Remote work offers numerous benefits, but navigating the tax implications can be daunting.

In the past year, a considerable portion of full-time workers in the United States embraced remote work, with 13% exclusively working from home and 28% adopting a hybrid model. A significant subset of these individuals performed their duties from a state different from their employer’s location. This scenario presents a challenge for millions of Americans during tax season, as they grapple with intricate income tax scenarios, potentially encountering instances of double taxation.

Where Is Income Taxed?

Typically, income is subject to taxation based on where you reside and where you work. When these locations coincide, such as with both remote and in-person workers, taxation occurs in that state. However, an exception exists (discussed below). Conversely, if you live and work in separate states—for example, residing in New Jersey while working in New York—you might face taxation in both jurisdictions.

Fortunately, states with income taxes provide a credit for taxes paid to another state. Yet, this credit cannot exceed the tax liability in your home state. Consequently, while double taxation is avoided, if the secondary state imposes higher income tax rates, your overall tax burden might increase compared to working solely within your home state.

Double Tax?

Five states enforce the “convenience of the employer” rule, which taxes individuals based on their employer’s office location, even if they work remotely and never physically enter the state. These states include Connecticut, Delaware, Nebraska, New York, and Pennsylvania, each with its own specific regulations regarding this rule.

Under this rule, if your employer is situated in one of these states, but you choose to work remotely elsewhere for your convenience rather than because your employer mandates it, you could potentially be subject to income taxation in both the state where you reside and work, as well as the state where your employer is headquartered, without receiving an offsetting tax credit.

For instance, consider a scenario where your employer is headquartered in New York, but you work remotely from California. As you both live and work in California, the state expects you to pay taxes on the income earned there. However, due to New York’s convenience rule, you are also liable for taxes on the income earned through your New York-based employer. Consequently, you would be obligated to pay income taxes to both California and New York.

What If You Commute across State Lines?

Tax season can be a headache for hybrid or in-office workers who commute across state lines. While residing in one state and working exclusively in another entails filing two income tax returns and receiving a credit, dividing workdays between different states means owing taxes proportionate to the time worked in each state, leading to complex calculations.

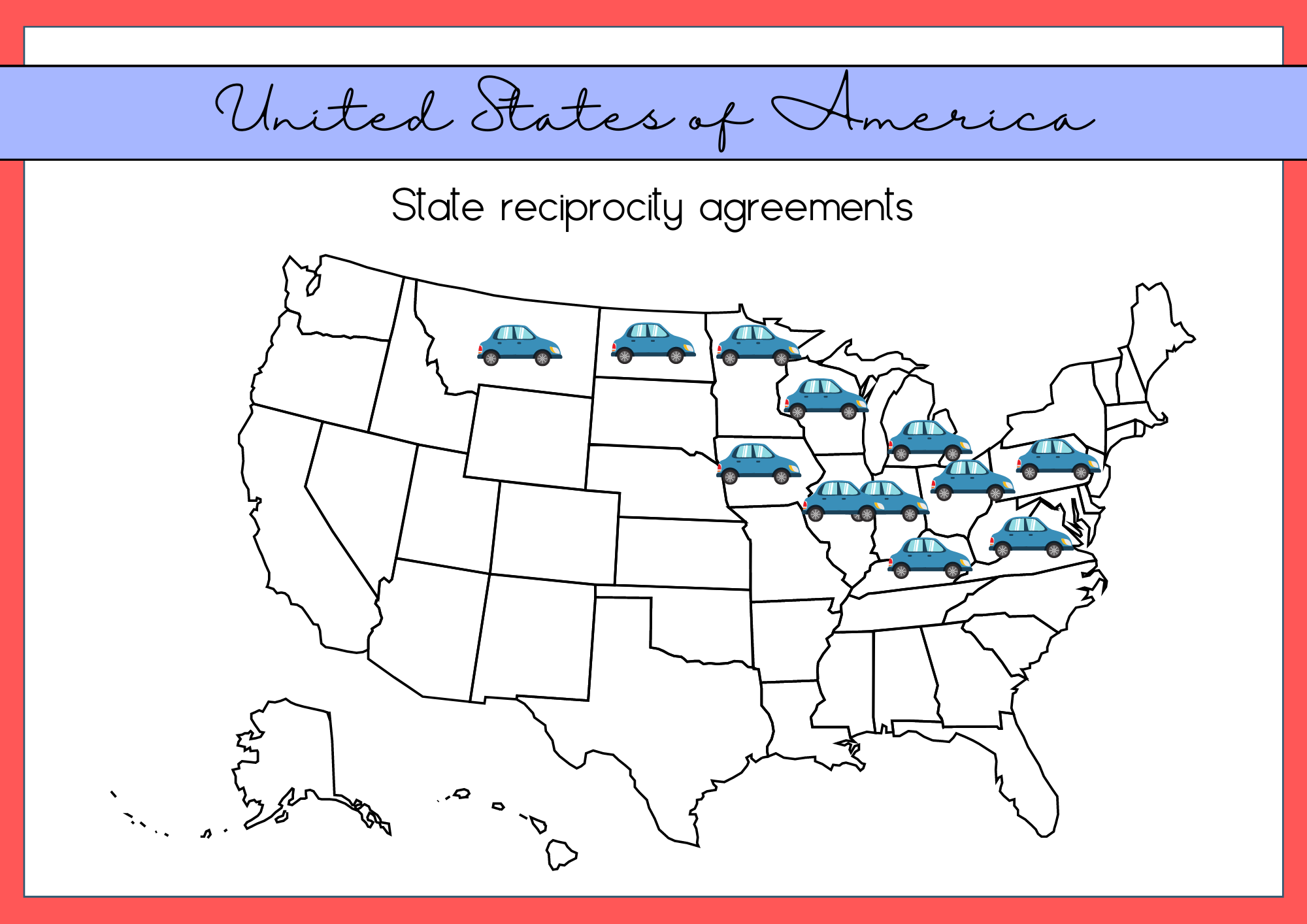

Fortunately, there’s a remedy in the form of state reciprocity agreements. These agreements involve neighboring states mutually deciding to tax cross-border workers only in the states where they reside. Currently, there are 30 such reciprocal agreements spanning across 16 states and the District of Columbia.

Reciprocity agreements offer benefits not only to workers but also to the states involved. Higher-tax states can retain job opportunities, while lower-tax states can attract residents. Additionally, both states benefit from simplified administration and reduced compliance costs for taxpayers.

As remote and hybrid work arrangements continue to shape the modern U.S. economy, state policymakers must adapt their tax codes accordingly. By embracing these changes, states can better align with the evolving nature of work and support both their residents and economic growth.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.