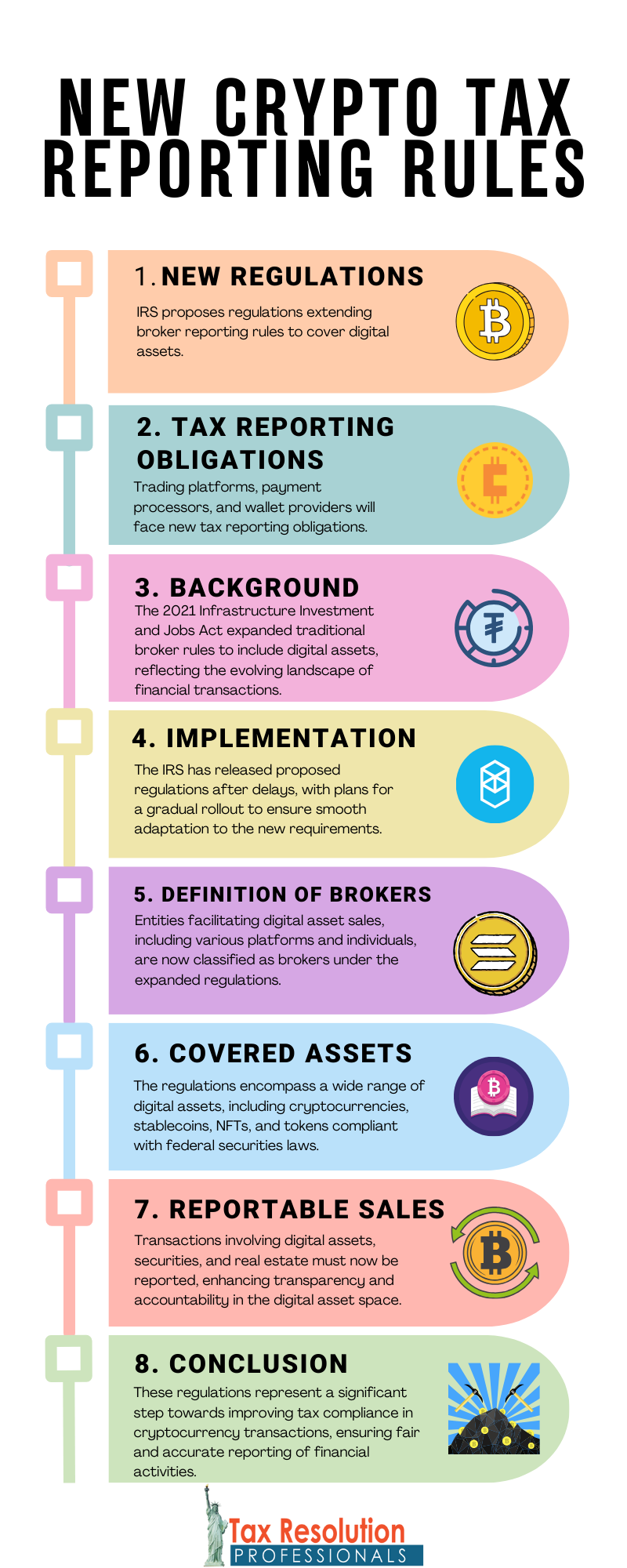

The Internal Revenue Service (IRS) has unveiled extensive proposed regulations, spanning over 280 pages, to enforce congressional directives extending broker reporting rules to cover digital asset transactions. This includes Bitcoin and other cryptocurrencies. These regulations, once enacted, will introduce significant tax reporting obligations on various entities involved in the digital asset space. Such as trading platforms, payment processors, and wallet providers.

Background

Traditionally, brokers have been mandated to submit IRS Form 1099-B for each individual for whom they execute transactions involving various financial instruments like stocks, bonds, and commodities. These filings entail details such as sales proceeds, transaction dates, tax basis, and categorization of gains or losses. Making it challenging for taxpayers to evade reporting their investment activities to the IRS.

