Currently Not Collectible status is one of the most popular options for tax relief cases. It is considered by many to be the second-best option to an Offer In Compromise. Here we go through the details on Currently Not Collectible status and explain what it is.

See our video explanation of Currently Non-Collectible if you prefer to watch it. Keep reading for the written explanation.

What a Currently Not Collectible Status is

Effectively, a Currently Not Collectible Status is a payment plan for $0:

- The IRS determines your ability to pay them is $0 per month

- The case sits in the status but can be kicked out a year later. Often it just sits until the debt expires.

- High income on a tax return can kick it out

When Currently Not Collectible is the best option

- Your income numbers meet the requirements, but assets or other reasons may prevent an Offer In Compromise from being accepted

- Some debts are close to expiring

- You do not want to do an Offer In Compromise for other reasons

In most cases, if you can get Currently Not Collectible Status you can get an Offer In Compromise, which is the best option in the vast majority of cases that qualify. Then you really are done with it instead of waiting for it to expire. Some clients of ours have some debts close to expiring and others that are not. Often the best approach is putting it into Currently Not Collectible, waiting until those debts expire, and then submitting an Offer In Compromise. This does cause some lien issues.

How to get Currently Not Collectible Status

First Step: Find out if your case is in IRS Collections or not. Most people reading this probably are in IRS Collections and researching the issue. Your case will usually be in one of three statuses if you have had debts for a while and have done nothing:

- Not in collections. Final notice of intent to levy letter was not issued. There is still time before the IRS issues garnishments or levies.

- Automated Collection System. A final Notice of Intent to Levy has been issued. Balance is under $100,000 (and some cases under $250,000). You can be garnished or levied as long as 30 days have passed since the Final Notice of Intent to Levy was issued.

- Assigned to an IRS Revenue Officer. An individual IRS agent is assigned to collect and review your case. Typically balances over $250,000.

