Removing an NYS Tax Lien requires a resolution

Once a tax warrant is issued and a lien is placed on the property, the tax needs to be completely paid in order to come off. Now there are a few ways that may have you paying less than the actual debt, but here are the most common options:

- Pay in full – Pay the debt off and the liens come off.

- Payment Plan – Once paid in full, the liens will be released.

- Offer In Compromise – Debt is settled for less than you owe. Hard to get if you have valuable property though. Once the terms of the Offer are complete NYS tax liens will be released. NYS Offer In Compromise is often tougher to get accepted than the IRS, but it depends on the case.

- Tax debt expires – NYS generally has 20 years to collect on a tax debt. The IRS has 10 years. See our page on expiring tax debts for more information on tax debts expiring.

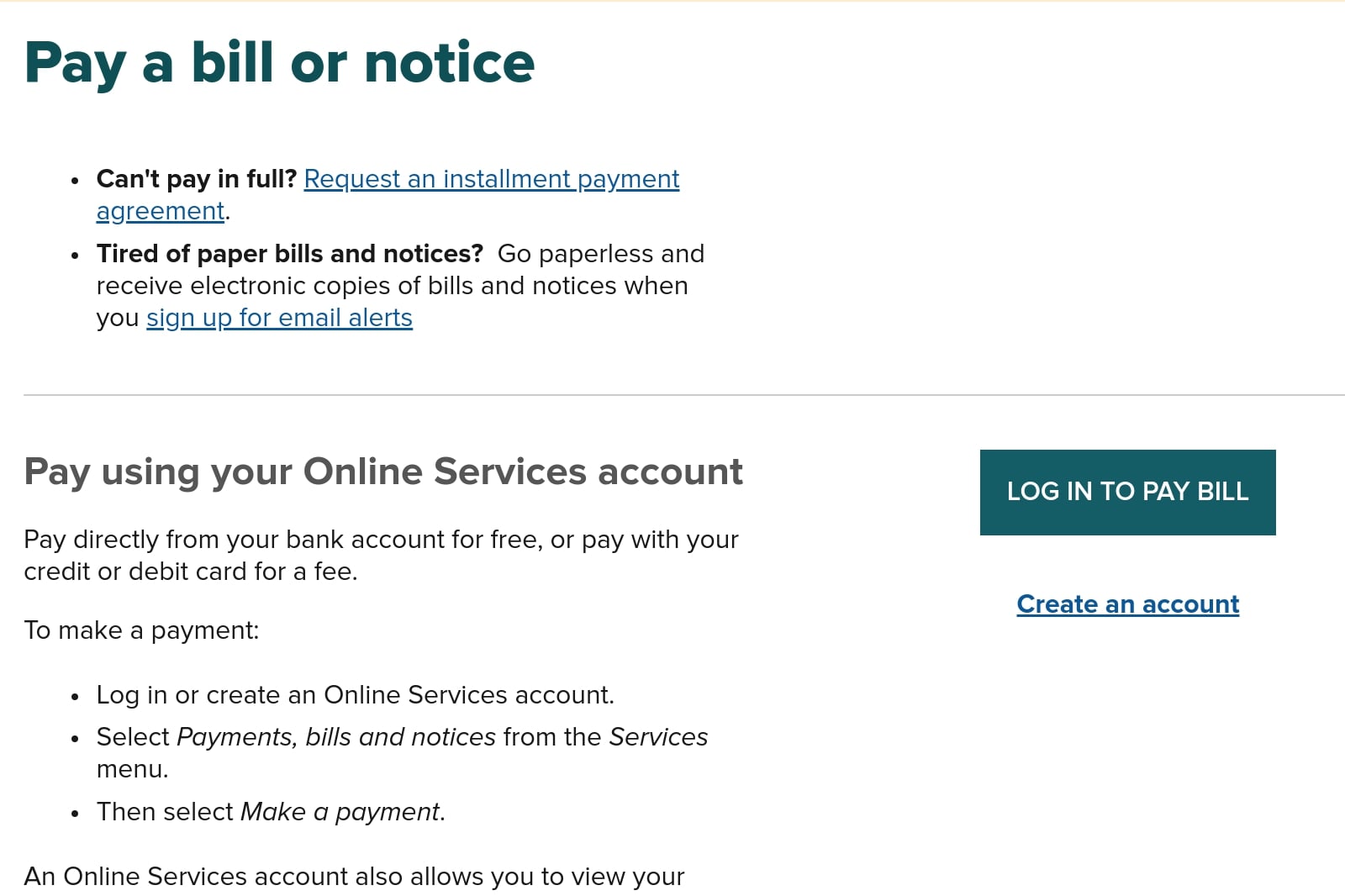

Below is what the NYS tax payment page looks like.

A cutout of the NYS tax payment page.

