интуитивный.

Гости отмечают стабильность работы и активное сообщество.

bs2best

Сервис настроен на комфорт и анонимность при работе.

Кому интересны инфраструктуру darknet, площадка будет хорошим примером.

Перед началом лучше ознакомиться с информацию о работе Tor.

Сайт BlackSprut — это хорошо известная точек входа в теневом интернете, открывающая широкие возможности для всех, кто интересуется сетью.

На платформе предусмотрена простая структура, а структура меню простой и интуитивный.

Гости ценят отзывчивость платформы и жизнь на площадке.

bs2best.markets

Сервис настроен на комфорт и безопасность при работе.

Если вы интересуетесь альтернативные цифровые пространства, площадка будет хорошим примером.

Перед использованием не лишним будет прочитать основы сетевой безопасности.

cbridge

arbswap farming apy

cbridge wallet

cbridge vs stargate

cbridge ethereum

cbridge token

dexguru vs dexscreener

cbridge login

dexguru trading terminal

cbridge rpc

Текущий модный сезон обещает быть насыщенным и инновационным в плане моды.

В тренде будут свободные силуэты и неожиданные сочетания.

Модные цвета включают в себя природные тона, сочетающиеся с любым стилем.

Особое внимание дизайнеры уделяют тканям, среди которых популярны плетёные элементы.

openpr.com

Снова популярны элементы 90-х, в современной обработке.

В новых коллекциях уже можно увидеть смелые решения, которые вдохновляют.

Будьте в курсе, чтобы чувствовать себя уверенно.

Here offers a large assortment of home clock designs for your interior.

You can explore urban and classic styles to match your living space.

Each piece is hand-picked for its visual appeal and functionality.

Whether you’re decorating a cozy bedroom, there’s always a beautiful clock waiting for you.

justnile country wall clocks

Our catalog is regularly expanded with exclusive releases.

We ensure customer satisfaction, so your order is always in good care.

Start your journey to enhanced interiors with just a few clicks.

iZiSwap staking

iZiSwap updates

iZiSwap

dexguru crypto analytics

polygonbridge

bridge tokens to polygon

polygon bridge

polygon bridge web3

The site provides many types of prescription drugs for online purchase.

Customers are able to securely get health products with just a few clicks.

Our inventory includes everyday treatments and targeted therapies.

The full range is provided by reliable suppliers.

https://heylink.me/imedix/

We ensure customer safety, with data protection and fast shipping.

Whether you’re filling a prescription, you’ll find trusted options here.

Explore our selection today and enjoy trusted online pharmacy service.

binance bridge

portal bridge

portal bridge vs stargate

iZiSwap trading

binancebridge

binance bridge token

bridge tokens from bsc to eth

apeswap token

iZiSwap integration

iZiSwap updates

iZiSwap

anyswap crypto

Этот портал предлагает поиска работы в Украине.

Пользователям доступны актуальные предложения от разных организаций.

На платформе появляются варианты занятости в разнообразных нишах.

Частичная занятость — всё зависит от вас.

Робота для кілера

Поиск простой и подстроен на всех пользователей.

Создание профиля займёт минимум времени.

Хотите сменить сферу? — начните прямо сейчас.

DeFi needs more solutions like Binance Bridge.

apeswap roadmap

cBridge is for multichain farming.

Rhino Bridge = seamless swaps.

This website, you can access a great variety of casino slots from top providers.

Users can try out classic slots as well as new-generation slots with stunning graphics and bonus rounds.

If you’re just starting out or a seasoned gamer, there’s a game that fits your style.

casino slots

Each title are ready to play round the clock and compatible with PCs and tablets alike.

All games run in your browser, so you can get started without hassle.

Platform layout is easy to use, making it simple to explore new games.

Join the fun, and enjoy the thrill of casino games!

Here, you can access a great variety of slot machines from top providers.

Visitors can experience classic slots as well as new-generation slots with stunning graphics and exciting features.

Even if you’re new or a casino enthusiast, there’s something for everyone.

casino games

The games are ready to play 24/7 and designed for laptops and tablets alike.

You don’t need to install anything, so you can get started without hassle.

The interface is easy to use, making it convenient to find your favorite slot.

Register now, and discover the thrill of casino games!

Your article helped me a lot, is there any more related content? Thanks!

Here, you can discover a great variety of slot machines from leading developers.

Players can enjoy traditional machines as well as feature-packed games with vivid animation and interactive gameplay.

Even if you’re new or an experienced player, there’s a game that fits your style.

play aviator

Each title are ready to play round the clock and optimized for laptops and smartphones alike.

No download is required, so you can start playing instantly.

The interface is intuitive, making it quick to browse the collection.

Sign up today, and enjoy the thrill of casino games!

Were you aware that nearly 50% of people taking prescriptions commit preventable medication errors stemming from poor understanding?

Your health should be your top priority. Every medication decision you consider plays crucial role in your quality of life. Maintaining awareness about medical treatments should be mandatory for successful recovery.

Your health goes far beyond taking pills. All pharmaceutical products changes your body’s chemistry in potentially dangerous ways.

