How To Setup An IRS Payment Plan, Guide and FAQs ...

This guide will go over setting up an IRS payment plan. This is part of our Tax Help Guide, […]

This guide will go over setting up an IRS payment plan. This is part of our Tax Help Guide, […]

If you are sending in multiple tax returns to the IRS or state, do not stuff them all […]

Get Free Money Back: Just Ask For a First Time Penalty Abatement The IRS offers a penalty abatement […]

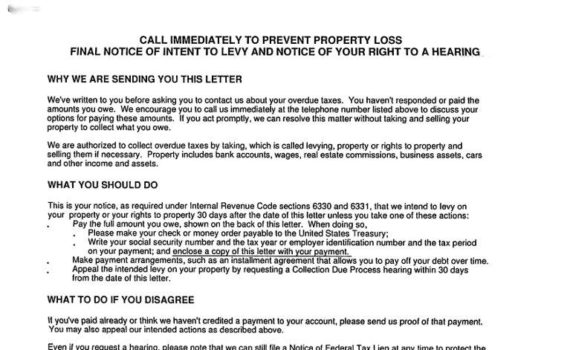

The IRS collection process is the procedures the Internal Revenue Service implements to collect on a debt. The […]

When you get a 1099-C (Booklet|Form), you are credited with income for a debt that was canceled. First, […]

Many taxpayers are getting calls from a person named Daniel Wiseman in the form of a voicemail stating […]

The IRS sends a series of letters before they take actual collection action on you. Here we will […]

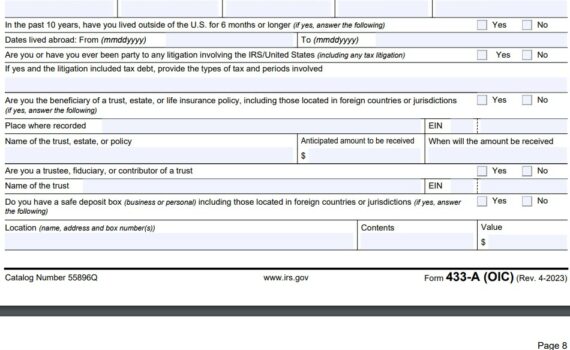

Form 656: Filling It Out This guide will explain how to fill out IRS Form 656 (Booklet|Form), which […]

This article covers how to withdraw an IRS lien. If you have active liens and debts that are […]