You might qualify for a penalty abatement if you pay it in full or are in a payment plan. These can be difficult to get and you may want to have a tax attorney evaluate your eligibility. They have an option to use an online services account and another option called Quick Pay, not to be confused with Chase QuickPay.

Selling a property with an NYS tax lien

The debt must be paid in full with guaranteed funds to release the lien. The state then issues a Notice of Pending Warrant Satisfaction. Most title companies will accept this as proof the lien will be removed.

Some notes on New York Sales Tax, Payroll Tax and personally filed liens

Sales tax and Payroll tax are treated as “trust fund tax” in New York State. They treat the funds as if you were holding it on behalf of the government and personally assess the debt on responsible parties. These taxes are “paid to you” instead of withheld by you for your own tax due. Many people call us surprised that they have tax liens for tax debts from a business. They thought since it was a corporation or LLC they would be protected. Not when it comes to sales tax and payroll tax.

Getting help with NYS tax lien removal

To get help with your NYS tax issue go to our Contact page or call us at (888) 515-4829. Got an IRS lien too? Check out our guide on IRS lien withdrawal or have us do it for you. Although our office is based in Las Vegas, we have handled more NYS tax cases than most NY tax attorneys.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

However, a SERM (such as Nolvadex) significantly reduces the possibilities of gynecomastia forming, in our expertise.

300 mg/week of testosterone (enanthate), when taken for

20 weeks, brought on HDL levels to drop by just 13%.

Secondly, testosterone doesn’t cross through the liver,

thus failing to stimulate hepatic lipase, an enzyme that may skew

cholesterol levels in the incorrect course. Testosterone poses little to no hepatic

concern (liver stress) as a outcome of it being injectable and thus entering the bloodstream immediately, as an alternative of the

liver having to filter it.

To cut back inflammation with out steroids, dietary changes could also be helpful.

You can even try getting extra sleep in addition to decreasing

stress and other triggers. The means the center contracts and relaxes may change when you

take giant doses of steroids. Moreover, roughly three to four million Individuals use steroids to achieve muscle mass.

Data and training are fundamental tools for AAS misuse preventions.

As long as anabolic steroid misuse is well-liked amongst younger athletes, data campaigns relating to AASs

and other doping agents ought to be inspired in excessive faculties.

In this regard, to forestall using AASs public well being measures in all settings are crucial.

In sports, using performance-enhancing medication is against the law and has led to a fall from grace for some massive athletes.

It’s finest to concentrate on sustainable, healthy methods to

build muscle and stay match. You’ll also stop the attainable bodily and psychological harm of counting on synthetic

substances to attain the level of fitness you need in the process.

From an moral perspective, using steroids for performance enhancement is taken into account cheating in most sports activities.

Other signs could embody facial flushing, insomnia

and excessive blood sugar. Well Being care suppliers usually restrict corticosteroid injections to

3 or 4 a year, depending on each person’s situation. When prescribed in sure doses, corticosteroids help scale back irritation. This can ease

signs of inflammatory conditions, similar to arthritis, asthma and

pores and skin rashes. Weightlifters exposed to AASs had lower cognitive capabilities, corresponding to motor and government efficiency, in comparability

with nonexposed subjects [43]. Furthermore, one other imaging study showed markedly elevated proper amygdala volumes; markedly decreased right

amygdala and reduced dACCgln/glu and scyllo-inositol levels in comparison with

nonusers [45].

Oral steroids are a preferred alternative for those trying to improve

their efficiency and physique. These steroids are simple to manage and provide fast outcomes, making them ideal

for people with busy lifestyles. When used responsibly, oral steroids may help improve power, endurance,

and muscle mass. They are notably helpful for those undergoing intense training regimens, as they assist in sooner recovery and

reduce muscle fatigue. The time period steroids cartel often carries a

unfavorable connotation, but it’s necessary to recognize the optimistic role that respected suppliers

play in the fitness neighborhood.

ChoicePoint aims to enhance the quality of life for

individuals struggling with substance use disorder and psychological health issues.

Our staff of licensed medical professionals analysis, edit

and evaluate the content material earlier than publishing.

Nevertheless, this info is not supposed to be an alternative to professional medical advice,

analysis, or remedy. For medical advice please consult your physicians or ChoicePoint’s qualified employees.

Most medical doctors recommend limiting alcohol throughout testosterone substitute therapy.

Persevering With to drink can undermine the effectiveness of the therapy, potentially reducing blood levels

of alcohol. Corticosteroids corresponding to prednisone

are used to deal with a wide variety of well being problems.

Side results can rely upon the type of corticosteroid,

corresponding to inhaled or topical. Typically, a dose above forty mg per day could also be considered a excessive dose of steroids.

However, it’s necessary to notice that people respond in one other way to

the drug, and “high dosages” might differ relying on the particular person. One of the side effects of Prednisone and dexamethasone is disruption of blood

sugar levels. They trigger an increase in sugar by making body cells less

conscious of the sugar. TNZ has performed industry sponsored research involving creatine supplementation and has acquired research funding

from industry sponsors associated to sports

activities vitamin merchandise and elements.