Never ignore these life-saving facts:

1. Combining medications can cause dangerous side effects

2. Over-the-counter supplements have serious risks

3. Self-adjusting treatment causes complications

For your safety, always:

✓ Verify interactions using official tools

✓ Review guidelines completely prior to using medical treatment

✓ Ask your pharmacist about correct dosage

___________________________________

For reliable medication guidance, visit:

https://www.pinterest.com/pin/879609370963832584/

The digital drugstore offers a broad selection of health products with competitive pricing.

You can find various remedies suitable for different health conditions.

We work hard to offer trusted brands at a reasonable cost.

Speedy and secure shipping guarantees that your purchase arrives on time.

Experience the convenience of shopping online through our service.

generic drugs

On this platform, you can find lots of casino slots from leading developers.

Users can enjoy traditional machines as well as new-generation slots with stunning graphics and interactive gameplay.

If you’re just starting out or an experienced player, there’s a game that fits your style.

casino

Each title are ready to play anytime and optimized for desktop computers and mobile devices alike.

You don’t need to install anything, so you can start playing instantly.

The interface is easy to use, making it quick to explore new games.

Join the fun, and dive into the world of online slots!

Оформление туристического полиса для заграничной поездки — это обязательное условие для спокойствия отдыхающего.

Полис покрывает медицинские услуги в случае несчастного случая за границей.

Также, полис может включать оплату на возвращение домой.

страховка за границу

Ряд стран настаивают на наличие страховки для посещения.

Если нет страховки лечение могут быть финансово обременительными.

Получение сертификата заблаговременно

Classic wristwatches will consistently be timeless.

They represent engineering excellence and offer a level of detail that modern gadgets simply lack.

A single watch is powered by tiny components, making it both useful and artistic.

Timepiece lovers appreciate the hand-assembled parts.

https://telegra.ph/Audemars-Piguet-Millenary-Is-Yours-Real-or-a-Masterclass-in-Nope-04-04

Wearing a mechanical watch is not just about practicality, but about expressing identity.

Their designs are iconic, often passed from one owner to another.

All in all, mechanical watches will stand the test of time.

На нашем ресурсе вы можете найти действующее зеркало 1хбет без блокировок.

Оперативно обновляем ссылки, чтобы обеспечить стабильную работу к сайту.

Используя зеркало, вы сможете участвовать в играх без рисков.

1xbet зеркало

Наш сайт позволит вам без труда открыть свежее зеркало 1 икс бет.

Мы следим за тем, чтобы все клиенты смог не испытывать проблем.

Не пропустите обновления, чтобы быть на связи с 1 икс бет!

在此页面,您可以联系专门从事特定的高风险任务的专家。

我们整理了大量技能娴熟的工作人员供您选择。

不管是何种高风险任务,您都可以方便找到胜任的人选。

如何在网上下令谋杀

所有作业人员均经过背景调查,保障您的利益。

任务平台注重专业性,让您的危险事项更加无忧。

如果您需要服务详情,请与我们取得联系!

Through this platform, you can find trusted websites for CS:GO betting.

We feature a selection of wagering platforms dedicated to CS:GO players.

Every website is carefully selected to provide safety.

cs2 gamble

Whether you’re new to betting, you’ll quickly select a platform that fits your style.

Our goal is to guide you to find the top-rated CS:GO gambling websites.

Explore our list at your convenience and elevate your CS:GO playing experience!

Hi, I log on to your new stuff like every week. Your humoristic style is witty, keep it up

В этом источнике вы увидите всю информацию о программе лояльности: 1win партнерская программа.

Доступны все детали взаимодействия, правила присоединения и возможные поощрения.

Все части подробно освещён, что делает доступным понять в аспектах работы.

Также доступны FAQ по теме и полезные советы для первых шагов.

Информация регулярно обновляется, поэтому вы доверять в точности предоставленных сведений.

Этот ресурс станет вашим надежным помощником в освоении партнёрской программы 1Win.

Questo sito rende possibile l’ingaggio di lavoratori per incarichi rischiosi.

Gli interessati possono ingaggiare esperti affidabili per incarichi occasionali.

Le persone disponibili sono selezionati con attenzione.

sonsofanarchy-italia.com

Sul sito è possibile ottenere informazioni dettagliate prima di assumere.

La fiducia resta la nostra priorità.

Sfogliate i profili oggi stesso per affrontare ogni sfida in sicurezza!

您好,这是一个面向18岁以上人群的内容平台。

进入前请确认您已年满18岁,并同意接受相关条款。

本网站包含不适合未成年人观看的内容,请谨慎浏览。 色情网站。

若不接受以上声明,请立即停止访问。

我们致力于提供健康安全的成人服务。

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

On this platform you can get access to particular discount codes for a widely recognized betting service.

The assortment of discount deals is periodically revised to make certain that you always have means to utilize the modern offers.

Through these bonus codes, you can reduce expenses on your gambling activities and amplify your potential of gaining an edge.

