When To File For Equitable Relief – Conditions For Qualification

In the case that you do not qualify for the general type of Innocent Spouse Relief or for […]

In the case that you do not qualify for the general type of Innocent Spouse Relief or for […]

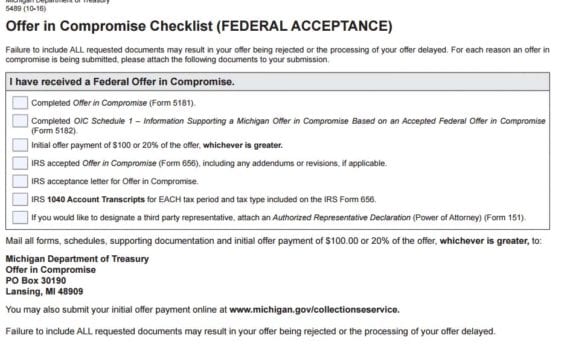

Michigan Offer In Compromise: The Easiest of The Bunch Getting a Michigan Offer In Compromise (OIC) is in […]

Blue Tax Closed: Another Tax Relief Firm Dies Blue Tax, a tax relief firm based in Los Angeles, CA, […]

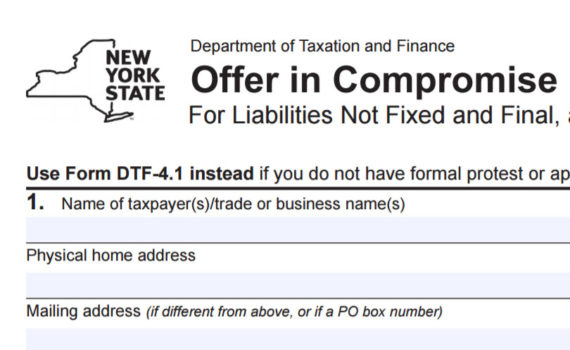

Settling New York State Taxes: NYS Offer In Compromise In this guide, we will go through filing an […]

Filling out Form DTF 4.1 for NYS Offer In Compromise This guide is part of our NYS Offer […]

Filling out Form DTF 4 for NYS Offer In Compromise This guide is part of our NYS Offer […]

Personal Injury Settlements Are Mostly Not Taxable Is your personal injury settlement taxable? Compensation for your actual physical […]

Welcome to our ongoing series of comparing tax relief companies. Here we compare Legacy Tax and Resolution Services […]

They only have so long to collect…. thanks to CSED CSED stands for collection statute expiration date. This […]