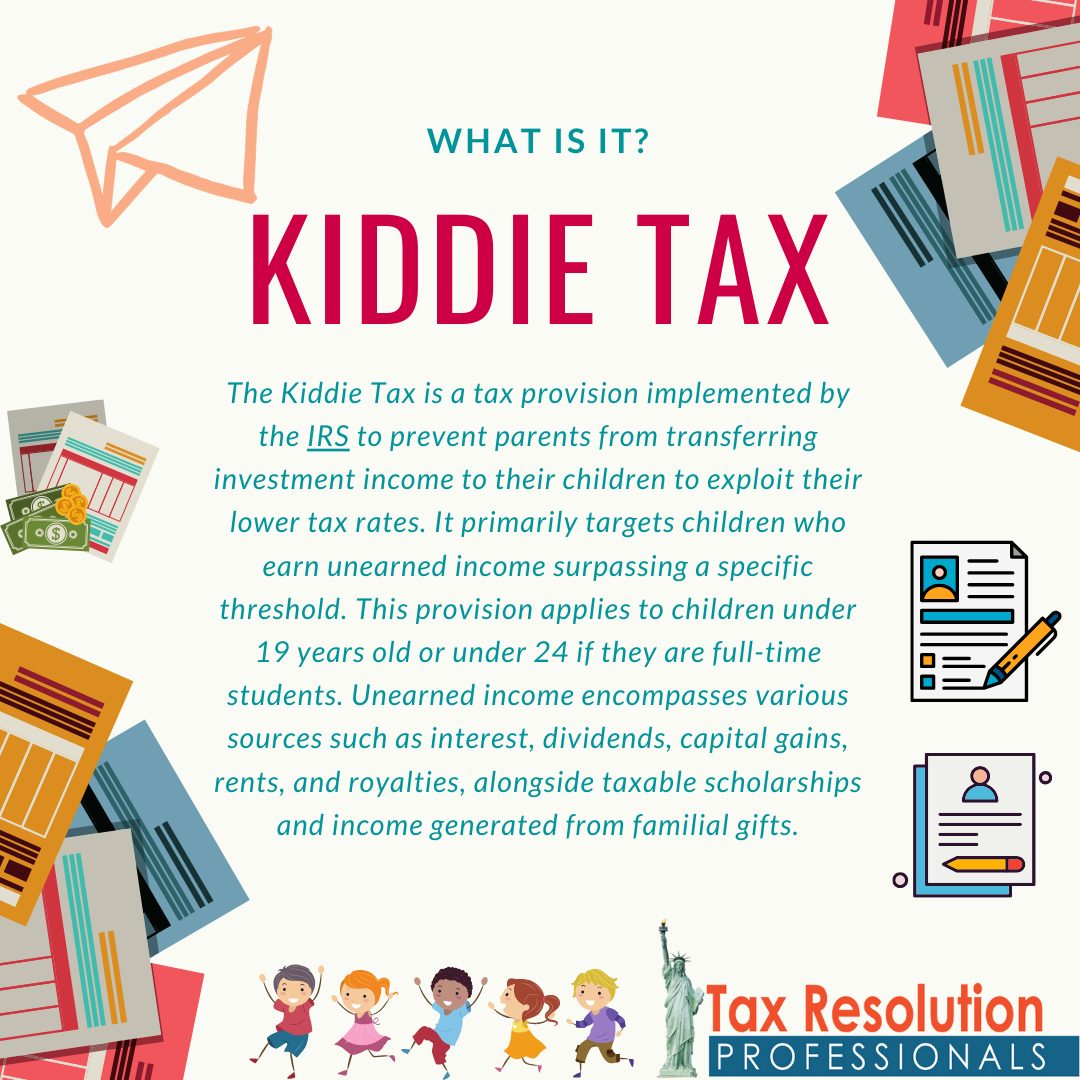

What is the Kiddie Tax?

The Kiddie Tax is a tax provision implemented by the IRS to prevent parents from transferring investment income to their children to exploit their lower tax rates. It primarily targets children who earn unearned income surpassing a specific threshold. This provision applies to children under 19 years old or under 24 if they are full-time students. Unearned income encompasses various sources such as interest, dividends, capital gains, rents, and royalties, alongside taxable scholarships and income generated from familial gifts.

Exemptions

Certain exemptions exist from the Kiddie Tax regulations, meaning not all children are subject to its provisions. A child will be exempt from the Kiddie Tax rules if they meet any of the following criteria:

- The child has no surviving parents by the end of the tax year.

