Form 656: Filling It Out

This guide will explain how to fill out IRS Form 656 (Booklet|Form), which is used to submit an Offer In Compromise to the Internal Revenue Service. This is part of our guide on How To Do Your Own Offer In Compromise. By using this form paired with the IRS Form 433-A(OIC), if you qualify for an Offer In Compromise you might be able to settle your tax debt for less than 1% of what you owe. This covers Form 656 if filling it out for individual taxes. You can read our complete Offer In Compromise Guide to get an idea if you qualify and prepare it yourself if you want to.

We will go section by section to tell you what to fill out. This guide covers filling out an Offer In Compromise for individuals.

Updated 5/21/2017: Adjustments for 2017 IRS OIC Forms.

Updated 6/06/2018: Adjustments for 2018 IRS OIC Forms.

Updated 4/03/2019: Adjustments for 2019 IRS OIC Forms.

Updated 6/16/2021: Adjustments for 2021 IRS OIC Forms.

Updated 7/11/2022: Adjustments for 2022 IRS OIC Forms

Updated 12/13/2023: Adjustments for 2023 IRS OIC Forms

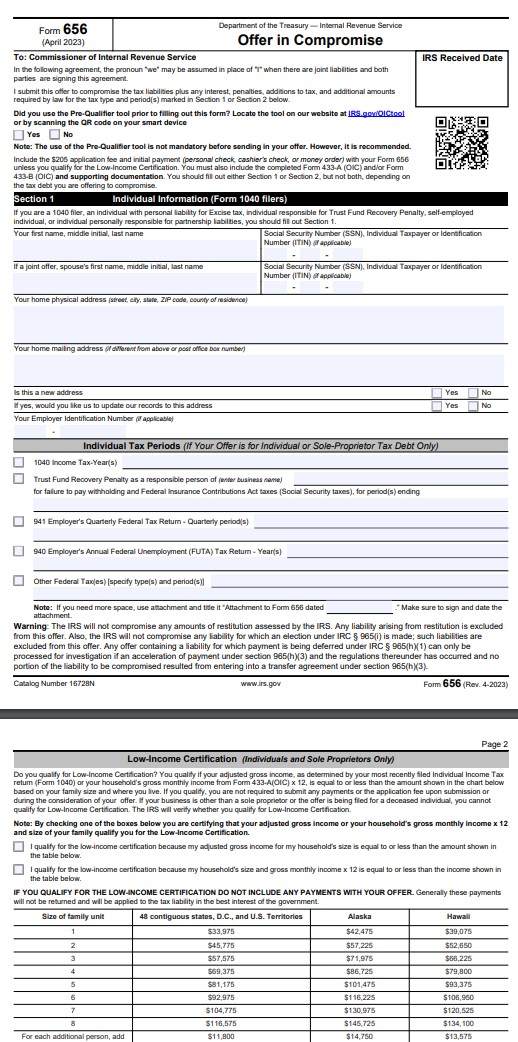

Section 1: Basic Information

On top, check whether or not you used the IRS pre-qualifier tool. In most cases, it is a good idea to before you start. It is not always right and sometimes you can still get an Offer In Compromise.

Individual Information

Fill out your name, SSN, physical address, and mailing address if different. Include your spouse’s name and SSN if the offer is for joint tax debt.

Individual Tax Periods

Fill out all the periods you owe for and check the appropriate boxes. For most people, it is going to be Form 1040. For payroll tax debts that are personally assessed against you that was from a corporation, LLC, or LLP, you will check and fill out the Trust Fund Recovery Penalty section. If you were a sole proprietorship with 941 Payroll or 940 Unemployment taxes, make sure to check the appropriate box. The last box “Other Federal Taxes” should contain any taxes not listed in the above taxes that are owed An example here could be the Heavy Highway Use Tax. If you owe more than one type of tax makes sure to include them all.

