IRS vs FTB Offer In Compromise: Some Tax Debt Settlements ...

IRS Offers In Compromise is almost always easier to get than FTB Offers In Compromise. Here we go […]

IRS Offers In Compromise is almost always easier to get than FTB Offers In Compromise. Here we go […]

When you have a financial liability with the IRS, beginning your settlement is often the toughest step. Penalties […]

When it comes to settling back taxes, many taxpayers find an answer by hiring a tax attorney. But […]

Getting help with unfiled tax returns is tough. Many tax relief companies claim to help but are not […]

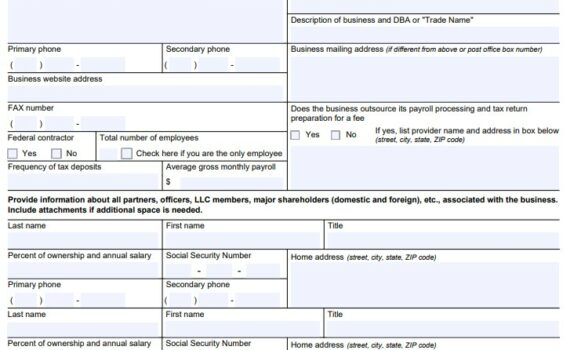

IRS Form 433-B (OIC) is the financial information statement for an IRS Business Offer In Compromise. This 433-B […]

The umbrella of California Self Employment Tax covers state residents who don’t receive a paycheck as an employee […]

Settling NYS taxes can be a difficult task. New York State takes a much harder look at submitted […]

Insight Financial Solutions is a tax resolution firm based in Palm Bay, Florida, with offices in Evergreen, Colorado, […]

Lots of people owe the IRS, but being assigned a revenue officer to your case means the IRS […]