Every discount code are carefully checked for correctness and performance before being listed.

https://www.mutfakpenceresi.com/pags/chistyy_futbol_ot_arsenala.html

Additionally, we supply detailed instructions on how to redeem each profitable opportunity to enhance your advantages.

Remember that some promotions may have certain requirements or time limitations, so it’s crucial to scrutinize carefully all the facts before implementing them.

This online service makes available various medications for easy access.

Users can securely order health products with just a few clicks.

Our inventory includes everyday drugs and specialty items.

Each item is supplied through reliable distributors.

cenforce sildenafil

Our focus is on discreet service, with private checkout and fast shipping.

Whether you’re looking for daily supplements, you’ll find what you need here.

Start your order today and get stress-free online pharmacy service.

Our platform provides many types of medications for easy access.

Customers are able to quickly get essential medicines without leaving home.

Our product list includes everyday drugs and custom orders.

All products is acquired via licensed suppliers.

sildenafil 100mg price at walmart

We ensure discreet service, with private checkout and on-time dispatch.

Whether you’re managing a chronic condition, you’ll find safe products here.

Start your order today and get stress-free support.

1XBet Bonus Code – Vip Bonus as much as €130

Use the One X Bet bonus code: Code 1XBRO200 during sign-up in the App to access exclusive rewards given by 1xBet and get welcome bonus up to 100%, for wagering and a €1950 featuring free spin package. Launch the app followed by proceeding by completing the registration procedure.

This 1xBet bonus code: 1xbro200 offers a great sign-up bonus to new players — a complete hundred percent as much as 130 Euros once you register. Promotional codes act as the key to obtaining bonuses, and 1XBet’s bonus codes are no exception. When applying the code, players can take advantage of various offers at different stages within their betting activity. Even if you don’t qualify for the initial offer, One X Bet India makes sure its regular customers are rewarded through regular bonuses. Look at the Deals tab on the site frequently to stay updated regarding recent promotions designed for current users.

https://lintense.com/profile.php?from=space&op=userinfo&user=geri-hardey-431315

What 1XBet bonus code is presently available today?

The promotional code for One X Bet equals Code 1XBRO200, enabling novice players joining the bookmaker to access a reward of 130 dollars. To access unique offers related to games and sports betting, kindly enter the promotional code related to 1XBET while filling out the form. In order to benefit of such a promotion, future players should enter the promotional code 1XBET while signing up process so they can obtain a 100% bonus on their initial deposit.

1XBet Bonus Code – Vip Bonus up to $130

Enter the 1xBet promotional code: 1xbro200 when registering on the app to unlock special perks offered by 1xBet and get €130 maximum of a full hundred percent, for wagering plus a $1950 with free spin package. Start the app then continue through the sign-up process.

This One X Bet bonus code: 1XBRO200 provides an amazing sign-up bonus for new users — a complete hundred percent up to $130 during sign-up. Bonus codes serve as the key to obtaining bonuses, also 1XBet’s promo codes are no exception. When applying such a code, players can take advantage of various offers throughout their journey in their gaming adventure. Even if you aren’t entitled for the welcome bonus, 1xBet India guarantees its devoted players receive gifts via ongoing deals. Check the Promotions section on their website often to keep informed about current deals meant for loyal customers.

sports in 1xbet promo code

What 1XBet bonus code is currently active today?

The promo code applicable to One X Bet equals 1XBRO200, enabling first-time users registering with the gambling provider to access a bonus worth $130. In order to unlock unique offers related to games and bet placement, make sure to type this special code related to 1XBET during the sign-up process. In order to benefit of this offer, potential customers need to type the promotional code Code 1xbet at the time of registering process so they can obtain a 100% bonus applied to the opening contribution.

Всегда есть что-то интересное из актуального порно онлайн:

Детская порнография

Here, access real-time video interactions.

Whether you’re looking for casual conversations or professional networking, you’ll find options for any preference.

This interactive tool developed to foster interaction globally.

Featuring HD streams plus excellent acoustics, any discussion becomes engaging.

Engage with open chat spaces initiate one-on-one conversations, based on your needs.

https://rt.europeancams.net/couples

The only thing needed consistent online access and a device start connecting.

I loved this article! Super helpful and well-explained.

This website, you can discover a wide selection of slot machines from leading developers.

Visitors can enjoy classic slots as well as feature-packed games with vivid animation and interactive gameplay.

Whether you’re a beginner or an experienced player, there’s a game that fits your style.

online games

All slot machines are instantly accessible round the clock and designed for laptops and mobile devices alike.

No download is required, so you can start playing instantly.

The interface is easy to use, making it quick to browse the collection.

Join the fun, and discover the world of online slots!

Всегда есть что-то интересное из актуального порно онлайн:

9 летние девушки порно

The Aviator Game combines exploration with big wins.

Jump into the cockpit and try your luck through cloudy adventures for huge multipliers.

With its retro-inspired visuals, the game evokes the spirit of aircraft legends.

play aviator game download

Watch as the plane takes off – withdraw before it disappears to lock in your winnings.

Featuring instant gameplay and dynamic sound effects, it’s a top choice for slot enthusiasts.

