Mexico Proposes a World-Class Alcohol Tax

Mexico is on the verge of a significant alcohol tax reform. A proposed shift from the current price-based […]

Mexico is on the verge of a significant alcohol tax reform. A proposed shift from the current price-based […]

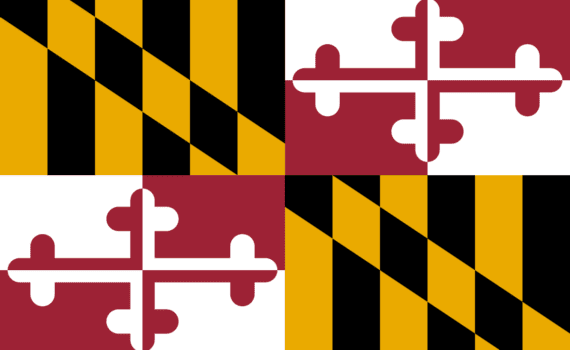

Maryland Governor Wes Moore has proposed a $1 billion tax increase package to address the state’s chronic budget […]

Las Vegas, the dazzling heart of Nevada, stands out in the American landscape for its unique tax structure: […]

The past few years have witnessed a remarkable shift in state income tax policy, with a surge of […]

The new year is upon us, and with it comes a fresh start for everyone, including the Internal […]

The IRS’s annual Priority Guidance Plan (PGP) provides a roadmap of key areas for the Treasury and the […]

Drop shipping is a popular business model for online sellers. It allows them to sell products without having […]

Sales tax is a complex issue for online sellers, especially when it comes to returns. In this blog […]

The Treasury Department and the Internal Revenue Service (IRS) have issued proposed regulations to modernize the rules governing […]