1. Permanent American Opportunity Credit:

The formerly temporary American Opportunity Credit is now a permanent fixture. Depending on income and filing status, individuals covering college-related expenses for themselves, a spouse, a child, or another dependent may qualify for a credit of up to $2,500 for tuition and related costs, including course materials. The credit structure involves a 100% credit for the initial $2,000 spent on post-secondary education, followed by a 25% credit on the subsequent $2,000. Notably, the credit is partially refundable, allowing for a refund of up to $1,000 if it results in a negative tax liability.

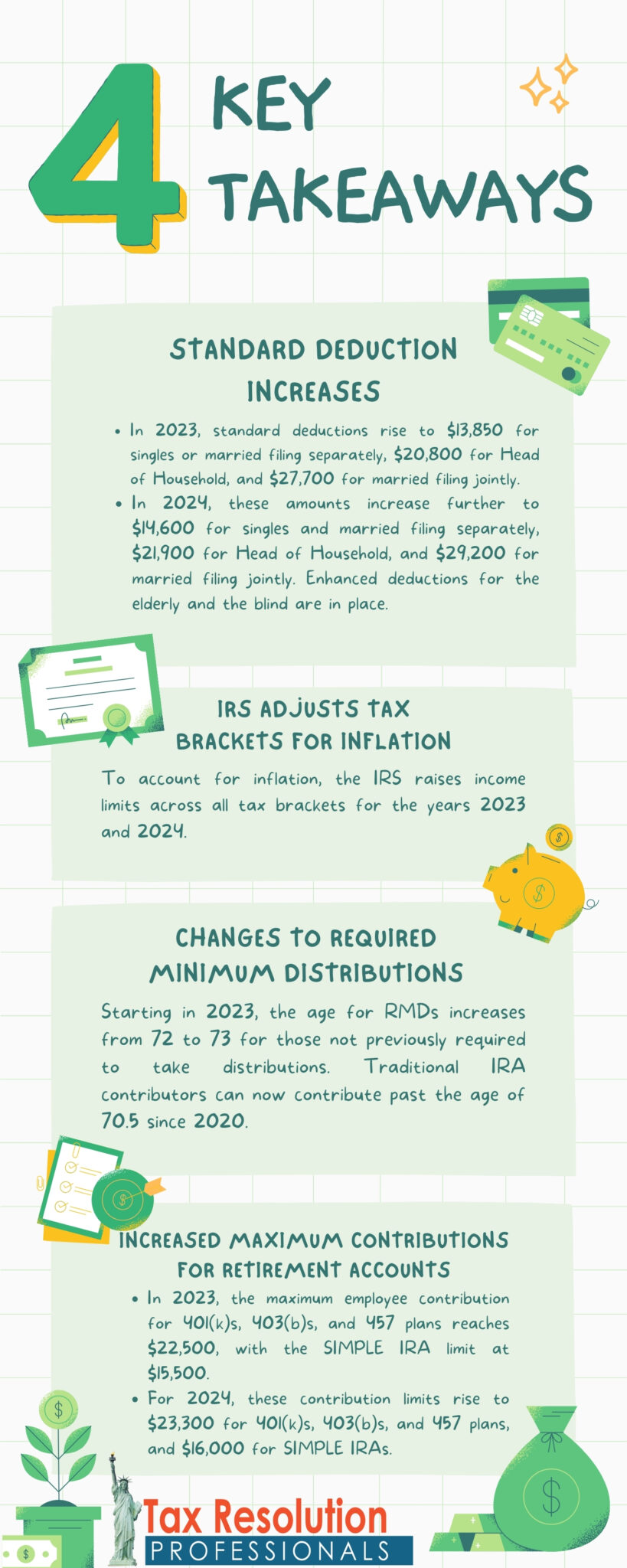

2. Changes to Retirement Accounts:

- The SECURE Act and the CARES Act have instigated several changes to retirement plans, including:

- Raising the minimum age for Required Minimum Distributions (RMDs) from 70.5 to 72 for those reaching 70.5 after 2019 (SECURE Act).

- Allowing seniors to forgo RMDs in 2020 without penalties (CARES Act).

- Permitting contributions to traditional IRAs beyond the age of 70.5 from 2020.

- Allowing parents having a baby or adopting a child to take IRA and 401(k) payouts of up to $5,000 per parent without the 10% penalty.

- Allowing taxpayers under 59.5 years of age to take IRA and 401(k) payouts of up to $100,000 for coronavirus-related expenses in the 2020 tax year without the 10% penalty. The distribution can be included in income over three years, and the taxpayer has three years to return the funds to the accounts to undo the tax consequences.

- Delaying retirement plan loans due in 2020 by one year.

- Increasing the 2023 maximum employee contribution amounts for 401(k)s, 403(b)s, and 457 plans to $22,500, and SIMPLE IRAs to $15,500. Additionally, Roth IRA contribution limits are now based on adjusted gross income (AGI). The 2024 amounts increase to $23,000 for 401(k)s, 403(b)s, and 457 plans, and to $15,500 for SIMPLE IRAs.