- The child is married and has filed a joint tax return for the tax year.

- The child isn’t obligated to file a tax return for the tax year.

- The child is completely or permanently disabled.

- The child is emancipated.

How does it work?

The Kiddie Tax operates as follows: The initial $1,250 of a child’s unearned income remains untaxed. Subsequently, the subsequent $1,250 is subjected to the child’s tax rate of 10%. Furthermore, any income surpassing $2,500 is taxed at the higher of either the child’s tax rate or the tax rate of the parent or guardian. For instance, if a child’s unearned income amounts to $3,000, $500 would be subject to the Kiddie Tax. Notably, the threshold will increase to $2,600 for the tax year 2024.

In 2023, a child’s standard deduction is determined by the greater of $1,250 or the child’s earned income plus $400, provided they can be claimed as a dependent. This is because $1,250 serves as the standard deduction for dependents. In cases where the child cannot be claimed as a dependent, they typically utilize the standard deduction of a single filer, which amounts to $13,850 for the year 2023.

Examples

Here are some examples illustrating the application of the Kiddie Tax:

- Sarah receives $3,000 in dividend income from stocks held in a custodial account under her name. Given her parents’ marginal tax rate of 24%, under the Kiddie Tax rules, the portion of Sarah’s income exceeding the $2,500 threshold ($500) will be taxed at her parents’ tax rate.

- Let’s consider a family with two children, Jack and Jill. Jack, aged 17, earns $1,800 in interest income from savings bonds. Jill, aged 20, is a full-time college student who receives $3,500 in dividends from investments. Jack’s income will be taxed at his individual tax rate of 10%. However, Jill’s income will be subject to the Kiddie Tax, taxed at her parents’ tax rates.

- 17-year-old Mike is legally emancipated from his parents. He earns $5,000 in interest income from a savings account in his name. As the Kiddie Tax does not apply to emancipated individuals like Mike, his interest income will be taxed at his individual tax rate.

- Ana, aged 18, has a disability that meets certain IRS criteria. Despite her disability, Sarah receives $4,000 in dividends from investments. If Ana’s disability qualifies her for an exemption from the Kiddie Tax, her dividends may be taxed at her individual tax rate rather than the trust and estate tax rates.

Reporting the Kiddie Tax

Reporting the Kiddie Tax on your tax return involves several steps to ensure accurate compliance with IRS regulations. Here’s how to report it:

- Calculate the child’s unearned income for the tax year. This includes interest, dividends, capital gains, rents, royalties, and other passive income sources.

- If the child’s unearned income exceeds the threshold, apply the Kiddie Tax rates to the portion of income exceeding the threshold. For 2023, unearned income up to $2,500 is taxed at the child’s rate, while any amount over $2,500 is taxed at the parent or guardian’s tax rate, which can be significantly higher.

- If the Kiddie Tax applies, use IRS Form 8615, Tax for Certain Children Who Have Unearned Income. This form assists in determining the portion of the child’s unearned income subject to the Kiddie Tax and calculates the tax liability at the appropriate rate. Parents should attach this form to the child’s Form 1040. Alternatively, in some cases, parents can include the child’s income on their own return using Form 8814, Parent’s Election to Report Child’s Interest and Dividends.

Tax Help for everyone

For parents incorporating financial planning strategies involving their children’s investments, comprehending the Kiddie Tax is paramount. Although aimed at preventing tax evasion, its implications can greatly influence investment decisions’ tax aspects. Seeking advice from a tax advisor or financial planner is advisable to devise tax-efficient strategies coherent with overall financial objectives.

Disclaimer: This is not legal advice, consult an attorney for legal advice or contact us.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.

Greetings! I’ve been following your web sute for a while now aand finally got

the bravery to go ahead and giv you a shout out ftom Huffman Texas!

Just wanted to mention keep up the good job! http://boyarka-inform.com

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/join?ref=P9L9FQKY

Athletes often use it to stay explosive and powerful

whereas shedding weight. Moreover, it’s a fantastic

choice for these trying to keep away from excessive water retention or bloating, as it promotes

a clear, tight physique. Anavar, also known as Oxandrolone, is widely considered probably the greatest steroids for slicing.

It’s a favourite amongst beginners and seasoned athletes alike because of its delicate nature

and impressive results. Anavar works by increasing your body’s capacity to retain nitrogen, which is crucial for muscle

preservation throughout a calorie deficit. This means you’ll have the ability to burn fat whereas keeping your muscles full and powerful.

