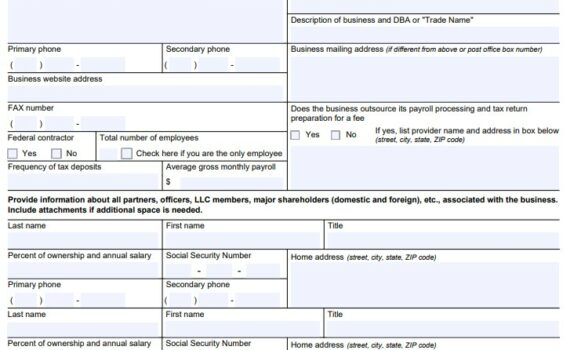

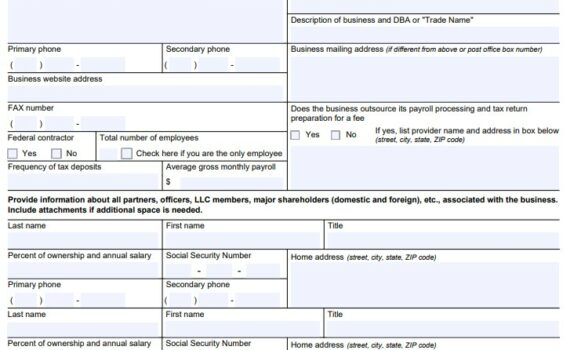

IRS Form 433-B (OIC) 2023 Version Instructions: Business Offer In ...

IRS Form 433-B (OIC) is the financial information statement for an IRS Business Offer In Compromise. This 433-B […]

IRS Form 433-B (OIC) is the financial information statement for an IRS Business Offer In Compromise. This 433-B […]

The umbrella of California Self Employment Tax covers state residents who don’t receive a paycheck as an employee […]

Settling NYS taxes can be a difficult task. New York State takes a much harder look at submitted […]

Insight Financial Solutions is a tax resolution firm based in Palm Bay, Florida, with offices in Evergreen, Colorado, […]

Lots of people owe the IRS, but being assigned a revenue officer to your case means the IRS […]

The most stressful thing about owing New York State back taxes is not knowing what to do about […]

A California Franchise Tax Board bank levy is a legal action by the State of California where funds […]

When you owe back due tax debts to the State of New York and take no action it […]

Did you know that the Internal Revenue Service (IRS) sends out millions of wage garnishment notices every year? […]