In 2021, the Infrastructure Investment and Jobs Act expanded these reporting rules to encompass digital assets. With an aim to bridge the tax gap. This legislation broadened the definition of “broker” to include entities facilitating digital asset transfers for others and classified digital assets as “covered securities” for tax reporting purposes.

Implementation

Despite being signed into law in 2021, the new reporting requirements were not immediately enforced. Many specifics are left for determination by the Treasury Secretary. Initially slated to commence in 2024, the implementation was postponed. Nearly two years later, the IRS has finally released proposed regulations to operationalize the new digital asset reporting obligations.

Key Definitions and Inclusions

Under the proposed regulations, “digital asset brokers” will be subject to similar reporting standards as brokers dealing with traditional financial instruments. However, the definition of digital asset brokers is notably expansive. Encompassing entities facilitating digital asset sales and possessing knowledge of the involved parties’ identities.

This broad definition incorporates a diverse range of platforms and individuals, including centralized and decentralized exchanges, custodial wallet service providers, digital asset kiosk operators, and even real estate intermediaries handling transactions involving digital assets as payments.

Exclusions from the definition of “digital asset broker” are also outlined. Such as merchants accepting digital assets as payment, validators of distributed ledger transactions, hardware sellers, and licensors of software exclusively controlling private keys for accessing digital assets.

Covered Assets and Sales

The proposed regulations define “digital assets” as cryptographic representations of value recorded on distributed ledgers like blockchains. This definition encompasses cryptocurrencies like Bitcoin and Ether, stablecoins pegged to fiat currencies. NFTs representing unique assets, and tokens meeting federal securities laws’ criteria.

Reportable sales include exchanges involving digital assets for cash or cash equivalents, other digital assets, stored value cards, broker services, securities, and real estate. However, certain transactions like hard forks, airdrops, and digital asset receipts in exchange for services are excluded from reporting requirements.

Required Information and Phased Implementation

Starting from January 1, 2025, reporting obligations include customer details, digital asset quantities, sale dates, gross proceeds, transaction IDs, and other relevant information, mirroring Form 1099-B requirements. A new Form 1099-DA will be introduced for reporting digital asset sales.

Full reporting, including adjusted basis and categorization of gains or losses, will commence in 2026. Brokers are exempt from reporting digital asset sales for tax years 2023 and 2024.

Conclusion

The proposed regulations mark a significant step towards enhancing tax compliance in the cryptocurrency realm. Taxpayers and entities operating in the digital asset space should prepare to adhere to these forthcoming reporting obligations. Aiming to ensure compliance with tax laws and avoid penalties. As the IRS moves to finalize these regulations, stakeholders should stay informed and adapt to the evolving regulatory landscape in the cryptocurrency sphere.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.

xcos1x

gvzcga

It’s not often that we come across content that really resonates with us, but this one is a standout. From the writing to the visuals, everything is simply wonderful.

I have bookmarked your blog and refer back to it whenever I need a dose of positivity and inspiration Your words have a way of brightening up my day

I have bookmarked your blog and refer back to it whenever I need a dose of positivity and inspiration Your words have a way of brightening up my day

I just wanted to take a moment to express my gratitude for the great content you consistently produce. It’s informative, interesting, and always keeps me coming back for more!

I love how this blog promotes self-love and confidence It’s important to appreciate ourselves and your blog reminds me of that

This blog post is packed with great content!

Give a round of applause in the comments to show your appreciation!

As a fellow blogger, I can appreciate the time and effort that goes into creating well-crafted posts You are doing an amazing job

This blog covers important and relevant topics that many are afraid to address Thank you for being a voice for the voiceless

Your positivity and enthusiasm are infectious I can’t help but feel uplifted and motivated after reading your posts

I love how this blog promotes self-love and confidence It’s important to appreciate ourselves and your blog reminds me of that

Your blog post was really enjoyable to read, and I appreciate the effort you put into creating such great content. Keep up the great work!

Wow, this blogger is seriously impressive!

This is such an important reminder and one that I needed to hear today Thank you for always providing timely and relevant content

Your blog is always a highlight of my day

Buenisimo el articulo. Un cordial saludo. Reciba un cordial saludo!