Still, providing constant effort is maintained, girls too, can construct stable

strength. 5a-reductase inhibitors can scale back the size of the prostate by 20–30% (2); however,

decreased fat loss and muscle building may also occur, with DHT

being a extremely anabolic hormone. Trenbolone which is known for

building lean muscle and burning fat provides one other layer of energy to the stack.

It takes the anabolic setting created by testosterone

and Dianabol to a different stage so that you get

more muscle progress with more definition. Dianabol

is an oral anabolic steroid that was first developed in the Fifties by Dr.

John Ziegler for the us It rapidly became in style because of its anabolic energy and talent to add speedy muscle features and energy in a

short time period.

Each health club has its fair proportion of individuals with giant chest and

biceps with skinny rooster legs hiding beneath those tactically long shorts.

The legs include the most important muscle groups in the physique, so it makes

sense to coach them if you would like to grow!

As reported by the users, Trenbolone additionally provides stimulating effect on the central

nervous system to trigger thermogenesis in the physique.

This can lead to opposed side effects similar to anxiousness, stress,

stressed sleep, elevated sweating and even paranoia in some circumstances.

Dianabol has some hard and serious cardiovascular and hepatic effects, which makes it not

a beneficial steroid for newbies. Instead, it is more suitable for intermediate and superior users to make

use of Dianabol for muscular energy, who have already skilled the use of

some milder steroid before, such as Testosterone. It’s best to focus on sustainable,

healthy ways to construct muscle and stay fit.

The false impression that Anadrol cycles are unsuitable for

girls could be attributed to bodybuilding’s lack of sensible data relating to steroids’ results on females.

This is due to steroids being less generally used

among ladies, resulting in less retelling of private experience

within the health neighborhood. Women may even experience noticeable lean muscle features as a

result of its positive impact on nitrogen retention and protein synthesis.

Testosterone and AAS stimulate anabolic processes by

enhancing protein synthesis, suppressing muscle protein breakdown, and rising the variety of

muscle fibres. They also increase the production of insulin-like progress issue 1 (IGF-1),

a hormone essential for muscle growth and repair. Additionally,

they may affect neurotransmitters, affecting

muscle contraction and strength throughout coaching.

Once More, this process is important street names for steroids, http://www.aufzu.de, muscle growth and preventing muscle loss

throughout slicing cycles. Anabolic steroids work by binding to androgen receptors in my

body, triggering a chain response that promotes muscle growth and development.

They improve protein synthesis which is essential

for constructing and repairing muscle tissue. They additionally

improve purple blood cell production so my muscle tissue get extra oxygen and vitamins during intense training.

His verdict is predicated on 10 years of anecdotal

proof and the analysis of two,000 patients’ labs.

SARMs (selective androgen receptor modulators) are

medicine’s try to create superior compounds to anabolic steroids.

Steroids initiate a complex hormonal cascade that drives

muscle hypertrophy.

But even a brief 4-week cycle (of oral Primobolan) will be effective.

The beneficial cycle length is in the 6-8 week range for best results whereas minimizing virilization threat.

If it’s your first Anavar cycle, six weeks at 5 to

10mg is an ideal introduction to this steroid. You

can begin at 10mg for the first six weeks, then increase the dose to 15-20mg for the final two weeks to ramp up your outcomes.

At doses wherever above the female beneficial vary of

5-10mg/day, virilization is undoubtedly a risk.

Some girls could be sensitive sufficient at these low doses to experience

negative effects, but as lengthy as you cut back the dose

or cease utilizing Anavar, they should go away alone.

It’s the anabolic traits which are interesting to athletes,

but as a female, you’ll even be dealing with the undesirable androgenic results.

These authorized steroids deliver exciting power and power, supporting quick recovery and large muscle positive aspects with cyclosome delivery know-how.

Huge Diet Ecdysterone is the highest authorized

steroid if you’re looking for lean muscle mass, protein synthesis, and improved performance.

Authorized steroids are a safe, pure approach to build lean muscle with out the serious unwanted

effects of unlawful anabolic steroids. One of the difficulties in testing for anabolic steroids, as opposed to recreational medication, is that hormones like testosterone and DHT are discovered

naturally within the physique. Effective performance drug testing, due to this fact, wants to have the

power to differentiate between the conventional presence of steroid hormones and those who exist because of exogenous

steroid use. While this could be comparatively easy to detect in females who have naturally very low levels

of testosterone, in male customers, it needs to be undertaken more

rigorously to keep away from false positives. The addition of the thyroid hormone Cytomel in this superior cycle assists in regulating metabolism and vitality.

