2026 State of the Union: 5 Key Fiscal Facts

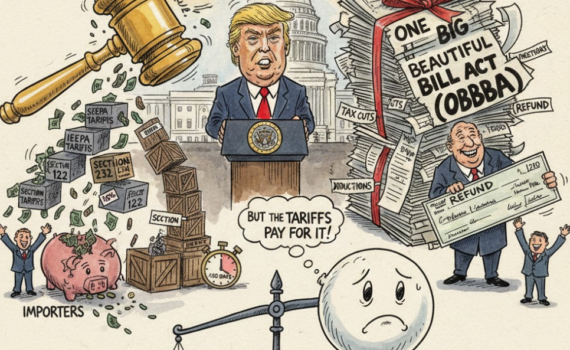

Tonight, President Trump delivers his first official State of the Union address of his second term. While his […]

Tonight, President Trump delivers his first official State of the Union address of his second term. While his […]

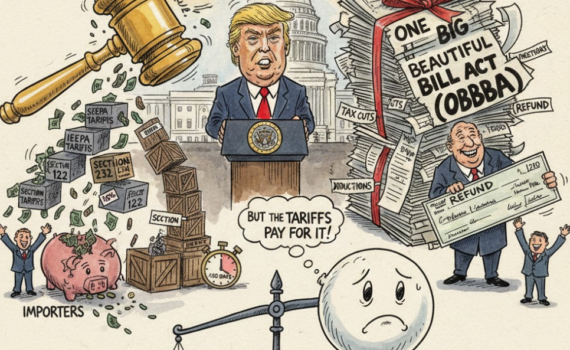

As governments scramble for revenue to fund aging populations and infrastructure, some are pivoting toward “big picture” global […]

As Chile prepares to inaugurate President José Antonio Kast on March 11, 2026, the national conversation has centered […]

Fixed-rate excise taxes are frequently implemented to lower consumption or steer the public away from harmful habits. However, […]

The Chicago Bears, a cornerstone of the NFL since 1921, are signaling that their century-long tenure in the […]

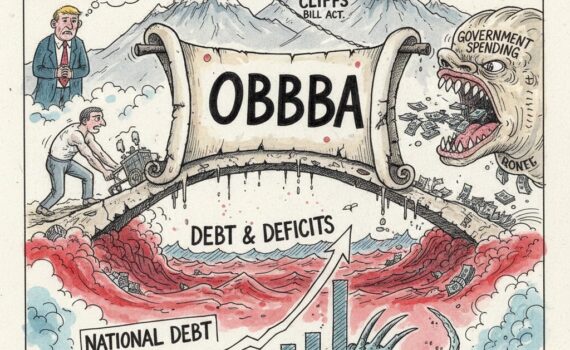

The One Big Beautiful Bill Act (OBBBA), the sixth-largest tax cut since 1940, is projected to increase U.S. […]

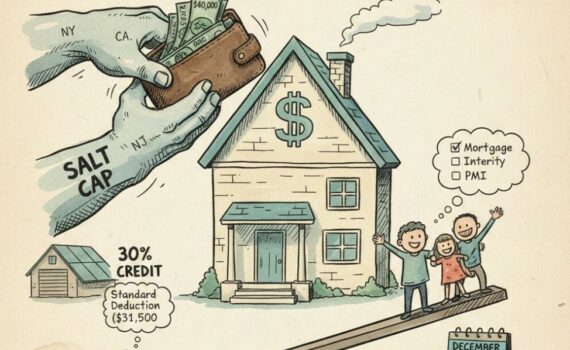

The 2025 tax year is turning out to be a pivotal one, especially for homeowners and high-income earners. […]

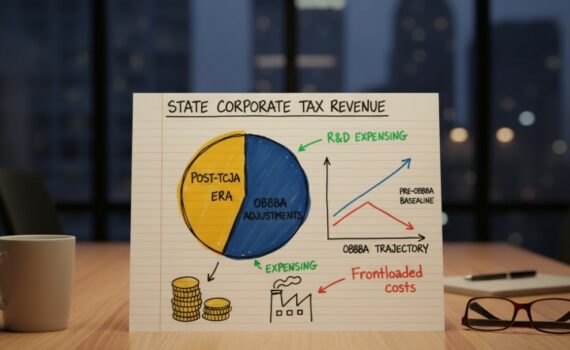

Some state lawmakers are considering decoupling from the business expensing provisions in the One Big Beautiful Bill Act […]

The Tax Foundation’s State Tax Competitiveness Index is more than a list of which states collect the most […]