If the year is almost over and you will owe on the current year, file your tax return as early as you can in the next year. Then file a settlement to include that year as well in the offer. For example, if it is 12/01/2016, and you will owe on 2016 also, file your 206 Form 1040 by the end of January 2017. Get your 2016 tax return done and submitted before submitting your settlement.

You must keep up on your current taxes. This means adjusting your payroll withholding to the correct amount if a wage earner or making estimated tax payments if self-employed. See our Estimated Tax Payments Guide for more information. The IRS has gotten more strict on this in 2016 and 2017.

Low-Income Certification

Take a look at the chart and compare the figures listed with how many dependents you have. If you make $2,529 or less and are single or a couple with no other dependents making $3,429 or less and living in the mainland 48 states, you do not need to pay a down payment with the Offer In Compromise or the $186 application fee. The full breakdown of what the qualifications are for a fee waiver is directly on the form. Ignore the two boxes regarding payments made below the low-income certification check box. Do not make any payments if you are using low-income certification. Keep it simple.

Make sure to add up all your dependents and do not use this option if you do not really qualify. The Offer may get rejected or they will send you another letter asking for the payments, and it just delays your Offer from processing quickly. If you get a letter stating you do not qualify for the fee waiver and you do in fact qualify, send a written response to the IRS by certified mail within 30 days of the letter’s date.

As of late 2017, we are seeing IRS ask for the payment and have not seen them outright reject it as they have before.

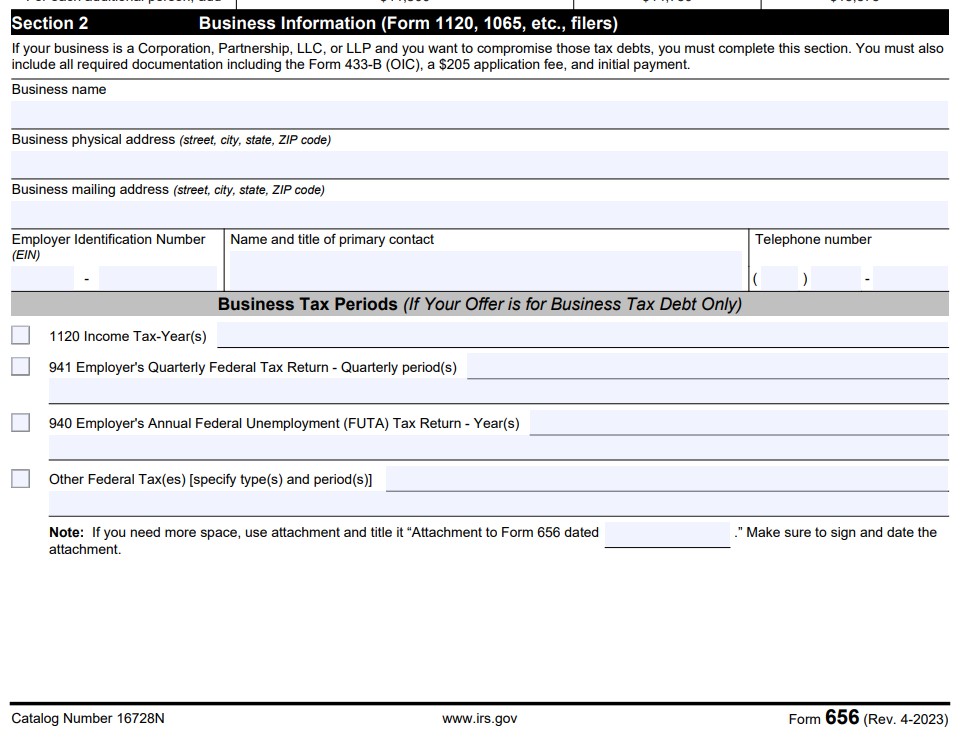

Section 2: Business Information

Skip this section if you are filing an individual offer in compromise, even if you run a self-employed sole proprietorship. This section is only for Corporations, LLCs, and Partnerships, which we will cover in a separate guide. It is strongly recommended to get a tax attorney for business debts. We are tax attorneys in Las Vegas, but we can help you nationwide.

