Beat the Rush: Skip the IRS Phone Lines This Presidents ...

The IRS is alerting taxpayers that Presidents’ Day week (starting Feb. 16, 2026) is historically the busiest time […]

The IRS is alerting taxpayers that Presidents’ Day week (starting Feb. 16, 2026) is historically the busiest time […]

The tax landscape is ever-changing, and as we look ahead to 2026, several key areas deserve your attention. […]

As Americans prepare to file their 2025 tax returns this spring, many are in for a pleasant surprise. […]

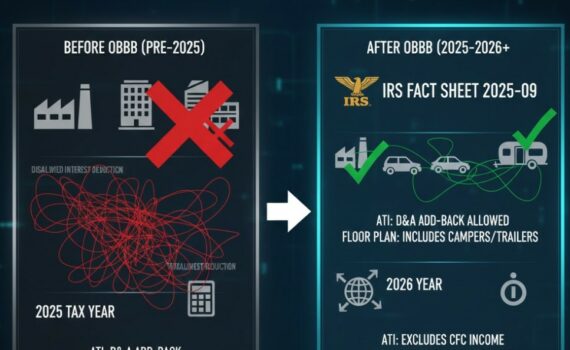

The Treasury Department and the IRS have released official guidance regarding the “No Tax on Car Loan Interest” […]

The Internal Revenue Service has released updated frequently asked questions (FAQs) in Fact Sheet 2025-09, outlining significant changes […]

The Internal Revenue Service has released the optional standard mileage rates for 2026. These rates, used to calculate […]

The Internal Revenue Service (IRS) has announced significant increases in retirement savings limits for the 2026 tax year, […]

The Department of the Treasury and the Internal Revenue Service (IRS) have issued Notice 2025-69 to clarify new […]

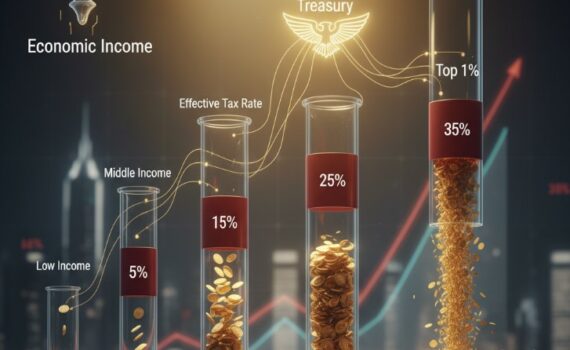

Despite claims that the wealthy pay lower effective tax rates (ETRs) than other Americans, a new analysis of […]