An IRS Demand Letter is a notice from the IRS stating that you owe them a certain amount of money from back taxes. Either you were not able to pay the full amount or you haven’t made a payment at all. Receiving a demand letter is the first step that the IRS makes during the collection process. When the payment hasn’t been made, it may lead to the levy of assets or garnishment of wages. The IRS will not stop collecting until the debt has been settled or it has expired.

Types of IRS Demand Letters

The IRS issues different types of demand letters and notices. Here we have listed the most commonly encountered ones.

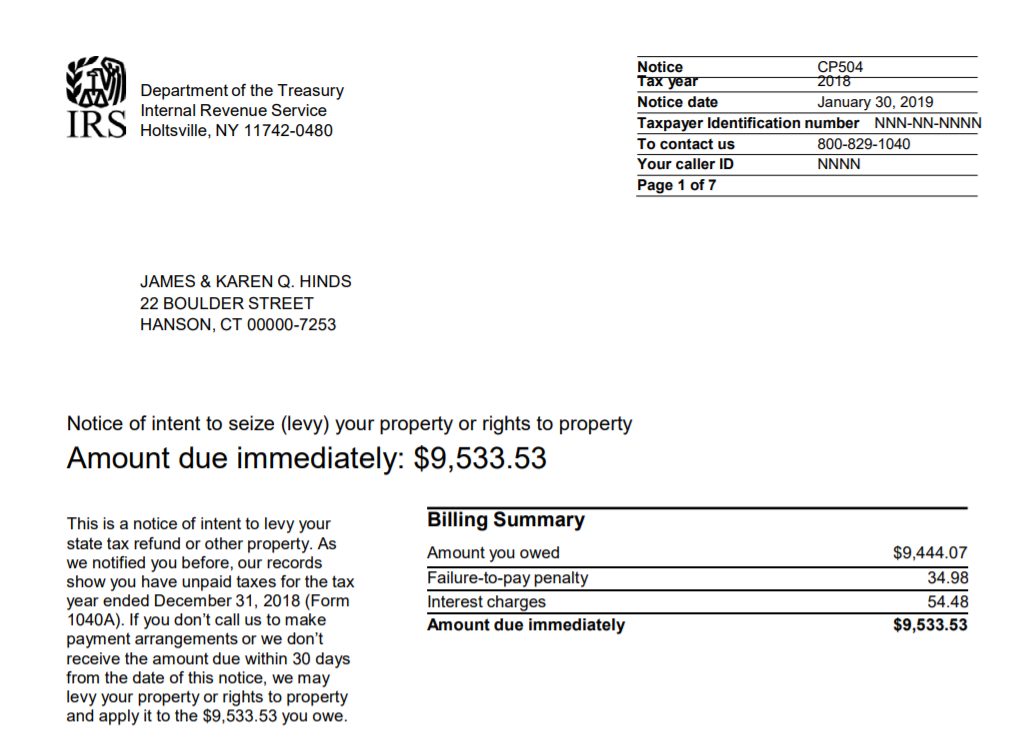

CP504 – Notice of Intent to Levy

The CP504 is probably a lot are familiar with since it’s received by taxpayers with unpaid taxes. It is basically a notice that the IRS intends to levy your assets if you fail to settle your tax debt. The IRS usually levies bank accounts and wages since these are easier to levy. They can also target insurance policies, pension, and your property. Here you may find an example of a CP504.