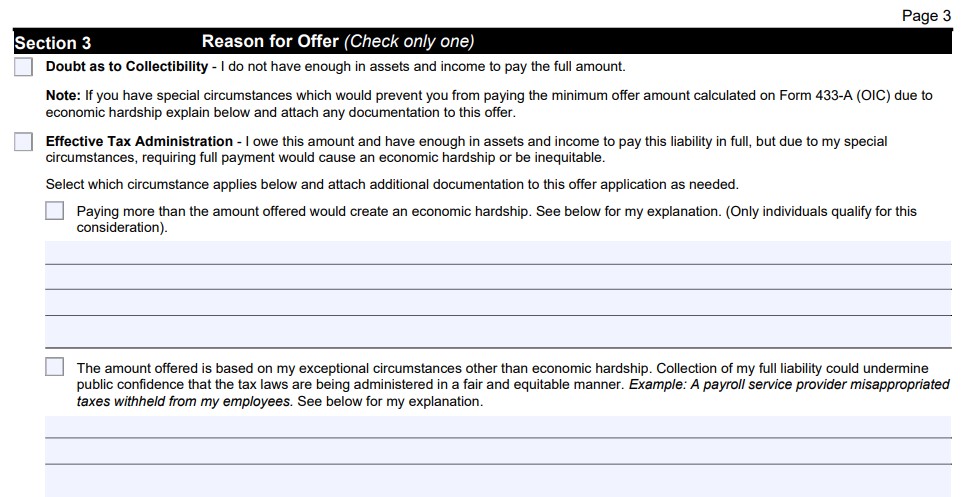

Section 3: Reason for Offer and Explanation

Reason for Offer

Select the reason for the offer, either “Doubt as to Collectibility” or “Exceptional Circumstances (Effective Tax Administration).” Almost all Offers In Compromise will be for Doubt as to Collectibility. This means you do not make enough money to pay back the tax debt within the IRS CSED date.

Exceptional Circumstances offers are rarely accepted. These offers are filed when you have enough assets or income to pay off the debt, but requiring you to pay it off would cause hardship or is somehow unjust.

There is a third type of offer called a Doubt as to Liability offer. This guide does not cover that offer type. Those cases are typically more complex and getting an evaluation from a tax attorney is recommended.

Explanation of Circumstances

If you are filing a Doubt as to the Collectibility offer, you can simply state, “I am unable to pay the taxes due to my financial condition.” For Exceptional Circumstances offers, provide a detailed explanation of why it would be unjust for you to be held liable for the tax, even though you have sufficient assets to pay it off. If you have extraordinary costs coming up, taking care of older relatives that you cannot claim as dependents, or something similar. Explain any medical problems you, your spouse, or one of your dependents may have. Attach an additional page if more explanation is needed.

