A recent editorial in The Wall Street Journal criticized the CTC component of the Wyden-Smith tax legislation, referencing data from a recent study by the American Enterprise Institute. According to this study, certain aspects of the CTC proposal could lead to hundreds of thousands of parents exiting the workforce, potentially counteracting the economic advantages of others who may enter the workforce due to changes in the program, as well as the benefits of reducing poverty among the most disadvantaged families.

Upon closer examination, it becomes evident that the issue is multifaceted, as the bill also aims to bolster the CTC’s incentives for employment.

Differing incentives

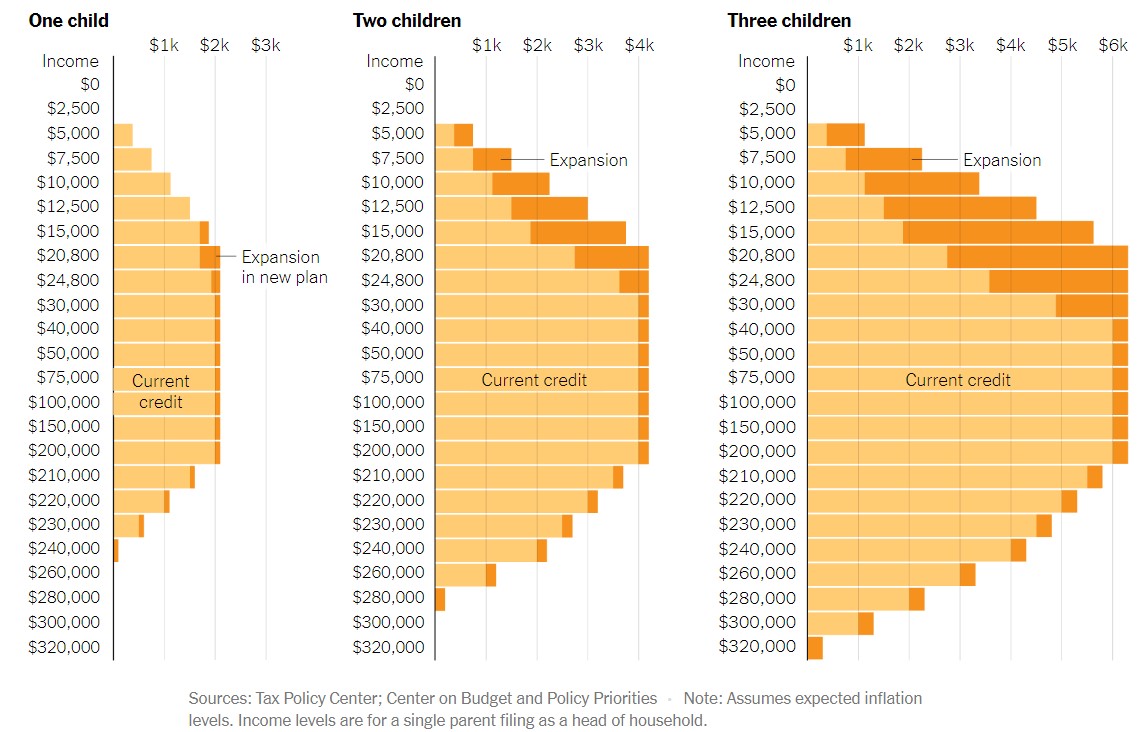

Under the existing Child Tax Credit (CTC) system, families can claim a tax break of up to $2,000 per child, with a portion of up to $1,600 potentially refundable beyond any taxes owed. The refundable segment of the credit initiates at a 15-percent rate for every dollar earned above $2,500 annually.

The Wyden-Smith proposal maintains the $2,500 income threshold for eligibility but aims to gradually expand the maximum refundable credit. By 2025, this adjustment would enable more low-income families to receive the full credit as a tax refund.

Furthermore, the bill proposes a faster phase-in of the credit for families with multiple eligible children: 30 percent for two children, 45 percent for three, and so forth. This stands in contrast to the current system, where the credit phases in at the same rate for all households, irrespective of family size. Consequently, the existing structure fails to adequately address the heightened expenses associated with raising multiple children for some low-income families.

A visual comparison between the current credit phase-in and the Wyden-Smith proposal.

Research on the Earned Income Tax Credit (EITC) suggests that the accelerated phase-in of the Child Tax Credit (CTC) would heighten the incentive to work, as the tax benefit would incrementally rise with each additional dollar earned by larger families. Economists Hilary Hoynes, Jesse Rothstein, and Krista Ruffini highlight substantial evidence indicating that the EITC effectively boosts labor force participation, particularly among women with limited education and workers with multiple children.

Additionally, the Wyden-Smith proposal introduces the option for taxpayers, beginning in 2024, to utilize the prior year’s income to determine their benefits during tax filing. While an American Enterprise Institute (AEI) study suggests this “lookback” provision might lead to approximately 700,000 individuals exiting the workforce every other year (projecting an average annual net loss of 150,000 workers), such outcomes are deemed highly improbable.

For instance, a family with three children and an income of $20,000 could potentially work in 2024 and then cease employment entirely in 2025 while still receiving identical CTC benefits. However, foregoing a year of employment would result in the loss of EITC benefits (roughly $4,000 for a one-child family or $7,500 for a family with three or more children), alongside forfeiting labor income.

Moreover, the lookback provision itself could incentivize work for certain households, as observed by AEI’s Kyle Pomerleau. If a taxpayer remains unemployed in the first year, returning to work in the second year would yield two years of benefits under the Wyden-Smith framework, rendering employment more advantageous compared to existing legislation.

Many lower-income households experience income volatility, complicating forecasts regarding changes in their tax benefits. Work-related decisions for these families are further influenced by various factors, including the need to care for children.

A recent economic analysis by the Joint Committee on Taxation forecasts minimal overall impact from the Wyden-Smith tax bill. It suggests that while the CTC expansion would, on balance, increase labor supply, the rise in after-tax incomes for households would generate a modest counteractive effect, slightly reducing labor supply. Consequently, the Joint Committee staff estimates that the aggregate increase in effective labor supply relative to the baseline forecast is insubstantial.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.