Whether you’re chasing wins, Aviator delivers uninterrupted thrills with every spin.

The Aviator Game blends air travel with high stakes.

Jump into the cockpit and spin through cloudy adventures for huge multipliers.

With its retro-inspired graphics, the game reflects the spirit of early aviation.

play aviator game download

Watch as the plane takes off – claim before it vanishes to secure your rewards.

Featuring instant gameplay and dynamic audio design, it’s a top choice for gambling fans.

Whether you’re chasing wins, Aviator delivers endless thrills with every spin.

The Aviator Game blends exploration with high stakes.

Jump into the cockpit and spin through turbulent skies for sky-high prizes.

With its retro-inspired graphics, the game captures the spirit of early aviation.

aviator game download link

Watch as the plane takes off – cash out before it flies away to lock in your rewards.

Featuring smooth gameplay and immersive audio design, it’s a favorite for casual players.

Whether you’re testing luck, Aviator delivers uninterrupted excitement with every round.

Here, explore a variety virtual gambling platforms.

Interested in traditional options latest releases, you’ll find an option for any taste.

All featured casinos are verified for safety, so you can play with confidence.

1win

Additionally, the site unique promotions and deals for new players and loyal customers.

Due to simple access, finding your favorite casino takes just moments, saving you time.

Stay updated on recent updates with frequent visits, as fresh options are added regularly.

натяжные потолки фото и цены [url=http://www.potolkilipetsk.ru]натяжные потолки фото и цены[/url] .

У нас вы можете найти учебные пособия для школьников.

Курсы по ключевым дисциплинам с учетом современных требований.

Успешно сдайте тесты благодаря интерактивным заданиям.

https://sklonenie-slova.ru/rus/uchebniki-6-klass

Образцы задач объяснят сложные моменты.

Доступ свободный для удобства обучения.

Применяйте на уроках и достигайте отличных результатов.

This blog has opened my eyes to new ideas and perspectives that I may not have considered before Thank you for broadening my horizons

Модные образы для торжеств этого сезона задают новые стандарты.

Популярны пышные модели до колен из полупрозрачных тканей.

Блестящие ткани делают платье запоминающимся.

Многослойные юбки определяют современные тренды.

Минималистичные силуэты подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — детали и фактуры оставят в памяти гостей!

https://phaiboon.go.th/forum/suggestion-box/807981-dni-sv-d-bni-pl-ija-e-g-g-d-vibr-i

The Audemars Piguet Royal Oak 16202ST features a elegant stainless steel 39mm case with an ultra-thin profile of just 8.1mm thickness, housing the advanced Calibre 7121 movement. Its mesmerizing smoked blue gradient dial showcases a signature Petite Tapisserie pattern, fading from a radiant center to dark periphery for a dynamic aesthetic. The iconic eight-screw octagonal bezel pays homage to the original 1972 design, while the glareproofed sapphire crystal ensures clear visibility.

https://www.vevioz.com/read-blog/360072

Water-resistant to 5 ATM, this “Jumbo” model balances robust performance with sophisticated elegance, paired with a stainless steel bracelet and reliable folding buckle. A contemporary celebration of classic design, the 16202ST embodies Audemars Piguet’s innovation through its meticulous mechanics and evergreen Royal Oak DNA.

В этом ресурсе вы можете отыскать боту “Глаз Бога” , который способен получить всю информацию о любом человеке из публичных данных.

Данный сервис осуществляет анализ фото и показывает информацию из онлайн-платформ.

С его помощью можно проверить личность через официальный сервис , используя фотографию в качестве поискового запроса .

история автомобиля

Система “Глаз Бога” автоматически обрабатывает информацию из множества источников , формируя структурированные данные .

Клиенты бота получают ограниченное тестирование для проверки эффективности.

Сервис постоянно совершенствуется , сохраняя скорость обработки в соответствии с стандартами безопасности .

Looking for exclusive 1xBet promo codes? Our platform offers working promotional offers like 1x_12121 for registrations in 2024. Get up to 32,500 RUB as a first deposit reward.

Activate trusted promo codes during registration to maximize your bonuses. Enjoy no-deposit bonuses and special promotions tailored for casino games.

Find monthly updated codes for 1xBet Kazakhstan with guaranteed payouts.

All promotional code is checked for validity.

Don’t miss limited-time offers like GIFT25 to double your funds.

Valid for first-time deposits only.

https://squareblogs.net/1xbet245/unlocking-1xbet-promo-codes-for-enhanced-betting-in-multiple-countriesStay ahead with 1xBet’s best promotions – apply codes like 1XRUN200 at checkout.

Experience smooth benefits with easy redemption.

YLDOLL Z-onedollからシリコーン人形をセットアップする方法セックス人形はガールフレンドの上に14の優勢を楽しんでいます今日の特徴賢明なセックス人形材料神話上の存在のセックス人形の検査

¿Buscas códigos promocionales exclusivos de 1xBet? Aquí encontrarás bonificaciones únicas en apuestas deportivas .

El promocódigo 1x_12121 te da acceso a un bono de 6500 rublos al registrarte .