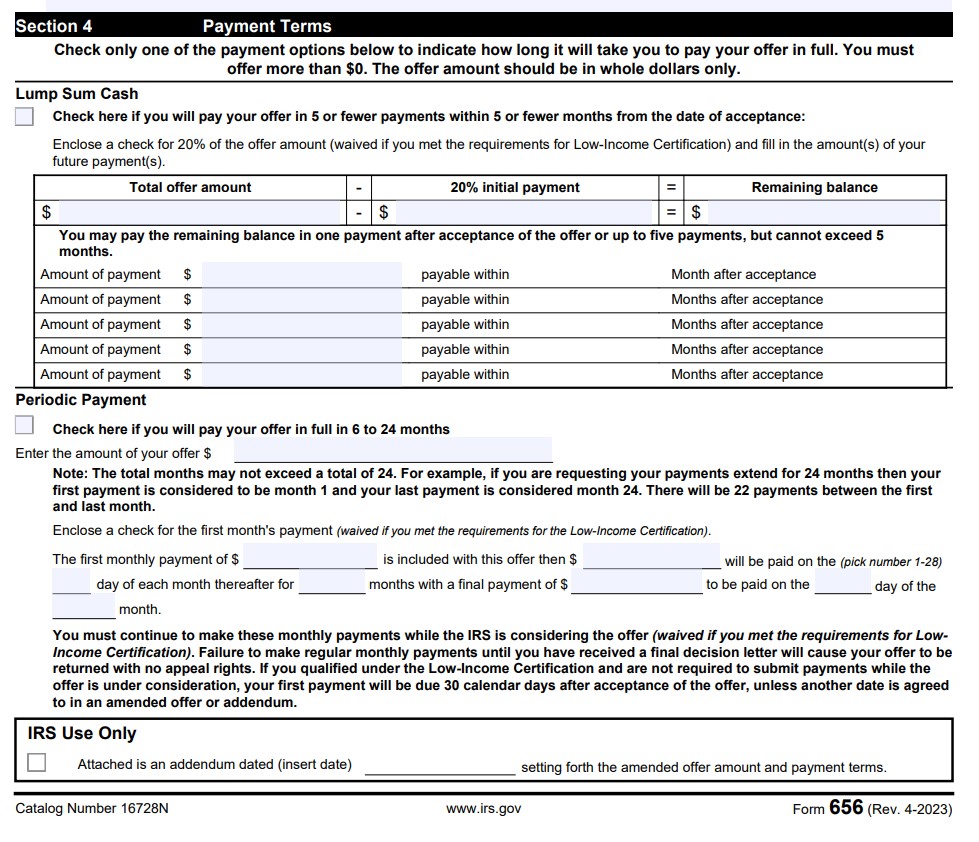

Section 4: How Much Are You Going To Pay and When?

Payment Terms

You have the choice of making a Lump Sum Cash offer or a Periodic Payment Offer. It’s strongly recommended to go with a Lump Sum Cash offer unless you absolutely cannot afford the down payments. The Periodic Payment offer usually costs twice as much!

Lump-Sum Cash Offer

If you select this option, check the appropriate box. Then write the total offer amount in the first box below that, then 20% of the total in the second box, then the remaining 80% in the third box of that row. The rest of the offer has to be paid within 5 months of acceptance. There is no point to use the first four months listed, just put the remaining 80% due next to the “payable within 5 months after acceptance” section at the bottom. If you get the Offer accepted, pay it off earlier than 5 months if you can.

If you qualified for a Low-Income Certification as mentioned above, enter the total Offer amount in the first box, then zero (0) by the 20% down payment, and then the full offer amount in the third box in that row. Put the total offer amount next to the “payable within 5 months after acceptance” section at the bottom.

Periodic Payment Offer

You select this if you intend to pay the offer amount over 6-24 months. This required you to make payments while the settlement offer is pending. This is usually not recommended and the offer amounts are often substantially higher. Additionally, there are situations where the offer is not accepted, but you would have otherwise gotten Currently Not Collectible status, and you wasted money by paying on a Periodic Payment Offer.

If you qualify for Low-Income Certification, you do not need to make any payments while the Offer is pending on a Periodic Payment Offer.

To do a Periodic Payment Offer, check the box for Periodic Payment Offer. In the next box, enter the amount of the entire offer. In the next area list the first Periodic Payment that is included with the offer, the amount to be paid each month, and the day of each month the payment will be sent. On the line below that, enter the total amount of months, the final payment amount, and the day and number of months of that final payment.

