The “Jock Tax” and the Multi-State Maze: Navigating U.S. Taxes ...

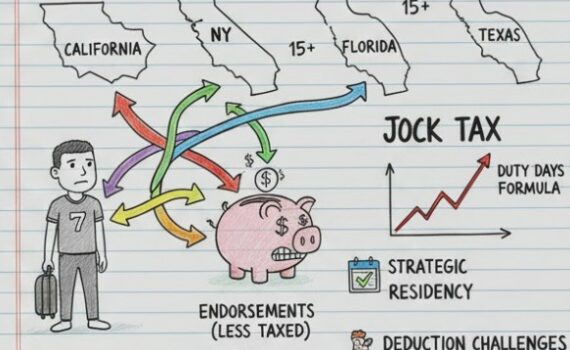

For professional athletes in the United States, signing a multi-million-dollar contract is only the first step. The second, […]

For professional athletes in the United States, signing a multi-million-dollar contract is only the first step. The second, […]

Ah, tax season! For many, it conjures images of overflowing shoeboxes, late-night number crunching, and a gnawing sense […]

With Congress currently focused on business investment incentives, a critical area for boosting economic growth lies in how […]

The past few years have witnessed a remarkable shift in state income tax policy, with a surge of […]

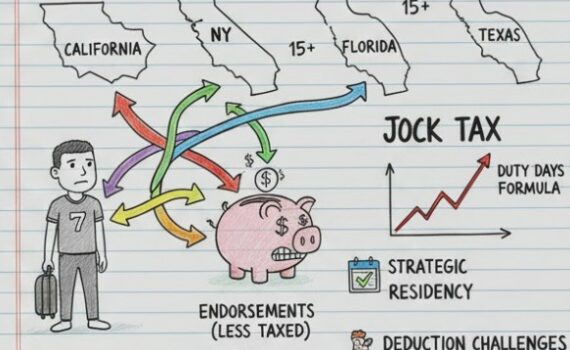

New York State is renowned for its high cost of living, and a significant portion of that cost […]

The U.S. tax system imposes a unique burden on its citizens living abroad. Unlike most developed nations, the […]

Selling a home, especially if you’re planning to relocate abroad, can be a complex process. This complexity is […]

Utah’s unique tax structure, heavily reliant on earmarking, is facing a potential overhaul. A proposed constitutional amendment on […]

If you live in an area impacted by natural disasters in 2023, you may be eligible for an […]