Boost for Main Street: Texas’s Proposed Personal Property Tax Exemption

A Texas ballot measure, Proposition 9, aims to significantly increase the personal property tax exemption for businesses. If […]

A Texas ballot measure, Proposition 9, aims to significantly increase the personal property tax exemption for businesses. If […]

The current gridlock that has led to a federal government shutdown is not merely a dispute over appropriations; […]

Excise taxes—those specific levies on goods like fuel, alcohol, or tobacco—generate over two trillion dollars annually worldwide. For […]

The current federal government shutdown stems primarily from a fiscal battle over spiraling healthcare costs and the enormous […]

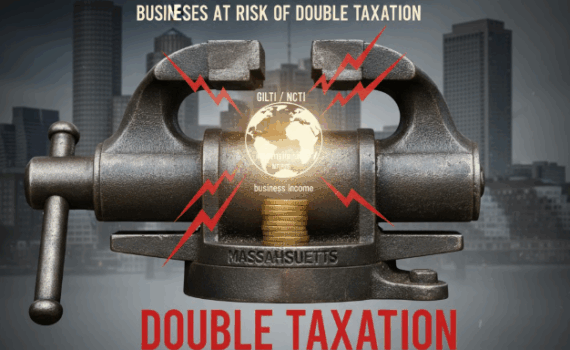

Massachusetts lawmakers are considering legislation that would change how the state taxes the international income of local businesses. […]

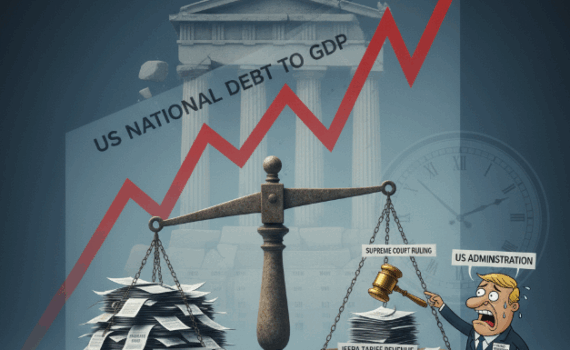

The question of who has the authority to impose tariffs in the United States is about to be […]

The legality of the Trump administration’s tariff regime is currently under review, with the US Supreme Court set […]

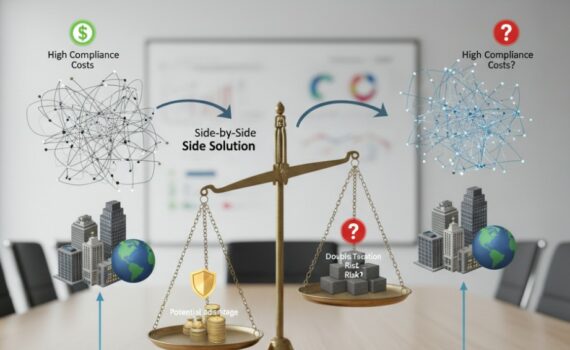

The G7’s proposed “side-by-side” solution for a global minimum tax has raised the question of whether it would […]

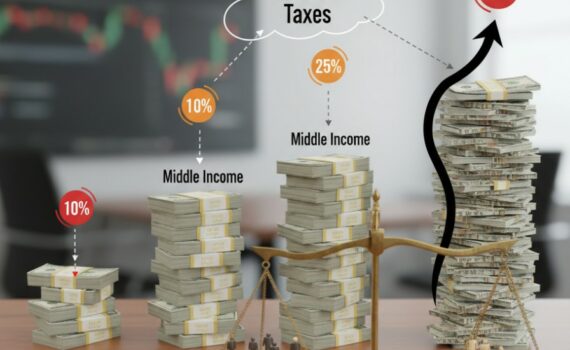

A tax system is progressive when the tax burden on higher-income individuals is proportionally greater than on those […]