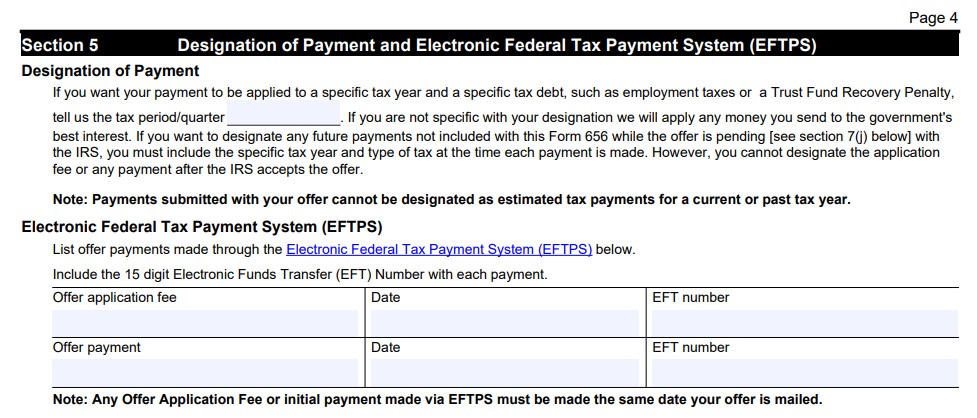

Section 5: Designation of Payment and Deposit

Designation of Payment

In this section you can designate any offer down payments you submit to be applied to a tax period of your choosing should the offer not get submitted. The application fee does not get applied.

Deposit

It is not recommended to send a deposit nor is it required. Why give the IRS more than you have to?

Making Payment For Application Fee and Down Payment

We recommend just writing out checks as opposed to doing the payments online when it comes to Offer In Compromise, which is covered below.

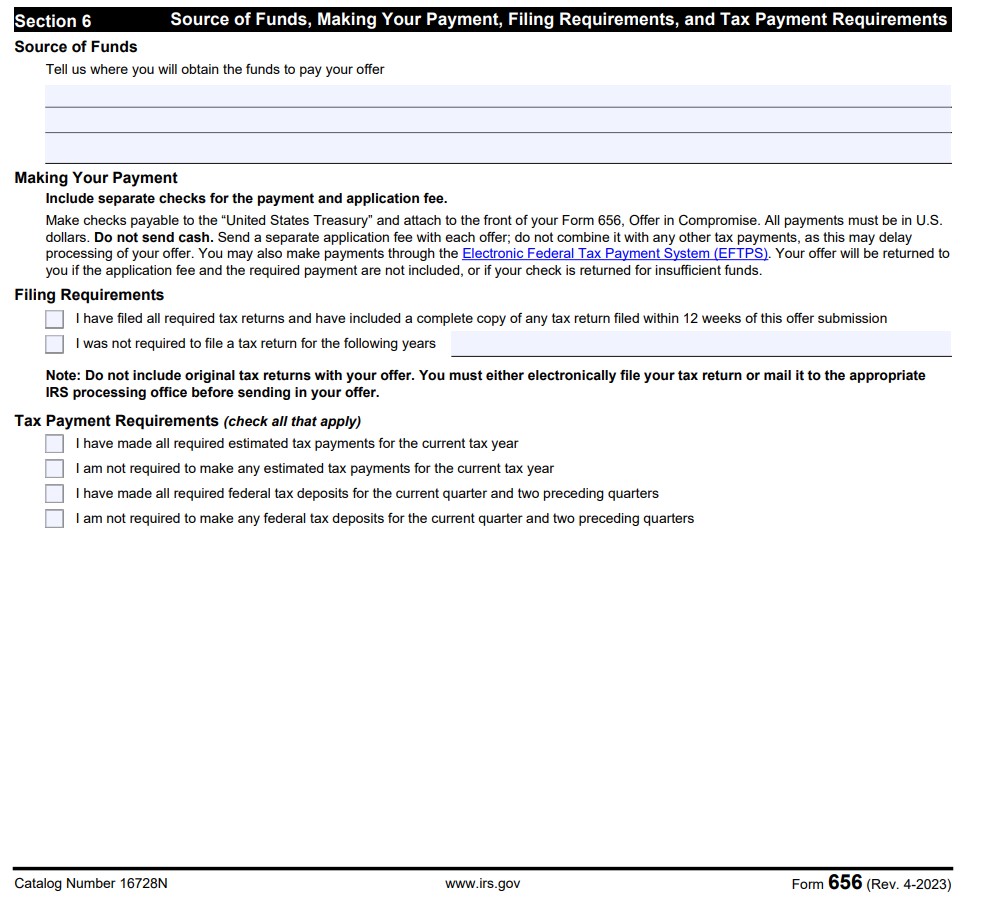

Section 6: Source of Funds, Making Your Payment, Filing Requirements, and Tax Payment Requirements

This section contains some significant changes from the earlier versions, as it now asks about filing requirements and estimated tax payments.

