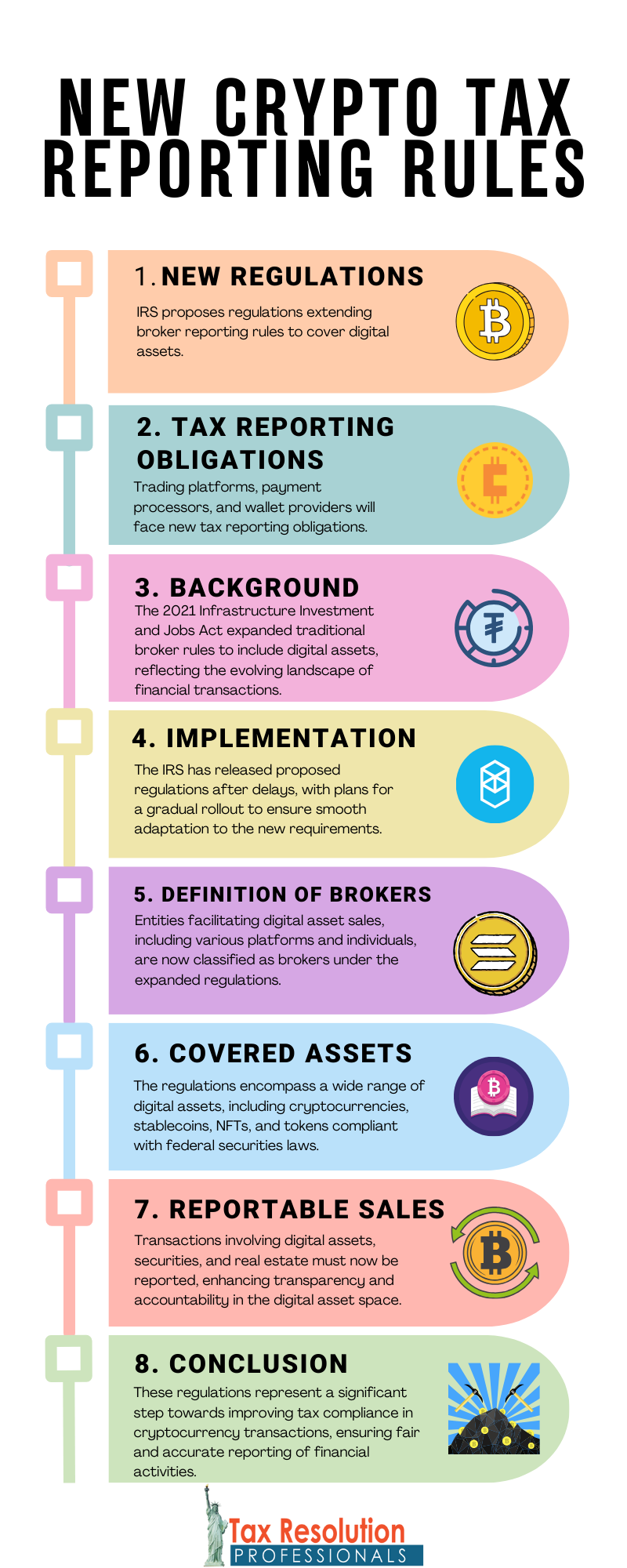

The Internal Revenue Service (IRS) has unveiled extensive proposed regulations, spanning over 280 pages, to enforce congressional directives extending broker reporting rules to cover digital asset transactions. This includes Bitcoin and other cryptocurrencies. These regulations, once enacted, will introduce significant tax reporting obligations on various entities involved in the digital asset space. Such as trading platforms, payment processors, and wallet providers.

Background

Traditionally, brokers have been mandated to submit IRS Form 1099-B for each individual for whom they execute transactions involving various financial instruments like stocks, bonds, and commodities. These filings entail details such as sales proceeds, transaction dates, tax basis, and categorization of gains or losses. Making it challenging for taxpayers to evade reporting their investment activities to the IRS.

In 2021, the Infrastructure Investment and Jobs Act expanded these reporting rules to encompass digital assets. With an aim to bridge the tax gap. This legislation broadened the definition of “broker” to include entities facilitating digital asset transfers for others and classified digital assets as “covered securities” for tax reporting purposes.

Implementation

Despite being signed into law in 2021, the new reporting requirements were not immediately enforced. Many specifics are left for determination by the Treasury Secretary. Initially slated to commence in 2024, the implementation was postponed. Nearly two years later, the IRS has finally released proposed regulations to operationalize the new digital asset reporting obligations.

Key Definitions and Inclusions

Under the proposed regulations, “digital asset brokers” will be subject to similar reporting standards as brokers dealing with traditional financial instruments. However, the definition of digital asset brokers is notably expansive. Encompassing entities facilitating digital asset sales and possessing knowledge of the involved parties’ identities.

This broad definition incorporates a diverse range of platforms and individuals, including centralized and decentralized exchanges, custodial wallet service providers, digital asset kiosk operators, and even real estate intermediaries handling transactions involving digital assets as payments.

Exclusions from the definition of “digital asset broker” are also outlined. Such as merchants accepting digital assets as payment, validators of distributed ledger transactions, hardware sellers, and licensors of software exclusively controlling private keys for accessing digital assets.

Covered Assets and Sales

The proposed regulations define “digital assets” as cryptographic representations of value recorded on distributed ledgers like blockchains. This definition encompasses cryptocurrencies like Bitcoin and Ether, stablecoins pegged to fiat currencies. NFTs representing unique assets, and tokens meeting federal securities laws’ criteria.

Reportable sales include exchanges involving digital assets for cash or cash equivalents, other digital assets, stored value cards, broker services, securities, and real estate. However, certain transactions like hard forks, airdrops, and digital asset receipts in exchange for services are excluded from reporting requirements.

Required Information and Phased Implementation

Starting from January 1, 2025, reporting obligations include customer details, digital asset quantities, sale dates, gross proceeds, transaction IDs, and other relevant information, mirroring Form 1099-B requirements. A new Form 1099-DA will be introduced for reporting digital asset sales.

Full reporting, including adjusted basis and categorization of gains or losses, will commence in 2026. Brokers are exempt from reporting digital asset sales for tax years 2023 and 2024.

Conclusion

The proposed regulations mark a significant step towards enhancing tax compliance in the cryptocurrency realm. Taxpayers and entities operating in the digital asset space should prepare to adhere to these forthcoming reporting obligations. Aiming to ensure compliance with tax laws and avoid penalties. As the IRS moves to finalize these regulations, stakeholders should stay informed and adapt to the evolving regulatory landscape in the cryptocurrency sphere.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.