I’m so glad I stumbled upon your blog. This post, like many others, is filled with valuable insights and a positive perspective. It’s clear that you put a lot of thought and care into your writing, and it makes a world of difference. Thank you for consistently creating content that uplifts and inspires! — please subscribe to my channel https://www.youtube.com/@jivoice?sub_confirmation=1

This post truly brightened my day! I appreciate how you delve into the topic with such positivity and clarity. It’s refreshing to see content that not only informs but also uplifts the reader. Your writing style is engaging and always leaves me feeling inspired. Keep up the fantastic work!

Muy buen post. Feliz semana. Gracias!!

Gracias por la informacion. muy recomendable! Un cordial saludo.

Muy buen post. Un cordial saludo. Reciba un cordial saludo!

I just wanted to let you know how much I enjoyed this article. Your writing style is engaging, and your positivity is contagious. It’s evident that you put a lot of thought and care into your posts, and it really shows. Thank you for creating such a positive space on the internet! — please subscribe to my channel https://www.youtube.com/@jivoice?sub_confirmation=1

Keep up the amazing work! Can’t wait to see what you have in store for us next.

Esta genial el aporte. Saludos. Gracias!!

Muy buen articulo. Feliz semana. Un cordial saludo.

I appreciate how this blog promotes self-growth and personal development It’s important to continuously strive to become the best version of ourselves

Here is my page https://cryptolake.online/crypto8

I admire how this blog promotes kindness and compassion towards ourselves and others We could all use a little more of that in our lives

Your blog is a treasure trove of wisdom and positivity I appreciate how you always seem to know just what your readers need to hear

What other topics would you like to see covered on the blog? Let us know in the comments!

This blog post has left us feeling grateful and inspired

Your writing is so eloquent and persuasive You have a talent for getting your message across and inspiring meaningful change

Keep up the fantastic work and continue to inspire us all!

I appreciate how this blog promotes self-growth and personal development It’s important to continuously strive to become the best version of ourselves

Your honesty and vulnerability in sharing your personal experiences is truly admirable It takes courage to open up and I applaud you for it

Gracias por tu aportacion. Gran aporte de esta web. Gracias!

Your knowledge and expertise on various topics never ceases to amaze me I always learn something new with each post

Your honesty and vulnerability in sharing your personal experiences is truly admirable It takes courage to open up and I applaud you for it

Your blog post was really enjoyable to read, and I appreciate the effort you put into creating such great content. Keep up the great work!

Top cryptocurrency news sites

This made my day, honestly. Please check my post at https://mazkingin.com

Great insights, I really enjoyed reading your blog! Please check my post at https://mazkingin.com

Esta genial el aporte. muy recomendable! Saludos.

Love this appreciation for great content

Love this appreciation for great content

Crypto market cap updates

Love this appreciation for great content

Gracias por la informacion. Gran aporte de esta web. Reciba un cordial saludo!

I love how you incorporate personal stories and experiences into your posts It makes your content relatable and authentic

I found this article to be very helpful. Thanks for the valuable information! And also please SignUp and get 30USD FREE investment plan at https://investurns.com/

If you may have been using steroids and want to

contribute to our prevention efforts, please contact us at We will publish your testimonial.

Always seek the guidance of a doctor if you are considering taking some type

of a supplement. No matter how pure the businesses say

they’re, there may be all the time something that can go wrong if you don’t use them properly.

Blood and other medical exams won’t bring you unhealthy

news anymore, they may simply present you the way a lot you might have superior

as a end result of your exercises. In doing so, Clenbutrol additionally causes an increase in your basal metabolic price (BMR),

so it’s easier for you to obtain that sought-after physique.

Some authorized anabolic steroids on the market can be

found for the individuals for use. The merchandise are categorized into Cutting, Bulking, Stacks and Combos.

This is very efficient most secure authorized steroids for individuals especially

males who wish to achieve lean muscle mass and reduce down on fat.

That is why CrazyBulk is the very wanted website when it

comes to shopping for authorized steroids. CrazyBulk merchandise are formulated beneath the guidance of cGMP and are

permitted by the FDA. The all crazybulk products are categorized into Chopping,

Bulking, Stacks and Combos.

