5

5 Elevating Tax Departments: The Power of Technology

Elevating Tax Departments: The Power of Technology Corporate tax departments are under immense pressure. A shrinking talent pool […]

5

5 Elevating Tax Departments: The Power of Technology Corporate tax departments are under immense pressure. A shrinking talent pool […]

The recent Republican victory in the U.S. presidential election, with Donald Trump returning to office, signals a major […]

1

1 What is Form 1098-T? IRS Form 1098-T is a document issued by your U.S. school to report the […]

10

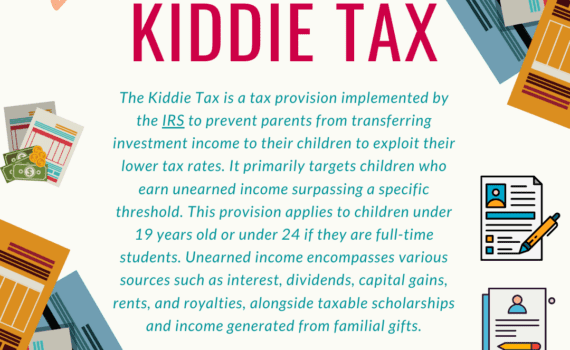

10 Understanding the complexities of taxation presents challenges for individuals across the board. Families with children encounter additional nuances […]

2

2 As any taxpaying veteran can tell you, dependents come in handy during tax season! They count as a […]

6

6 A CP 2000 is a letter from the IRS notifying you in the case where their figure of […]

1

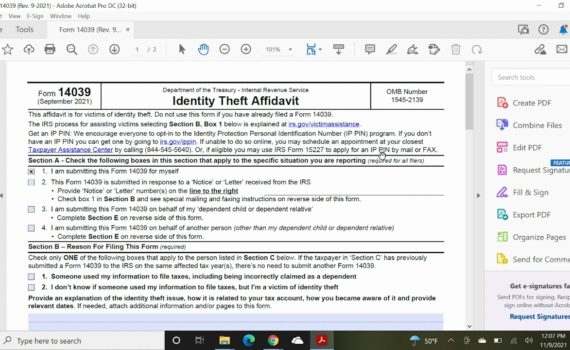

1 Identity Theft IRS Form - How To File IRS Identity Theft Affidavit Form 14039Watch this video on YouTube […]

23

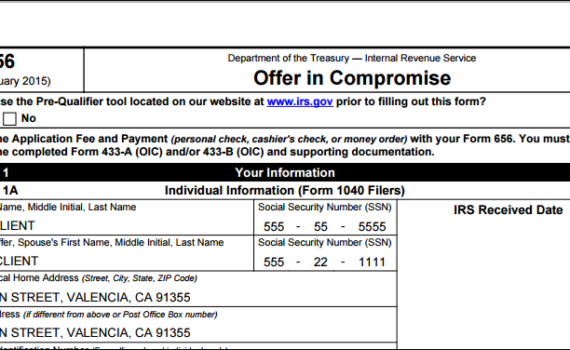

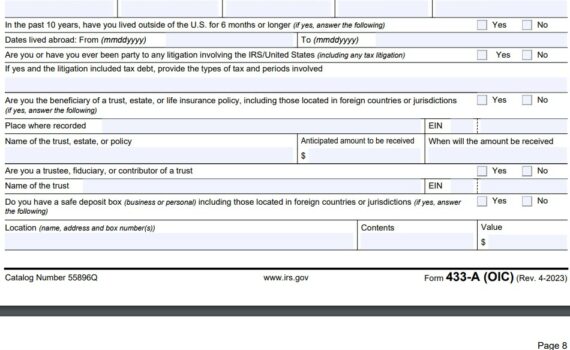

23 If you want to know how you can file for an Offer In Compromise, below you will learn […]

18

18 Form 656: Filling It Out This guide will explain how to fill out IRS Form 656 (Booklet|Form), which […]