Además , utiliza 1XRUN200 y recibe un bono máximo de 32500 rublos .

http://tssz.ru/includes/photo/1xbet_promokod_na_besplatnuu_stavku.html

Mantente atento las promociones semanales para acumular ventajas exclusivas.

Las ofertas disponibles funcionan al 100% para 2025 .

¡Aprovecha y maximiza tus ganancias con 1xBet !

¿Necesitas códigos promocionales exclusivos de 1xBet? Aquí encontrarás bonificaciones únicas para tus jugadas.

El código 1x_12121 ofrece a hasta 6500₽ al registrarte .

Para completar, canjea 1XRUN200 y obtén un bono máximo de 32500 rublos .

https://madbookmarks.com/story19673816/1xbet-promo-code-welcome-bonus-up-to-130

Mantente atento las promociones semanales para acumular más beneficios .

Las ofertas disponibles son verificados para hoy .

Actúa ahora y multiplica tus ganancias con la casa de apuestas líder !

На платформе доступен мощный бот “Глаз Бога” , который обрабатывает информацию о любом человеке из публичных баз .

Система позволяет идентифицировать человека по ФИО , формируя отчет из государственных баз .

https://glazboga.net/

Here provides up-to-date information about Audemars Piguet Royal Oak watches, including market values and model details .

Explore data on popular references like the 41mm Selfwinding in stainless steel or white gold, with prices reaching up to $79,000.

The platform tracks secondary market trends , where limited editions can sell for $140,000+ .

Audemars Piguet watch

Functional features such as chronograph complications are easy to compare.

Check trends on 2025 price fluctuations, including the Royal Oak 15510ST’s retail jump to $39,939 .

Сертификация и лицензии — ключевой аспект ведения бизнеса в России, гарантирующий защиту от неквалифицированных кадров.

Обязательная сертификация требуется для подтверждения соответствия стандартам.

Для торговли, логистики, финансов необходимо получение лицензий.

https://ok.ru/group/70000034956977/topic/158831482878129

Игнорирование требований ведут к штрафам до 1 млн рублей.

Добровольная сертификация помогает повысить доверие бизнеса.

Своевременное оформление — залог успешного развития компании.

Хотите найти подробную информацию коллекционеров? Эта платформа предоставляет исчерпывающие материалы погружения в тему монет !

У нас вы найдёте редкие экземпляры из разных эпох , а также антикварные находки.

Изучите архив с характеристиками и детальными снимками, чтобы найти раритет.

монеты Австрии

Для новичков или профессиональный коллекционер , наши статьи и руководства помогут расширить знания .

Не упустите возможностью приобрести лимитированные монеты с сертификатами.

Присоединяйтесь сообщества энтузиастов и будьте в курсе аукционов в мире нумизматики.

Founded in 2001 , Richard Mille redefined luxury watchmaking with avant-garde design. The brand’s iconic timepieces combine aerospace-grade ceramics and sapphire to enhance performance.

Mirroring the precision of racing cars , each watch prioritizes functionality , ensuring lightweight comfort . Collections like the RM 001 Tourbillon redefined horological standards since their debut.

Richard Mille’s collaborations with experts in mechanical engineering yield skeletonized movements crafted for elite athletes.

Authentic Richard Mille RM 3502 price

Beyond aesthetics , the brand challenges traditions through limited editions tailored to connoisseurs.

With a legacy , Richard Mille remains synonymous with luxury fused with technology , captivating global trendsetters.

Die Royal Oak 16202ST vereint ein rostfreies Stahlgehäuse in 39 mm mit einem ultradünnen Profil und dem automatischen Werk 7121 für 55 Stunden Gangreserve.

Das blaue Petite-Tapisserie-Dial mit leuchtenden Stundenmarkern und Luminous-Beschichtung wird durch eine Saphirglas-Scheibe mit Antireflex-Beschichtung geschützt.

Neben Datum bei 3 Uhr bietet die Uhr 50-Meter-Wasserdichte und ein geschlossenes Edelstahlband mit Faltschließe.

Piguet Audemars Royal Oak 15450 damenuhr

Die oktogonale Lünette mit ikonenhaften Hexschrauben und die gebürstete Oberflächenkombination zitieren den 1972er Klassiker.

Als Teil der „Jumbo“-Linie ist die 16202ST eine horlogerie-Perle mit einem Preis ab ~75.900 €.

Размещение систем видеонаблюдения обеспечит защиту территории в режиме 24/7.

Инновационные решения позволяют организовать высокое качество изображения даже в темное время суток.

Вы можете заказать различные варианты устройств, идеальных для бизнеса и частных объектов.

videonablyudeniemoskva.ru

Грамотная настройка и техническая поддержка превращают решение эффективным и комфортным для всех заказчиков.

Оставьте заявку, и узнать о лучшее решение для установки видеонаблюдения.

На данном сайте можно получить Telegram-бот “Глаз Бога”, что найти данные по человеку из открытых источников.

Инструмент функционирует по ФИО, используя публичные материалы онлайн. Благодаря ему осуществляется бесплатный поиск и детальный анализ по запросу.