But most men and women bounce again badly and regain all the load they

misplaced. All four steroids within the stack work very well when paired collectively

in strategic doses. When CrazyBulk came up with the vary of single steroids and

SARMS, it observed that everybody was amazed

at the security profiles and the results. But there have been fitness buffs who would fortunately want something stronger.

Stacking steroids require a deep understanding of

how every steroid works, as properly as how they work synergistically.

They defend your hard-earned muscle tissue from breaking down,

guaranteeing that your weight-loss journey does not come at the value of muscle loss.

Certain shoppers of mine are uncomfortable with the number of dietary supplements that need to be taken throughout the

stack.

Women can use some of the greatest authorized steroids,

however not all of them are ideal for the female body. Loopy Bulk DecaDuro is

among the finest legal steroids known for its advantages in supporting joint health.

Particularly designed to alleviate joint discomfort and promote total joint well-being,

DecaDuro goals to enhance the workout expertise for people seeking to build muscle and

energy.

The Loopy Bulk Cutting Stack is meant to assist with “cutting,” which is a bodybuilding time period that has made its method into the health neighborhood at

giant. So, whatever your objective is – whether or not it is

to organize for a fierce bodybuilding competition or

to look good, there is a CrazyBulk supplement suitable for

every stage of your workout program. This method, you presumably can experience optimal and quick results through the cutting part.

If you purpose to construct power, then you’ll be able

to select Anadrol, Winstrol, Testosterone, and Deca Durabolin.

Performance-enhancing medication have numerous antagonistic

effects on each men and women. The best Closest Legal Supplement To Steroids steroids aren’t steroids,

but somewhat dietary dietary supplements which have an analogous impact.

Here, we answer all of your burning questions so you can even make an informed

determination about these merchandise. Provacyl is tailor-made to deal with

the natural decline in testosterone ranges that always comes with getting older.

Provacyl goals to potentially increase vitality, improve stamina, and contribute to an total sense of vitality by incorporating elements that help the body’s

hormone production. HyperGH14X is famend for its function as an HGH

releaser particularly aimed at promoting lean muscle progress.

At the highest of our list of the most effective legal steroids

for muscle progress is a product from Loopy Bulk, certainly one of my absolute favourite fitness supplement corporations in the business.

Offering safe, non steroidal, authorized alternate options

to anabolic steroids is in itself a laudable thought.

The human body functions by processing various chemicals corresponding to proteins, fats, and other nutrients and utilizing them

as gasoline and constructing supplies. SARMs do suppress pure testosterone manufacturing, especially at greater doses or when used for longer than 4–6 weeks.

When stacked with anabolic steroids — that are inherently suppressive — this

creates a double hit to the HPTA (hypothalamic-pituitary-testicular axis).

GenFX is a notable HGH releaser and probably the greatest authorized steroids designed to enhance

general well-being.

When I wanted a reliable complement to assist me minimize fats whereas

preserving lean muscle, Winsol grew to become my go-to choice.

Designed to copy the effects of Winstrol, Winsol helps

obtain a lean, shredded physique without dangerous side effects.

When on the lookout for a safe method to enhance my fat-burning and

improve my cardiovascular efficiency, Clenbutrol stood out as an excellent

choice. Designed to replicate the highly effective thermogenic and performance-enhancing

properties of Clenbuterol, Clenbutrol helps me obtain a lean, toned physique.

When coaching we are literally tearing our muscle tissue down, and once we recuperate this

is the place it’s built, repaired and becomes stronger.

Loopy Bulk Development Hormone Stack could improve muscle development, fats loss, and total performance by focusing on the body’s pure development hormone manufacturing.

HGH-X2 from Crazy Bulk is a trusted resolution for naturally amplifying HGH levels.

70918248

References:

cons of taking steroids (http://scenario-center.com/)

70918248

References:

none – https://www.avvocatosiviero.it/diritti-e-tutela-del-professionista-sanitario/,

70918248

References:

none (https://atsu.com.ec/2012/12/08/aenean-laoreet-tortor/)