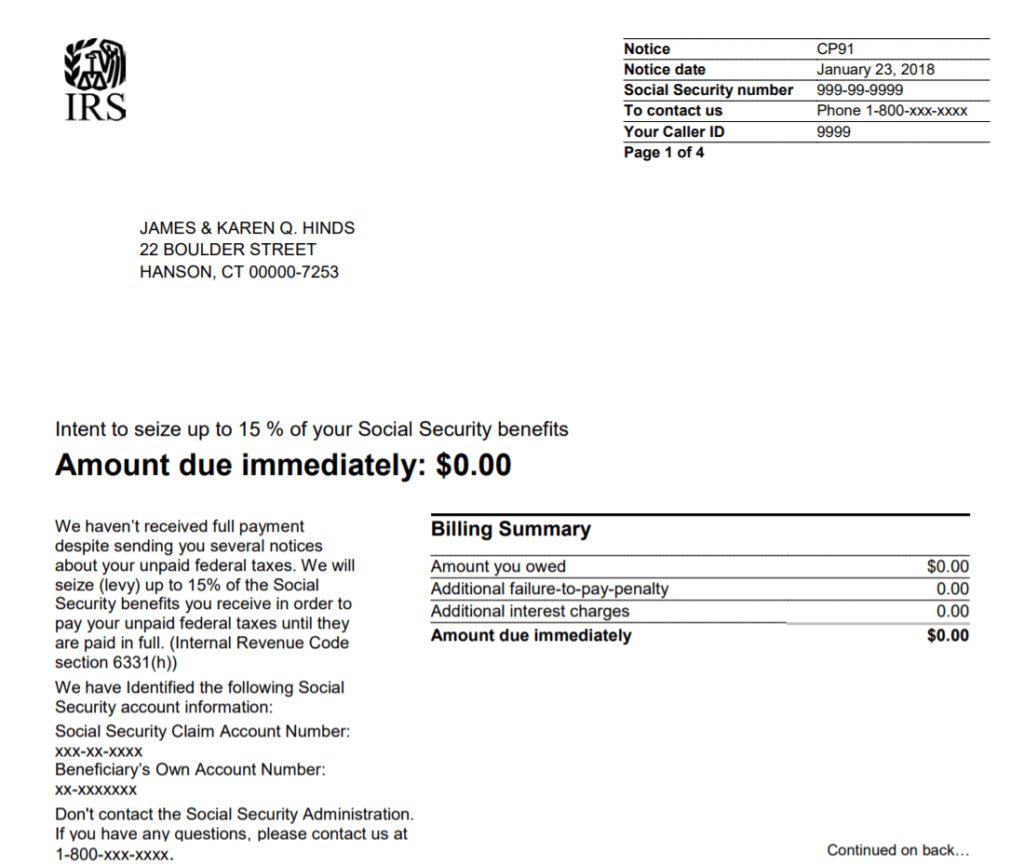

CP91 – Intent to Levy on Social Security Benefits

If you receive a CP91 notice from the IRS, they are notifying you that if you don’t settle your unpaid taxes, they can take up to 15% of your social security benefits. The time frame for this is 30 days until they can finally levy your social security. Before you receive a CP91, the IRS will be sending you a few letters first regarding the unpaid taxes. Here is a sample of a CP91 for reference.