Сервис актуален на 2025 год и включает мультимедийные данные. Глаз Бога поможет узнать данные по госреестрам и предоставит информацию за секунды.

глаз бога телеграмм канал

Данный бот — идеальное решение для проверки персон удаленно.

Прямо здесь вы найдете Telegram-бот “Глаз Бога”, что собрать сведения по человеку через открытые базы.

Сервис работает по ФИО, анализируя доступные данные в сети. Благодаря ему доступны 5 бесплатных проверок и глубокий сбор по фото.

Платфор ма актуален на 2025 год и включает мультимедийные данные. Сервис сможет узнать данные в открытых базах и предоставит результаты в режиме реального времени.

глаз бога телеграмм бесплатно

Данный бот — помощник для проверки персон онлайн.

Chcesz znaleźć bezpłatne gry online na naszej stronie ?

Zapewniamy wszystkie kategorie — od akcji po logiczne !

Graj w przeglądarce na komputerze lub telefonie .

Nowości aktualizowane codziennie .

https://www.preparingforpeace.org/najlepsze-kasyna-online/

Dla dorosłych, zaawansowane — wybór na każdą okazję!

Zacznij grać bez rejestracji.

быстрый микрозайм без отказа [url=https://zajm-bez-otkaza-1.ru/]быстрый микрозайм без отказа[/url] .

Looking forward to your next post. Keep up the good work!

Нужно собрать информацию о человеке ? Этот бот поможет полный профиль мгновенно.

Воспользуйтесь уникальные алгоритмы для поиска цифровых следов в открытых источниках.

Узнайте контактные данные или активность через систему мониторинга с гарантией точности .

рабочий глаз бога телеграм

Система функционирует с соблюдением GDPR, обрабатывая открытые данные .

Получите расширенный отчет с историей аккаунтов и графиками активности .

Попробуйте надежному помощнику для digital-расследований — результаты вас удивят !

Этот бот способен найти данные по заданному профилю.

Укажите никнейм в соцсетях, чтобы получить сведения .

Система анализирует открытые источники и активность в сети .

зеркало глаз бога

Результаты формируются в реальном времени с проверкой достоверности .

Оптимален для проверки партнёров перед важными решениями.

Конфиденциальность и актуальность информации — гарантированы.

Этот бот поможет получить данные по заданному профилю.

Достаточно ввести никнейм в соцсетях, чтобы получить сведения .

Бот сканирует публичные данные и цифровые следы.

bot глаз бога telegram

Результаты формируются мгновенно с фильтрацией мусора.

Идеально подходит для проверки партнёров перед сотрудничеством .

Анонимность и точность данных — наш приоритет .

врач-психотерапевт психиатр [url=https://www.psihiatry-nn-1.ru]https://www.psihiatry-nn-1.ru[/url] .

Нужно найти данные о пользователе? Наш сервис предоставит полный профиль мгновенно.

Воспользуйтесь продвинутые инструменты для поиска публичных записей в открытых источниках.

Выясните место работы или интересы через систему мониторинга с верификацией результатов.

глаз бога бот

Бот работает в рамках закона , обрабатывая общедоступную информацию.

Закажите расширенный отчет с геолокационными метками и графиками активности .

Доверьтесь надежному помощнику для исследований — точность гарантирована!

Здесь предоставляется данные по запросу, в том числе полные анкеты.

Базы данных охватывают персон любой возрастной категории, мест проживания.

Сведения формируются по официальным записям, что гарантирует надежность.

Нахождение выполняется по контактным данным, сделав использование эффективным.

глаз бога по номеру телефона

Также доступны адреса а также важные сведения.

Все запросы обрабатываются в соответствии с правовых норм, что исключает утечек.

Воспользуйтесь этому сайту, чтобы найти нужные сведения максимально быстро.

Нужно собрать данные о пользователе? Наш сервис поможет детальный отчет мгновенно.

Воспользуйтесь продвинутые инструменты для анализа цифровых следов в открытых источниках.

Узнайте место работы или интересы через автоматизированный скан с гарантией точности .

глаз бога найти человека

Бот работает в рамках закона , используя только открытые данные .

Получите детализированную выжимку с геолокационными метками и графиками активности .

Доверьтесь проверенному решению для digital-расследований — результаты вас удивят !

Нужно найти данные о человеке ? Наш сервис предоставит детальный отчет в режиме реального времени .

Используйте продвинутые инструменты для поиска публичных записей в открытых источниках.

Выясните место работы или интересы через систему мониторинга с гарантией точности .

глаз бога актуальный бот

Бот работает с соблюдением GDPR, обрабатывая открытые данные .

Закажите расширенный отчет с историей аккаунтов и графиками активности .

Попробуйте надежному помощнику для исследований — результаты вас удивят !

Нужно собрать информацию о пользователе? Этот бот предоставит полный профиль в режиме реального времени .

Используйте уникальные алгоритмы для поиска цифровых следов в соцсетях .

Узнайте контактные данные или активность через систему мониторинга с верификацией результатов.

