California Franchise Tax Board Liens: How to Resolve Them

Getting constant reminders from the California Franchise Tax Board (FTB) of your unpaid tax debt is not something […]

Getting constant reminders from the California Franchise Tax Board (FTB) of your unpaid tax debt is not something […]

An IRS Demand Letter is a notice from the IRS stating that you owe them a certain amount […]

Getting an NYS tax lien removal through is not that easy. The way to get it done is […]

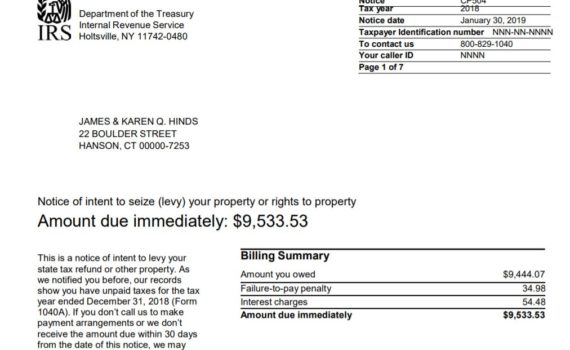

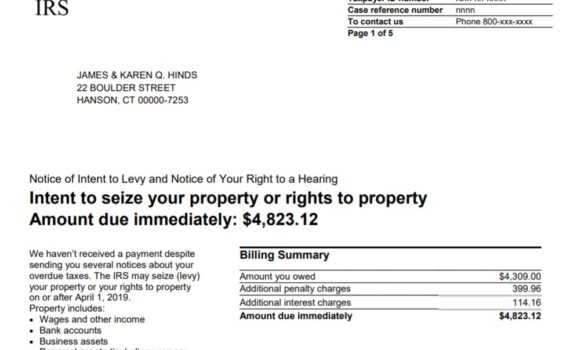

Getting an LT11 notice means that the IRS intends to levy your property or rights to property. It […]

A part of the IRS duty is to remind taxpayers if they have any outstanding taxes. They send […]

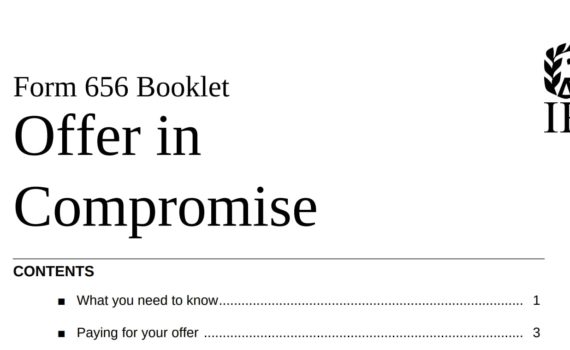

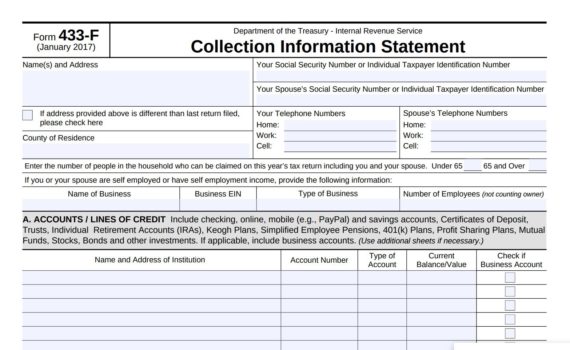

One of the programs that the IRS offers to those who cannot pay their tax debt is through […]

Tax relief is a category that encompasses many options. Here we go through and explain the various options […]

Where your collections case is handled depends on the balance and tax type. The IRS collections process can […]

When you have a financial liability with the IRS, beginning your settlement is often the toughest step. Penalties […]