House Budget Resolution: Balancing Tax Cuts and Spending Reductions

House Budget Resolution: Balancing Tax Cuts and Spending Reductions The House Budget Committee has unveiled a budget resolution […]

House Budget Resolution: Balancing Tax Cuts and Spending Reductions The House Budget Committee has unveiled a budget resolution […]

New Jersey and Utah are the latest states to consider revising their economic nexus policies, which dictate when […]

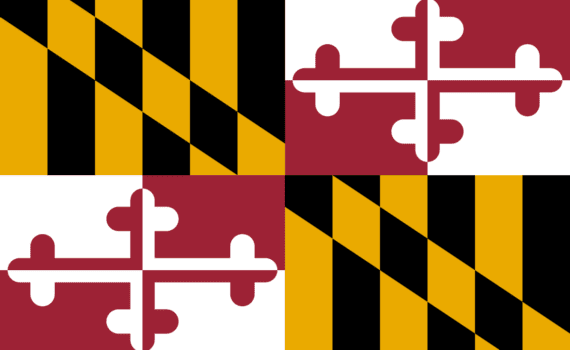

Maryland Governor Wes Moore has proposed a $1 billion tax increase package to address the state’s chronic budget […]

The past few years have witnessed a remarkable shift in state income tax policy, with a surge of […]

The new year is upon us, and with it comes a fresh start for everyone, including the Internal […]

The IRS’s annual Priority Guidance Plan (PGP) provides a roadmap of key areas for the Treasury and the […]

Drop shipping is a popular business model for online sellers. It allows them to sell products without having […]

Sales tax is a complex issue for online sellers, especially when it comes to returns. In this blog […]

Louisiana has made significant strides in tax reform, adopting a pro-growth tax package during a special session. This […]