In many locations, including the Usa, anabolic steroids are categorised as managed substances

and are illegal and not using a prescription. Using steroids and not utilizing a

prescription can lead to authorized penalties.

Some athletes take countries where steroids are legal within the hopes that they may

help them run faster, hit farther, lift heavier weights, leap higher, or have more endurance.

In the Usa, it’s in opposition to the regulation to make use

of anabolic steroids without a prescription. Nevertheless,

this only applies to a select variety of anabolic steroids which are FDA-approved and used medicinally (such

as testosterone, Deca Durabolin, and Anadrol). Different anabolic steroids usually

are not permitted or prescribed as a outcome of excessive ranges of toxicity.

The study that got everyone’s attention was conducted by Syrov, V.

N., in 2000.

Bile duct injury is typically absent or delicate and vanishing bile duct syndrome hardly

ever ensues. The frequency of acute cholestasis from androgenic steroids is not

well known, but it’s likely considerably dose related and should happen in ~1% of patients handled with methyltestosterone,

danazol, stanozolol or oxymetholone. Cholestasis has not been described in patients receiving unmodified testosterone (by injection or transdermal patch).

Throughout this process, estrogen levels rise, causing water retention in customers.

This hormonal shift usually decreases muscle definition whereas rising the chance of bloating and gynecomastia.

Thus, controlling estrogen levels is critical for

delicate users to prevent the buildup of feminine breast tissue.

Seek The Guidance Of your healthcare provider if you have questions

or concerns about your prednisone dose and size of therapy.

Call your healthcare provider immediately when you have critical unwanted facet effects.

Conversely, call 911 in case your signs feel life-threatening or

should you assume you have a medical emergency. One such in style steroid medication is prednisone, a drug used to decrease symptoms of low corticosteroid levels.

A teen shouldn’t just go out and binge on protein, however, in an effort to achieve muscle

mass. Sure, the proper amount of protein is important, but overdosing on it only means it will be used for

energy or stored within the form of fats.

Protein is not a super-efficient power source,

both — carbohydrates are superior. Protein performs a big function in the body’s

capacity to placed on muscle, however only when mixed with a wise coaching routine.

As defined by the Academy of Vitamin and Dietetics,

dietary protein helps repair the fast muscle steroids (Rms-fulda.De) cells that break down during weight coaching.

Rheumatology was consulted and beneficial oral prednisone 40

mg twice daily till her follow-up in per week. No biopsy was warranted given the prior prognosis with

a pores and skin biopsy. Her rash was very gentle

and positioned solely on the bilateral lower extremities.

Classical male hypogonadism is when low testosterone ranges are as a end result of an underlying medical condition or injury to your testicles, pituitary gland or hypothalamus.

Lower-than-normal testosterone levels usually only cause signs in males.

Teenagers who work out with weights might cut back their threat of experiencing a sports activities harm,

explains Stanford Children’s Health.

Or the doctor may begin with 20 mg for two days and by Day three it could be

10 mg for two days, and then for the last day just 5 mg. The patient

was treated with intravenous (IV) methylprednisolone of 60 mg each eight

hours. Nephrology was consulted and decided that microscopic hematuria was

most probably glomerular in supply secondary to IgA involvement.

Prednisone, which is what the OP was referring to does not

turn deadly. But if years previous expiry, could not provide the full effectiveness you need.

But if you need prednisone and that is all you have, would nonetheless be higher than nothing.

Latest research have shown that corticosteroids have limited impact on long-term outcomes in IgA vasculitis,

however steroid-sparing brokers have potential for the remedy of recurrent steroid-dependent

IgA vasculitis. We current the case of a 19-year-old feminine patient with

recurrent steroid-dependent IgA vasculitis.

Anabolic steroids are synthetic (manmade) hormones that can enhance the physique’s capability to make muscle and forestall muscle breakdown. If

your signs are severe and you’ve got got difficulty breathing, chest pain, or

are hypertensive, you may have to name emergency companies and cease supplementation. If

symptoms are extra benign, consult your physician or

a medical skilled. We have seen clenbuterol

elevate patients’ coronary heart charges to perilous ranges, at over 120 beats per minute,

and cause cardiac hypertrophy.

This medicine could cause modifications in temper or habits for some sufferers.

Inform your physician right away if you have melancholy, mood swings, a false or unusual sense of

well-being, trouble with sleeping, or personality changes while using this drugs.

This medication could increase your threat

for most cancers, including Kaposi’s sarcoma. Tell your physician immediately in case you have flat, painless

spots that are pink or purple on white pores and skin or bluish, brownish, or

black on darkish skin. Do not take extra of it, don’t take it extra typically, and don’t take it for an extended time than your physician ordered.

Using this drugs with any of the next medicines is often not recommended, but may be required in some circumstances.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.