3. Standard Deduction Adjustments for 2023 and 2024:

The standard deduction is subject to changes in tax laws for 2023 and 2024. The amounts are as follows:

| Filing Status | Standard Deduction |

| Married filing jointly under the age of 65 | $27,700 |

| Married filing jointly over the age of 65 | $27,700 plus $1,500 for each spouse over the age of 65 |

| Single or married filing separately under the age of 65 | $13,850 |

| Single or married filing separately over the age of 65 | $15,700 |

| Heads of household under the age of 65 | $20,800 |

| Heads of household over the age of 65 | $22,650 |

2024 amounts:

| Filing Status | Standard Deduction |

| Married filing jointly under the age of 65 | $29,200 |

| Married filing jointly over the age of 65 | $29,200 plus $1,550 for each spouse over the age of 65 |

| Single or married filing separately under the age of 65 | $14,600 |

| Single or married filing separately over the age of 65 | $16,550 |

| Heads of household under the age of 65 | $21,900 |

| Heads of household over the age of 65 | $23,850 |

4. Tax bracket changes for 2023 and 2024

To adjust for inflation, the IRS has adjusted the 2023 income limits for all tax brackets:

| Filing status and income | Marginal Tax Rate |

| Single over $578,125Married filing jointly over $693,750 | 37% |

| Single over $231,250 to $578,125Married filing jointly over $462,500 to $693,750 | 35% |

| Single over $182,100 to $231,250Married filing jointly over $364,200 to $462,500 | 32% |

| Single over $95,375 to $182,100Married filing jointly over $190,750 to $364,200 | 24% |

| Single over $44,725 to $95,375Married filing jointly over $89,450 to $190,750 | 22% |

| Single over $11,000 to $44,725Married filing jointly over $22,000 to $89,450 | 12% |

| Single up to $11,000Married filing jointly up to $22,000 | 10% |

The IRS has further adjusted the 2024 income limits for all tax brackets as well:

| Filing status and income | Marginal Tax Rate |

| Single over $609,350Married filing jointly over $731,200 | 37% |

| Single over $243,725 to $609,350Married filing jointly over $487,450 to $731,200 | 35% |

| Single over $191,950 to $243,725Married filing jointly over $383,900 to $487,450 | 32% |

| Single over $100,525 to $191,950Married filing jointly over $201,050 to $383,900 | 24% |

| Single over $47,150 to $100,525Married filing jointly over $94,300 to $201,050 | 22% |

| Single over $11,600 to $47,150Married filing jointly over $23,200 to $94,300 | 12% |

| Single up to $11,600Married filing jointly up to $23,200 | 10% |

5. Changes to Charitable Cash Donations:

In 2020 and 2021, the CARES Act temporarily suspended the 60% of Adjusted Gross Income (AGI) limit for most charitable cash deductions, providing increased deductions for taxpayers who itemize. Notably, this does not apply to cash donations directed to a donor-advised fund or private nonoperating foundation. Additionally, non-itemizers can deduct qualified charitable cash contributions up to $300 in both 2020 and 2021, irrespective of filing status, and up to $600 in 2021 for those married filing jointly. Starting from 2023, itemizing deductions will be necessary to claim charitable contributions.

6. Changes to W-4 Form:

In 2020, the IRS introduced changes to Form W-4, eliminating the concept of withholding allowances. The updated form is more straightforward, requiring information about filing status, number of dependents, number of jobs, estimated tax breaks, and other income reported on a 1040. Employees are not obliged to submit a new Form W-4 unless hired after 2019 or seeking to adjust their withholdings.

7. Changes to Form 1099-MISC and Form 1099-NEC:

Since the tax year 2020, Form 1099-MISC has been redesigned, and Form 1099-NEC has been reintroduced. Employers will no longer report nonemployee compensation of $600 or more on Form 1099-MISC; instead, such payments to non-employees are reported on Form 1099-NEC. The reporting deadline for these forms is January 31 each year, and they must be provided to the payee and filed with the IRS. The IRS initially planned to implement changes to the 1099-K reporting requirement for the 2023 tax year, but recent delays mean that tax year 2023 will maintain the previous $20,000 reporting threshold for third-party processors like Venmo and Paypal. There is no reporting threshold for payment card transactions.

8. Changes to Long-Term Care Premium Deductions:

For taxpayers itemizing on Schedule A or self-employed individuals completing Schedule 1 of Form 1040, the limits for long-term care premium deductions have been adjusted for 2023 and 2024.

-

- 2023 Amounts:

- Age 40 or under: $480

- Age 41 to 50: $890

- Age 51 to 60: $1,790

- Age 61 to 70: $4,770

- Age 71 and over: $5,960

- 2024 Amounts:

- Age 40 or under: $470

- Age 41 to 50: $880

- Age 51 to 60: $1,760

- Age 61 to 70: $4,710

- Age 71 and over: $5,880

- 2023 Amounts:

9. Changes to Alternative Minimum Tax (AMT):

The AMT “patch” made permanent in early 2013 remains in effect to prevent taxpayers from having to pay AMT. Exemption amounts for 2023 and 2024 are as follows:

2023 Exemption Amounts:

- $81,300 for single and head-of-household filers.

- $126,500 for married couples filing jointly and surviving spouses.

- $63,250 for married people filing separately.

2024 Exemption Amounts:

- $85,700 for single and head-of-household filers.

- $133,300 for married couples filing jointly and surviving spouses.

$66,650 for married people filing separately.

10. Energy-Efficiency Credit Changes:

Taxpayers installing energy-efficient equipment in their homes, such as solar water heaters, solar panels, fuel cells, and wind turbines, can claim a credit of 26% of the expense for tax years 2020 and 2021. The credit increases to 30% from 2022 through 2032, then decreases to 26% for 2033 and 22% in 2034 before expiring. While the credit is not refundable, any excess can be carried forward to future tax years.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.