They have a broad range of merchandise providing a tailored bodybuilding, shedding,

and transformation plan. Based Mostly in your individual fitness targets, choose the merchandise which are suitable for you.

D-Bulk by Brutal Pressure is among the many finest legal steroids that you can find online.

It is better than anabolic steroids due to minimal unwanted

side effects.

Moreover, at least one study from 2012 found that very high quantities of coal tar, corresponding to those

used to seal pavement, increased the chance of

most cancers. There are loads of options to choose from in terms of over-the-counter therapies, every with unique concerns and advantages.

In people with psoriasis, the skin can’t shed as shortly because it must in order to keep up with

the pace of new skin cells. This leads to the formation of thick, pink,

red, purplish or grey scaly, inflamed, itchy plaques on the

pores and skin.

Mild corticosteroids, similar to clobetasone, hydrocortisone skin cream and hydrocortisone

for piles and itchy bottom, can usually be bought over the counter from pharmacies.

Sure, hydrocortisone is a corticosteroid, a kind of steroid used topically to scale back inflammation.

Usually, apply hydrocortisone cream to the affected area two to a few instances day by day.

Such organ enlargement additionally applies to the center,

increasing cardiac mass (10). Tissue enlargement can be frequent while taking

HGH, with people’s noses usually getting greater in measurement over time.

Clenbuterol notably increases heart fee in our patients, which can be supported by analysis

(8). This happens due to excessive adrenaline

production, placing pointless pressure on the guts.

Winsol is a authorized steroid designed to produce the identical results as Winstrol.

Anvarol is the legal steroid for Anavar, one of the

most used chopping steroids on the earth.

We have evidence to recommend that Crazy Bulk’s authorized steroids do work, primarily

based on our anecdotal experience of sufferers trying their supplements.

Loopy Bulk also has thousands of verified buyer critiques on third-party

platforms and optimistic suggestions on social media profiles.

Legal steroids haven’t caused any virilization-related unwanted

facet effects in our female patients. Nonetheless,

we recommend buying from a reliable model to

make certain you are getting real legal steroid alternate options (instead of a spiked product).

Though legal Weight loss steroids [https://cascadeclimbers.com/]

steroids are in pill type, they do not appear to

be taxing on the liver like oral anabolic steroids.

Consequently, we see customers hold all of their positive aspects from authorized steroids,

versus those that usually lose measurement after taking anabolic steroids (due to the physique shifting into a catabolic state post-cycle).

Also, people that have had bronchial asthma or hay fever (or a family history of those conditions) are vulnerable to eczema.

The similar is true for individuals with pre-existing pores and skin inflammation. If drugs don’t

help, your eczema could have a unique cause.

Pores And Skin lotions, airborne allergens, and other irritants may cause localized versions of eyelid

eczema. While Benadryl oral is considered secure, Benadryl spray

must be used with warning as a end result of presence of alcohol.

Anabolic-androgenic steroids (AAS) are lab-made testosterone supplements.

They’re never a good selection for building muscle tissue or strength because of their quite a

few unfavorable side effects. Prospects reward this hydrocortisone

cream, with one customer noting it performs higher than Eucerin and pure merchandise.

During this remedy, you stand in a cupboard with a light-emitting machine, wearing goggles and minimal clothing,

such as underwear. It might take a couple of months and multiple classes for you to begin seeing results.

Your doctor may recommend combining phototherapy with other treatments.

If you might have eczema, you even have the next

likelihood of having allergic reactions, which can make your pores and skin situation worse.

Antihistamines can help management the inflammation and itch from allergies.

If you discover another effects, examine along with your healthcare skilled.

Frequent unwanted side effects of methylprednisolone are

similar to those of prednisone and might include increased appetite,

weight gain, mood adjustments, insomnia, fluid retention, and elevated

blood sugar ranges. Long-term use can result in more critical unwanted facet effects

corresponding to osteoporosis, cataracts, and elevated

threat of an infection. Permitted datasheets are

the official source of information for medicines, together with approved uses, doses, and safety information.

Examine the person datasheet in your nation for information about medicines.

A topical steroid is absorbed in numerous rates relying on pores and skin thickness.

70918248

References:

d ball steroid (https://www.eils.Or.id/)

70918248

References:

what is gear bodybuilding (reservationslunel.groupe-lentrepotes.fr)

70918248

References:

none (Alphonso)