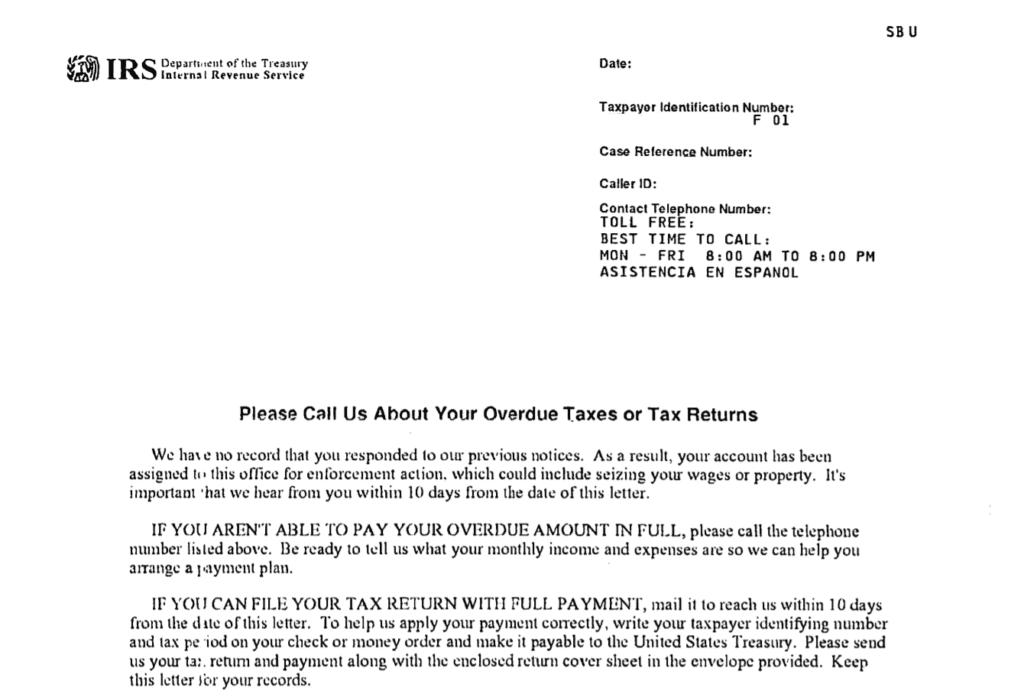

Letter 2050

A Letter 2050 from the IRS means that they are asking you to call them about any overdue taxes or tax returns. The letter includes a number of the IRS Collections that you can call back. If you receive a Letter 2050, most probably the IRS has already sent other notices to levy before such as a CP504.

