Currently Not Collectible Status (with a 2022 update): What It ...

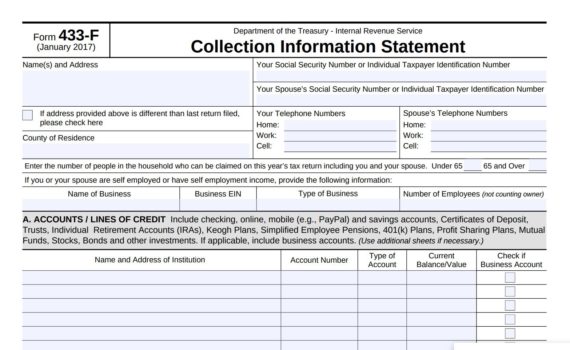

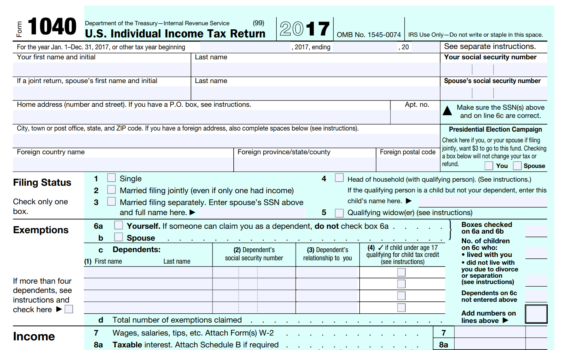

Currently Not Collectible status is one of the most popular options for tax relief cases. It is considered […]

Currently Not Collectible status is one of the most popular options for tax relief cases. It is considered […]

Where your collections case is handled depends on the balance and tax type. The IRS collections process can […]

Here is what to do when you have 20 or more years of unfiled tax returns. Not all tax […]

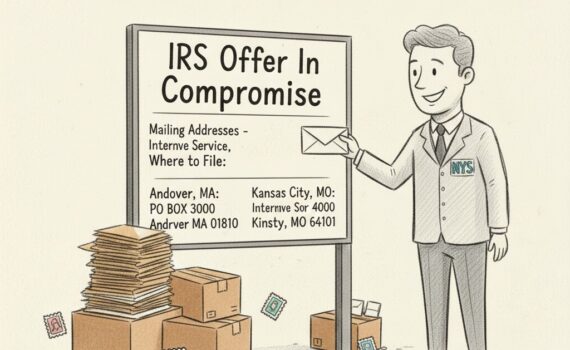

The mailing address for IRS Offer In Compromise changes depending on the state that you live in. There […]

Audit Insurance, also known as Audit Protection, is a service where the tax filer pays for insurance that […]

IRS Offers In Compromise is almost always easier to get than FTB Offers In Compromise. Here we go […]

When you have a financial liability with the IRS, beginning your settlement is often the toughest step. Penalties […]

When it comes to settling back taxes, many taxpayers find an answer by hiring a tax attorney. But […]

Getting help with unfiled tax returns is tough. Many tax relief companies claim to help but are not […]