Movers and Shakers in the 2026 State Tax Competitiveness Index

The Tax Foundation’s State Tax Competitiveness Index is more than a list of which states collect the most […]

The Tax Foundation’s State Tax Competitiveness Index is more than a list of which states collect the most […]

Signed into law in July 2025, the One Big Beautiful Bill Act (OBBBA) introduces the largest set of […]

The annual State Tax Competitiveness Index is a crucial diagnostic tool that measures the structure of state tax […]

In the United States, there’s a growing divide in how the government generates its revenue. For the majority […]

The One Big Beautiful Bill Act (OBBBA) represents the most extensive federal tax overhaul in almost a decade, […]

A Texas ballot measure, Proposition 9, aims to significantly increase the personal property tax exemption for businesses. If […]

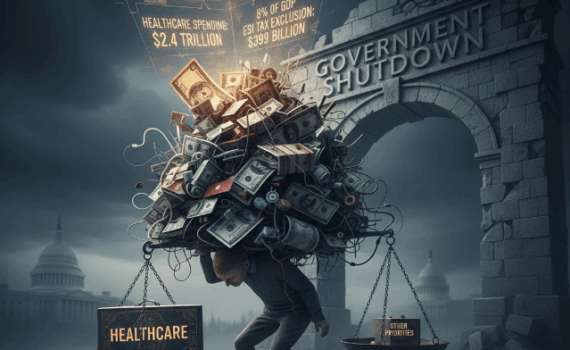

The current gridlock that has led to a federal government shutdown is not merely a dispute over appropriations; […]

Excise taxes—those specific levies on goods like fuel, alcohol, or tobacco—generate over two trillion dollars annually worldwide. For […]

The current federal government shutdown stems primarily from a fiscal battle over spiraling healthcare costs and the enormous […]