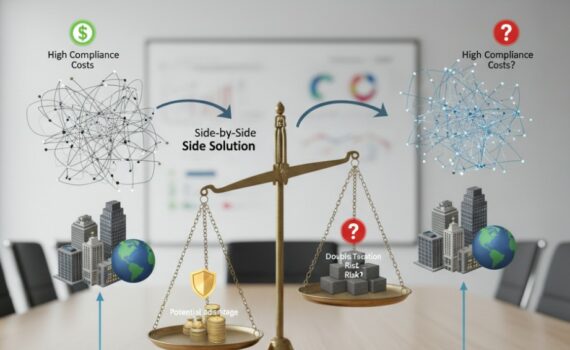

Does the G7 Global Minimum Tax “Side-by-Side” Solution Give US ...

The G7’s proposed “side-by-side” solution for a global minimum tax has raised the question of whether it would […]

The G7’s proposed “side-by-side” solution for a global minimum tax has raised the question of whether it would […]

Living abroad as a U.S. citizen comes with unique tax challenges, especially when you own or are a […]

Dr. Mosquera Valderrama describes the EU’s tax policy as “a little confusing,” citing the multitude of projects and […]

In today’s digital age, many Americans are generating income through social media platforms. Whether it’s through sponsored posts […]

The UTPR is a key enforcement mechanism under the OECD’s Pillar Two framework, designed to prevent tax avoidance. […]

Taxes are often seen as a dry and mundane topic, but a look into America’s past reveals a […]

The One Big Beautiful Bill Act (OBBBA) introduces significant changes to federal tax policy, many of which directly […]

The 2025 legislative session in Alabama proved to be a pivotal period for tax policy, with the enactment […]

While the previous administration’s tariffs initially exempted crude oil and some energy-related minerals, these exclusions won’t shield the […]