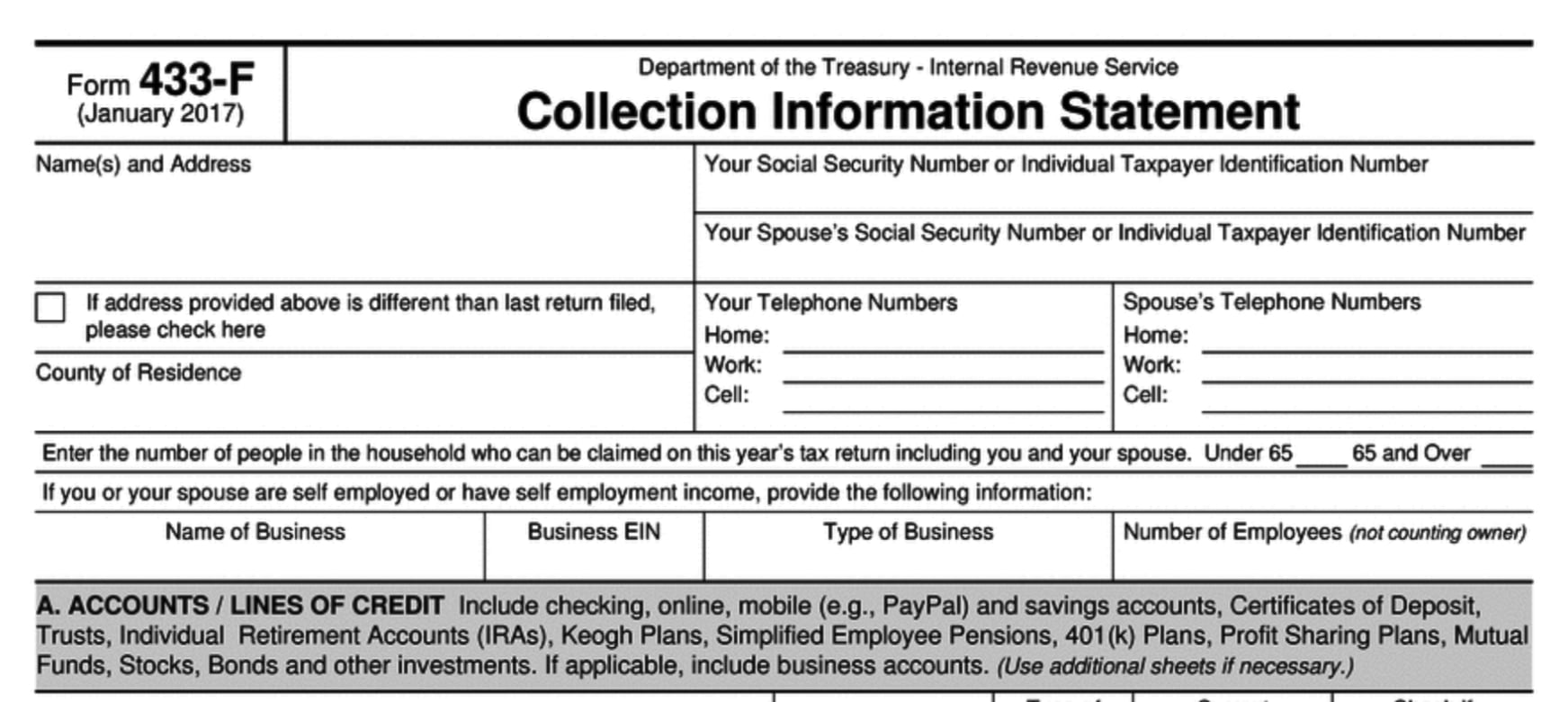

Second Step: Submit Form 433F or 433A with supporting documentation. The form usually depends on where the case is being handled. Send all mail to the IRS by USPS Certified Mail with a return receipt. Do not send regular mail, they may lose it. Here is what you do depending on who is handling it:

- Not in Collections: Prepare Form 433F and add supporting documentation. Then add a cover letter requesting Currently Not Collectible and mail it to where you normally file.

- Automated Collection System: You can call the IRS at (800) 829-7650 and give the information from your Form 433F over the phone to an agent or ask for a mailing address to send it to. Request a hold on collections if you are They might ask for supporting documentation to fax or mail to them.

- Revenue Officer. Mail or Fax Form 433A and supporting documentation to the IRS Revenue Officer assigned to the case.

Downsides of Currently Not Collectible and Notes

The downside of Currently Not Collectible Status is liens are filed against you if you owe over $10,000. Technically they can file a lien for less, but they rarely do. These liens cannot be withdrawn if the debt expires, but they will be released.

The other downside is the debt does not go away right away like in an Offer In Compromise. You have to wait until it expires. They could also kick out the status, find you have a higher income, and now request a payment plan. You cannot sell items that are lined without paying off the IRS or getting a lien subordination.

In conclusion, this is the best option for people that have assets that disqualify them from a settlement, that have old debts that could be expiring, or if they need to get a garnishment off right away. Otherwise, Offer In Compromise is the best way to resolve your tax case.

If you think you could benefit from the help of a tax attorney, schedule a consultation with one of our expert tax attorneys here or call us at (888) 515-4829.

2022 UPDATE

Tax attorney Robert Kayvon goes through Currently Not Collectible Status. A brief explanation followed by an analysis of 2022’s increased expenses and how it may change your odds of getting approved. Still, an Offer In Compromise is better for most people. Let us do a free in-depth analysis of your case to see what you may qualify for.

Call us at (888) 515-4829 or go to https://trp.tax/start For information on expiring tax debts, see here: https://trp.tax/tax-guide/csed-irs-states/

Official page from the IRS discussing Currently Not Collectible Status: https://www.irs.gov/irm/part5/irm_05-016-001r

See our free tax help guide: https://trp.tax/taxhelp