New York State Tax Collections Levy

A levy is done by New York State Tax Collections to collect money from a third party that is holding money on your behalf, pays your funds, or owes you money. Banks receive levies most commonly. A levy can be issued to a credit card processor or a tenant to collect any funds due and apply them to back due to NYS tax debt.

The following types of funds are exempt from levy:

- Social Security and Supplemental Security Income

- Public assistance (ie: welfare)

- Alimony

- Child support

- Unemployment compensation

- DIsability

- Worker’s compensation

- public and private pensions”

A levy can be sent for either party when more than one party is liable. Sales tax, payroll tax, and joint liabilities are examples where more than one party may be liable.

Resolving an NYS Tax Collections Levy

The levy can be removed by paying the bill in full or documenting that the funds are exempt and proving it to the NYS tax collections department. In cases of extreme financial hardship, you may also be able to get a release as well. Filing bankruptcy will also stop any further levies from occurring.

Income Execution For NYS Tax Debts

An income execution by New York State Tax Collections is a legal order that requires you or your employer to pay out a percentage of your wages to NYS that are applied to back due to NYS tax debt. On most orders, you have the option of paying it yourself and your employer is not notified. You are given 20 days to make the first payment and if you do not act the employer is sent the notice and is required to send the funds by New York State Tax Collections. Each time you are paid NYS gets paid too.

Removing an Income Execution

The New York State Tax Department says on their Income Execution page that the only way to release the income execution is to pay in full. You can have it released by proving a valid hardship to the NYS Tax Collections Department. An NYS Offer In Compromise should be sent in most cases where hardship is approved.

Seizure and Sale By Way of NYS Tax Warrant

The NYS Tax Collections Department comes in and sells your stuff. Real property is the most common thing they sell, but in a larger balance case they may sell artwork, jewelry, vehicles, and other items. They first have to file a tax warrant in order to take the property. NYS does not have forever to collect. They must collection within the NYS tax warrant statute of limitations, which is 20 years in most cases. The IRS has 10 years. So keep that in mind if you owe both.

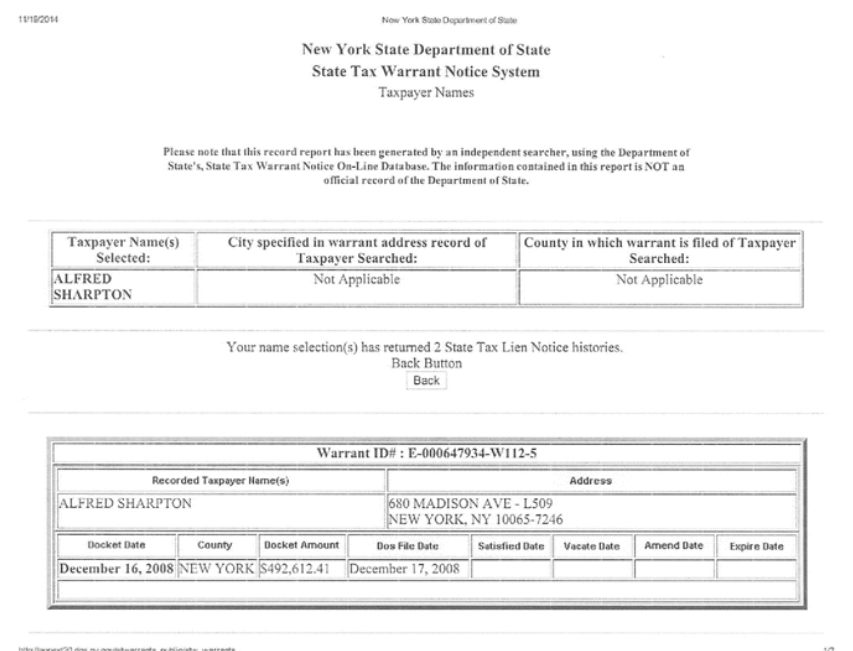

A copy of a notice showing an NYS tax warrant for Al Sharpton.

The Seizure Process for NYS Tax Collections

The steps of an NYS tax debt seizure are:

- Assets are seized (warrant must be filed)

- If a solution is reached prior to sale, the property is returned

- NYS Tax Collections notifies you of the sale date

- Property is sold at public auction for fair market value

- You are sent an accounting of the sale

- If the sale more than covers your tax debt, you are sent any remaining funds

Avoiding Seizure For NYS Tax Debts

Avoid seizure by coming to a resolution with New York State Tax Collections. Seizure is one of the last actions they take. A seizure rarely happens if you or your tax attorney are working with them. Doing nothing is what usually leads to a seizure. If you file a bankruptcy, that also halts the seizure process.

Resolving NYS Tax Collections Issues

You can resolve NYS tax debt by way of the payment plan, Offer In Compromise, bankruptcy and hardship. The debt is not a forever debt. NYS has 20 years to get it in most cases. The worst thing you can do is nothing and the best thing you can do is have tax attorneys get you the best result possible. For a free consultation with one of our experienced tax attorneys, go to our Contact Us page or call us at (888) 515-4829 for us to call you. We have handled more NYS tax debt cases than most NY tax attorneys, at a much more affordable rate.

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I do know it was my option to read, but I truly thought youd have one thing attention-grabbing to say. All I hear is a bunch of whining about one thing that you could possibly repair for those who werent too busy in search of attention.

Great article. It is quite unfortunate that over the last years, the travel industry has had to fight terrorism, SARS, tsunamis, bird flu virus, swine flu, plus the first ever true global economic downturn. Through it all the industry has really proven to be effective, resilient and dynamic, discovering new tips on how to deal with difficulty. There are generally fresh challenges and the possiblility to which the marketplace must yet again adapt and reply.

BAYAR4D | BAYAR4D LOGIN | BAYAR4D DAFTAR | BAYAR4D LINK | BAYAR4D LINK ALTERNATIF | BAYAR4D SITUS | BAYAR4D AGEN | BAYAR4D RTP SLOT | LOGIN BAYAR4D | DAFTAR BAYAR4D | LINK BAYAR4D | LINK ALTERNATIF BAYAR4D | SITUS BAYAR4D | AGEN BAYAR4D | RTP SLOT BAYAR4D

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.