Virginia Legislative Alert: Proposed Tax Hikes Could Make the Commonwealth ...

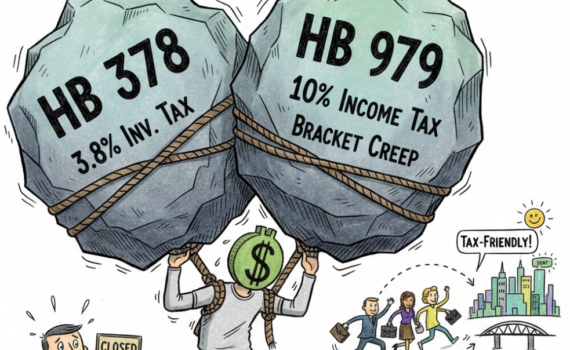

Virginia’s 2026 legislative session is in full swing, and despite campaign promises from across the aisle to prioritize […]

Virginia’s 2026 legislative session is in full swing, and despite campaign promises from across the aisle to prioritize […]

As Chile prepares to inaugurate President José Antonio Kast on March 11, 2026, the national conversation has centered […]

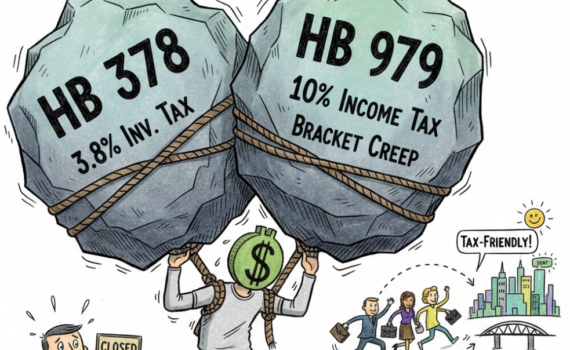

For professional athletes in the United States, signing a multi-million-dollar contract is only the first step. The second, […]

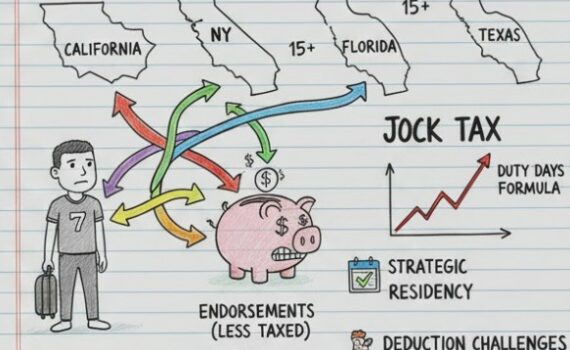

Oklahoma continues its impressive stride towards a more competitive tax environment. Recent legislative action has further refined the […]

Washington, D.C. – As the “One, Big, Beautiful” (OBBB) reconciliation bills move through Congress, lawmakers are proposing a […]

The Senate Finance Committee has released its draft bill, proposing significant and largely permanent changes to U.S. international […]

The House-passed tax bill proposes three significant Section 199A Deduction Changes aimed at making the deduction permanent and, […]

The world of finance, much like a vibrant ecosystem, is constantly evolving, with new regulations and policies emerging […]

Ah, tax season! For many, it conjures images of overflowing shoeboxes, late-night number crunching, and a gnawing sense […]