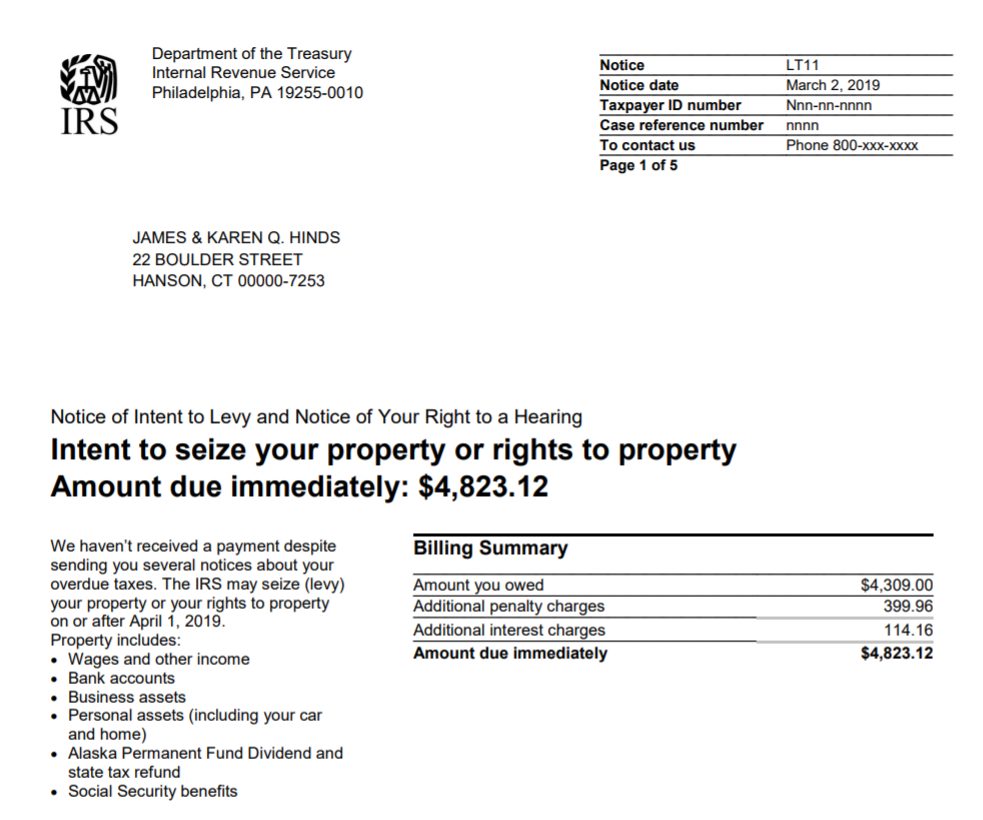

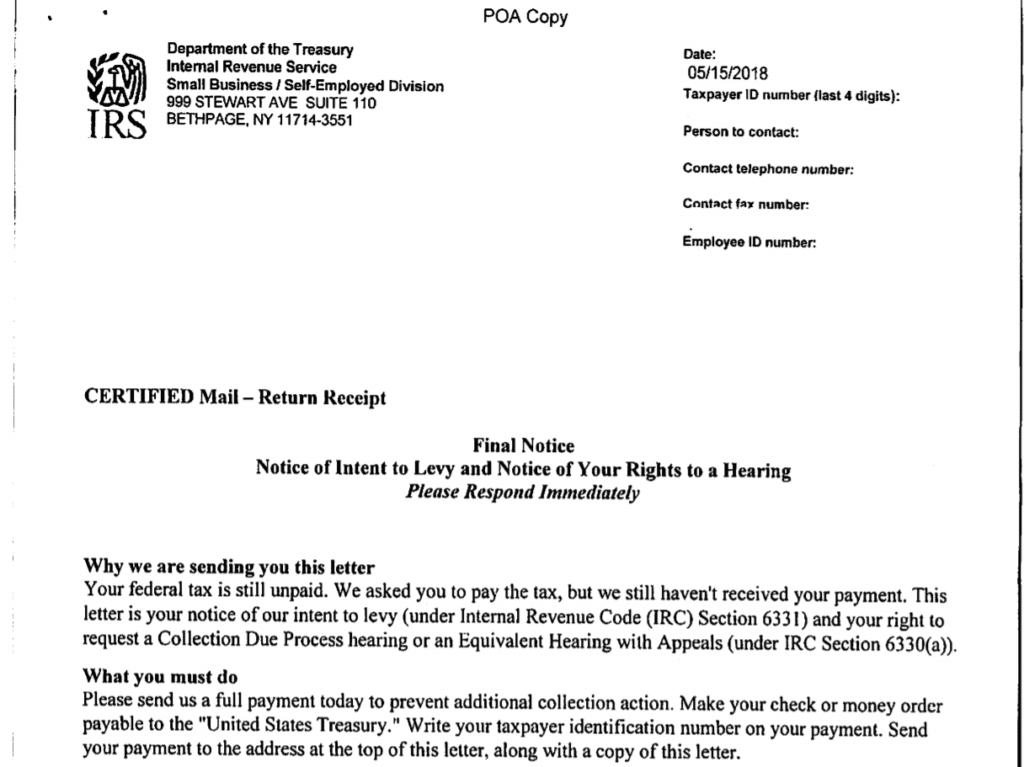

LT-11 Notice -Intent to Levy and Notice of Your Right to a Hearing

Getting a LT-11 means that the IRS intends to levy your property or rights to property. It is also similar to a CP504. You are given 30 days before they can take any action. The IRS can take away wages, your bank account, personal and business assets, and pension benefits. In addition to that, they can also deny your US passport. If you have trouble paying your overdue taxes, you may ask to set up an installation plan provided that you owe less than $50,000. Here’s what an LT-11 Notice looks like.

IRS Letter 1058

An IRS Letter 1058 is a type of letter given as a final notice to levy your assets or property. They can levy your bank account, wages, or pension. The letter also explains that if you do not agree with their intention to levy, you have the right to file for an appeal within 30 days. If you would like to request for an Appeals hearing, you need to file a Form 12153 which is a Request for a Collection Due Processing Hearing.

What an IRS Demand Letter Contains

A demand letter from the IRS usually has the following:

Amount due

This is the full amount of tax you need to pay plus additional penalties and interest that have accrued for past due taxes. You can find these outlined in the billing summary of the letter.

Deadline of payment

Make the payment before the set deadline for the IRS to stop making further collection activity.

Billing Details

This section contains the breakdown of what you owe, including the amount owed for each tax period, the penalty and interest.

Warning

In the letter, the IRS states that failure to make a payment may result to levy of assets. They will also indicate how long it would it take before they can start making collections.

Contact Information

The letter will have contact information on the office that issued it.

Resolving your tax debt, how to respond to the IRS demand letters

The easiest way to resolve it is to hire someone to complete a response for you. You can also respond yourself. If you already received a final notice of intent to levy, it’s often better to call and do your resolution over the phone.

When there is a lot of extra paperwork requested the IRS may ask for it to be mailed and then give another follow up date or tell you or your representative to wait for a response in the mail.

Your options to resolve the tax debt and stop the demand letters

The main ways to resolve a tax debt are:

- Pay it off in full

- Payment Plan

- Currently Not Collectible

- Offer In Compromise

The first two are pretty simple as long as you owe less than $50,000 since the IRS will take a payment plan spread out over 72 months. It’s simple if you can afford the monthly payment. If not, Currently Not Collectible and Offer In Compromise are your best options.

Don’t want to handle it yourself? Drop us a line at our Contact page or call us at (888) 515-4829.