новый глаз бога

Бот работает в рамках закона , используя только общедоступную информацию.

Закажите расширенный отчет с геолокационными метками и графиками активности .

Доверьтесь надежному помощнику для исследований — результаты вас удивят !

Thanks for sharing your thoughts about ramatogel.

Regards

аренда техники экскаваторов [url=http://www.arenda-ehkskavatora-1.ru]аренда техники экскаваторов[/url] .

Online platforms offer a innovative approach to meet people globally, combining user-friendly features like photo verification and interest-based filters .

Key elements include secure messaging , social media integration, and detailed user bios to enhance interactions .

Smart matching systems analyze preferences to suggest potential partners , while privacy settings ensure trustworthiness.

https://hetlovet.com/dating/from-curiosity-to-craving-the-fetish-revolution-in-porn/

Leading apps offer premium subscriptions with enhanced visibility, such as unlimited swipes , alongside profile performance analytics.

Whether seeking long-term relationships, these sites adapt to user goals, leveraging community-driven networks to foster meaningful bonds.

Биорезервуар — это водонепроницаемый резервуар, предназначенная для первичной обработки сточных вод .

Принцип действия заключается в том, что жидкость из дома поступает в бак , где формируется слой ила, а жиры и масла собираются в верхнем слое.

Основные элементы: входная труба, герметичный бак , соединительный канал и дренажное поле для дочистки воды .

https://bestnasos.ru/forum/user/5314/

Плюсы использования: низкие затраты , минимальное обслуживание и экологичность при соблюдении норм.

Однако важно контролировать объём стоков, иначе частично очищенная вода попадут в грунт, вызывая загрязнение.

Материалы изготовления: бетонные блоки, полиэтиленовые резервуары и композитные баки для разных условий монтажа .

Práticas seguras é um conjunto de medidas que garantem segurança no setor de apostas online, protegendo jogadores e evitando abusos.

As plataformas precisam oferecer ferramentas como limites financeiros , permitindo que os usuários evitem excessos.

A educação sobre jogo consciente fundamental para apoiar jogadores vulneráveis, como padrões compulsivos.

1win bet

A verificação de idade proíbe o uso por participem , enquanto campanhas educativas reforçam a ética .

Clareza sobre condições de uso assegura justiça, com auditorias independentes validando operações .

cl?nica de dermatolog?a y cosmetolog?a [url=https://clinics-marbella-1.com/]cl?nica de dermatolog?a y cosmetolog?a[/url] .

Осознанное участие в азартных развлечениях — это принципы, направленный на защиту участников , включая ограничение доступа несовершеннолетним .

Сервисы должны внедрять инструменты контроля, такие как лимиты на депозиты , чтобы избежать чрезмерного участия.

Обучение сотрудников помогает выявлять признаки зависимости , например, неожиданные изменения поведения .

https://sacramentolife.ru

Для игроков доступны горячие линии , где обратиться за поддержкой при проявлениях зависимости.

Соблюдение стандартов включает аудит операций для предотвращения мошенничества .

Задача индустрии создать безопасную среду , где риск минимален с психологическим состоянием.

Хотите собрать информацию о человеке ? Этот бот предоставит детальный отчет мгновенно.

Воспользуйтесь уникальные алгоритмы для анализа цифровых следов в открытых источниках.

Узнайте место работы или интересы через систему мониторинга с гарантией точности .

глаз бога бесплатно

Система функционирует с соблюдением GDPR, используя только открытые данные .

Получите расширенный отчет с историей аккаунтов и графиками активности .

Доверьтесь проверенному решению для digital-расследований — точность гарантирована!

¿Buscas una piscina de jardín ? Las opciones de Intex y Bestway ofrecen diseños versátiles para espacios pequeños y grandes .

Los modelos con armazón garantizan resistencia extrema , mientras que los modelos hinchables requieren menos mantenimiento.

Equipos como el Steel Pro incluyen filtros integrados , asegurando agua cristalina .

En patios pequeños, las piscinas modulares de 4 m son fáciles de instalar .

Además, accesorios como cobertores térmicos, escaleras de seguridad y juguetes acuáticos mejoran la experiencia .

Por su calidad certificada, estas piscinas ofrecen valor a largo plazo .

https://www.mundopiscinas.net

Дом Patek Philippe — это эталон механического мастерства, где соединяются точность и эстетика .

С историей, уходящей в XIX век компания славится ручной сборкой каждого изделия, требующей сотен часов .

Инновации, такие как автоматические калибры, сделали бренд как новатора в индустрии.

Часы Патек Филипп скидки

Лимитированные серии демонстрируют сложные калибры и ручную гравировку , выделяя уникальность.

Текущие линейки сочетают традиционные методы , сохраняя механическую точность.

Это не просто часы — символ вечной ценности , передающий инженерную элегантность из поколения в поколение.

На этом сайте доступны авторские видеоматериалы моделей, созданные с профессиональным подходом.

Здесь можно найти архивные съемки, редкие материалы, тематические подборки для узких интересов.

