6

6 5 Ways To Get Rid Of Your IRS Tax Debt

When you owe tax payments to the IRS, there may be alternative avenues to explore. Find out if […]

6

6 When you owe tax payments to the IRS, there may be alternative avenues to explore. Find out if […]

140

140 The Tax Doctor TV Advertisements are showing up frequently on TV and online. So what are these ads? […]

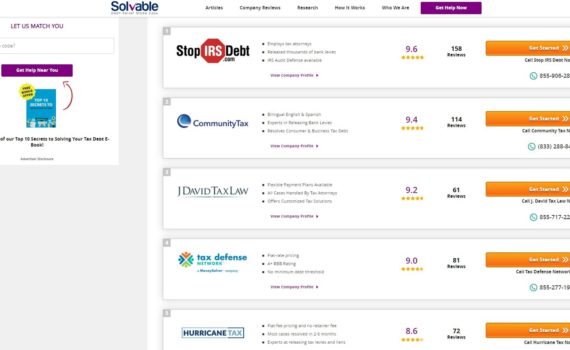

7

7 Here we go over another tax relief scam, Solvable. Firms that are rated extremely low on Yelp, BBB, […]

2

2 Whether it’s for convenience, to seek professional help or any other reason one may have, there are those […]

4

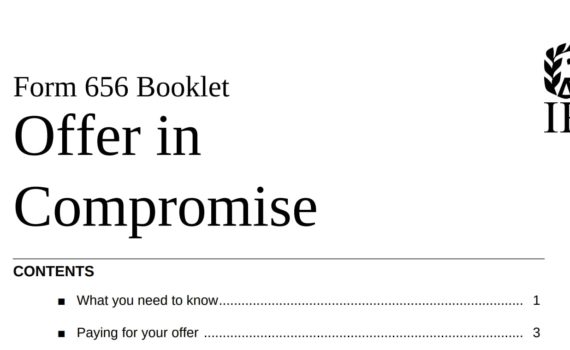

4 One of the programs that the IRS offers to those who cannot pay their tax debt is through […]

3

3 Tax relief is a category that encompasses many options. Here we go through and explain the various options […]

328

328 Currently Not Collectible status is one of the most popular options for tax relief cases. It is considered […]

1

1 When you have a financial liability with the IRS, beginning your settlement is often the toughest step. Penalties […]

13

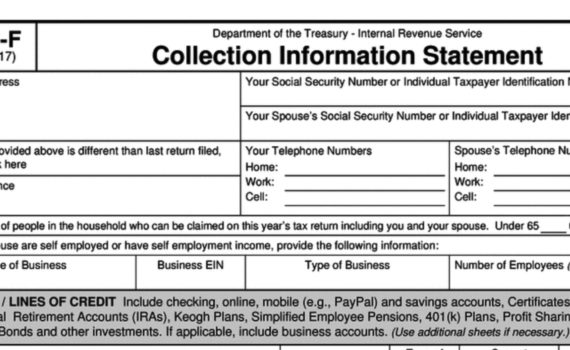

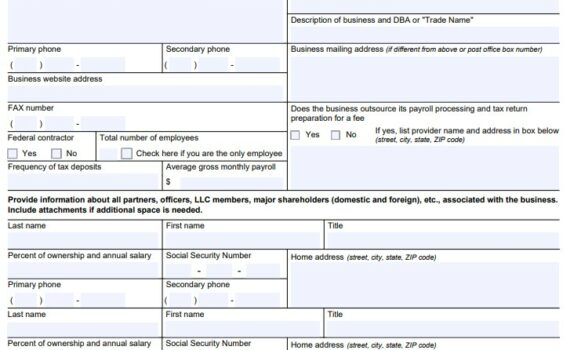

13 IRS Form 433-B (OIC) is the financial information statement for an IRS Business Offer In Compromise. This 433-B […]