The EU’s Tax Policy: A Confusing Mix

Dr. Mosquera Valderrama describes the EU’s tax policy as “a little confusing,” citing the multitude of projects and […]

Dr. Mosquera Valderrama describes the EU’s tax policy as “a little confusing,” citing the multitude of projects and […]

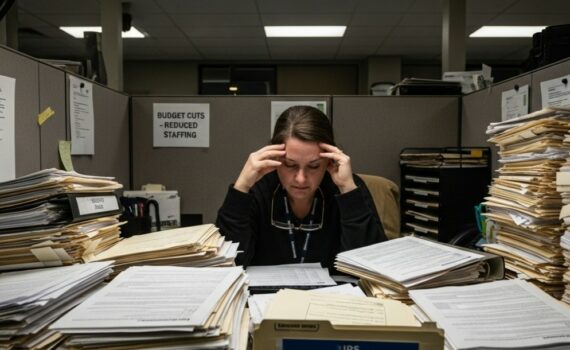

Identity theft victims are facing significant delays in receiving their tax refunds, with average wait times stretching to […]

The IRS terminated thousands of probationary employees early this year without following its own performance review policies, a […]

In recent years, the international community has been working to change global tax rules for multinational corporations. In […]

President Donald Trump has proposed a new policy that would impose tariffs of up to 250% on imported […]

In today’s digital age, many Americans are generating income through social media platforms. Whether it’s through sponsored posts […]

The UTPR is a key enforcement mechanism under the OECD’s Pillar Two framework, designed to prevent tax avoidance. […]

Taxes are often seen as a dry and mundane topic, but a look into America’s past reveals a […]

US businesses and consumers are feeling the pinch from higher costs on goods, largely due to the Trump […]