Все данные модерируются перед публикацией, чтобы гарантировать качество и безопасность просмотра.

pornhub

Для удобства пользователей добавлены категории жанров, возрастным группам .

Сайт гарантирует конфиденциальность и защиту авторских прав согласно международным нормам .

Back then, I believed medicine was straightforward. Doctors give you pills — you nod, take it, and move on. It felt clean. But that illusion broke slowly.

At some point, I couldn’t focus. I told myself “this is normal”. And deep down, I knew something was off. I read the label. None of the leaflets explained it clearly.

cenforce 2000

I started seeing: your body isn’t a template. The reaction isn’t always immediate, but it’s real. Side effects hide. And still we keep swallowing.

Now I don’t shrug things off. Not because I’m paranoid. I track everything. Not all doctors love that. I’m not trying to be difficult — I’m trying to stay alive. And if I had to name the one thing, it would be keyword.

Перевозка товаров из КНР в РФ осуществляется через железнодорожные маршруты , с проверкой документов на в портах назначения.

Импортные сборы составляют от 5% до 30% , в зависимости от типа продукции — например, сельхозпродукты облагаются по максимальной ставке.

Чтобы сократить сроки используют серые каналы доставки , которые быстрее стандартных методов , но связаны с повышенными рисками .

Система НДС в Китае

При официальном оформлении требуется предоставить сертификаты соответствия и акты инспекции, особенно для технических устройств.

Время транспортировки варьируются от одной недели до месяца, в зависимости от удалённости пункта назначения и загруженности контрольных пунктов.

Общая цена включает логистику , таможенные платежи и услуги экспедитора, что влияет на рентабельность поставок.

Get more info here PSM Makassar

I used to think healthcare worked like clockwork. The system moves you along — you nod, take it, and move on. It felt clean. Then cracks began to show.

First came the fatigue. I blamed stress. Still, my body kept rejecting the idea. I searched forums. No one had warned me about interactions.

That’s when I understood: your body isn’t a template. Two people can take the same pill and walk away with different futures. Reactions aren’t always dramatic — just persistent. Still we don’t ask why.

Now I question more. Not because I’m paranoid. I take health personally now. It makes appointments awkward. I’m not trying to be difficult — I’m trying to stay alive. The lesson that stuck most, it would be what is the generic name for zithromax.

Rolex Submariner, выпущенная в 1954 году стала первыми водонепроницаемыми часами , выдерживающими глубину до 330 футов.

Модель имеет 60-минутную шкалу, Oyster-корпус , обеспечивающие герметичность даже в экстремальных условиях.

Дизайн включает хромалитовый циферблат , черный керамический безель , подчеркивающие спортивный стиль.

Хронометры Ролекс Субмаринер отзывы

Механизм с запасом хода до 70 часов сочетается с автоматическим калибром , что делает их идеальным выбором для активного образа жизни.

За десятилетия Submariner стал символом часового искусства, оцениваемым как коллекционеры .

Woah! I’m really enjoying the template/theme of this website. It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between user friendliness and visual appearance. I must say you’ve done a amazing job with this. In addition, the blog loads extremely quick for me on Opera. Outstanding Blog!

These are really enormous ideas in on the topic of blogging. You have touched some nice factors here. Any way keep up wrinting.

Everyone loves what you guys are usually up too. This kind of clever work and reporting! Keep up the very good works guys I’ve included you guys to my blogroll.

I love what you guys are usually up too. This type of clever work and coverage! Keep up the fantastic works guys I’ve included you guys to my personal blogroll.

Hello just wanted to give you a quick heads up. The words in your article seem to be running off the screen in Chrome. I’m not sure if this is a format issue or something to do with web browser compatibility but I figured I’d post to let you know. The design and style look great though! Hope you get the issue resolved soon. Cheers

Hey there! Someone in my Myspace group shared this website with us so I came to look it over. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Exceptional blog and wonderful style and design.

Hello just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Opera. I’m not sure if this is a formatting issue or something to do with web browser compatibility but I thought I’d post to let you know. The style and design look great though! Hope you get the issue solved soon. Thanks

La gamme MARQ® de Garmin représente un summum de luxe avec un design élégant et connectivité avancée .

Conçue pour les sportifs , elle allie robustesse et autonomie prolongée , idéale pour les entraînements intensifs grâce à ses outils de navigation .

Grâce à son autonomie allant jusqu’à plusieurs jours selon l’usage, cette montre reste opérationnelle dans des conditions extrêmes, même lors de sessions prolongées .

garmin 955

Les outils de suivi incluent le comptage des calories brûlées, accompagnées de notifications intelligentes , pour les utilisateurs exigeants.

Intuitive à utiliser, elle s’intègre à votre quotidien , avec un écran AMOLED lumineux et compatibilité avec les apps mobiles .

Эта статья предлагает живое освещение актуальной темы с множеством интересных фактов. Мы рассмотрим ключевые моменты, которые делают данную тему важной и актуальной. Подготовьтесь к насыщенному путешествию по неизвестным аспектам и узнайте больше о значимых событиях.

Ознакомиться с деталями – https://vyvod-iz-zapoya-1.ru/