Source of Funds

Simply put where the money is coming from. Good answers include, but are not limited to: Loan from a family member; Loan from a friend; Bank account; Social Security; Wages earned.

Making Your Payment

This section just mentions the checks or money orders you need to send with your offer if you do not qualify for a Low-Income Certification. See above for Low-Income Certification instructions.

Filing Requirements

In order for the IRS to consider accepting an Offer In Compromise, you must have all required tax returns filed. Check the box that you have filed all tax returns, if this is true, and if you were not required to file any tax returns, check the box also that states “I was not required to file tax returns for the following years:” and enter in the line below the years you were not required to file. It’s safe to say the IRS is not looking for tax returns from the 1990s, and most likely has already filed a substitute return for anything from 2009 or before, so input any tax returns you were not required to file from 2009-2015 (this is as of June 21, 2016).

Pro Tip: Don’t always go back and file a bunch of old tax returns. If the IRS has done Substitute For Returns for you and you are in financial hardship, there is a reason not to file if the filed return would also owe a balance. First, if you file these returns you open up the statute of limitations period for the IRS to collect on you for another 10 years. Second, if you end up with Currently Not Collectible status, but do not qualify for an Offer In Compromise, you would have gotten out of the debt sooner by just leaving it as is. Dealing with this can change case by case, and it’s recommended you consult with a tax lawyer if you are unsure. There are cases also where one owes nothing after the return is prepared, in those cases, the returns should be filed.

Tax Payment Requirements

This has four check-boxes, and you should check all that apply:

- I have made all required estimated tax payments for the current tax year. (This means: are you current with estimated tax payments? If you made so little you were not required to make payments, make sure to check the second box. If you have not made estimated tax payments but are required to, see our Estimated Tax Payments Guide and get some in before you send your offer in.)

- I am not required to make any estimated tax payments for the current tax year. (If you are generally not required to make estimated tax payments, check this box. This includes almost all wage earners, Social Security recipients, and those living off of disability payments. If you are self-employed but made so little money you believe you are not required to make estimated tax payments, also check this box. )

- I have made all required federal tax deposits for the current quarter. (This box is referring to 940 and 941 taxes, and only applies to businesses and self-employed persons who have employees. If you are one of these people, make sure to get current on your tax deposits before you submit your offer. For our clients who are behind on payroll taxes, we recommend they switch to an automatic, online service, and pay people weekly. We use Gusto (formerly Zenpayroll) and recommend it to our clients as it’s the easiest system out there and cheaper than most accountants.

- I am not required to make any federal tax deposits for the current quarter. (If you have no employees, check this.)

Pro Tip: Towards the end of 2016 and for 2017, the IRS has been much more strict on estimated tax payments being current in order for them to continue processing your settlement. They used to be laxer and let you catch up when you filed the return as long as you had some payments. If you are heading towards the end of the tax year and in no way can keep up, file your tax return early in January of the next year. Then keep up that year and file your OIC.

Section 7: Offer Terms

Read this section but nothing to fill out. The main point is the IRS takes refunds while the Offer In Compromise is pending and takes the refund of the tax year in which the offer is accepted.

How do you avoid the IRS taking these refunds? Don’t give them the money! Have your tax withholding set to where you do not overpay or underpay at the end of the year. Essentially refunds are from over-withholding taxes during the year, so set your paycheck or your estimated tax payments correctly and you won’t owe or get a refund. This might be a bit confusing to get just the right figure so you may want to ask your tax preparer or a tax lawyer. If you do owe on a new tax year within five years and have an accepted Offer In Compromise, make sure to pay that balance in full or you will default the settlement. Not filing your tax returns on time over the next five years can also default your settlement.

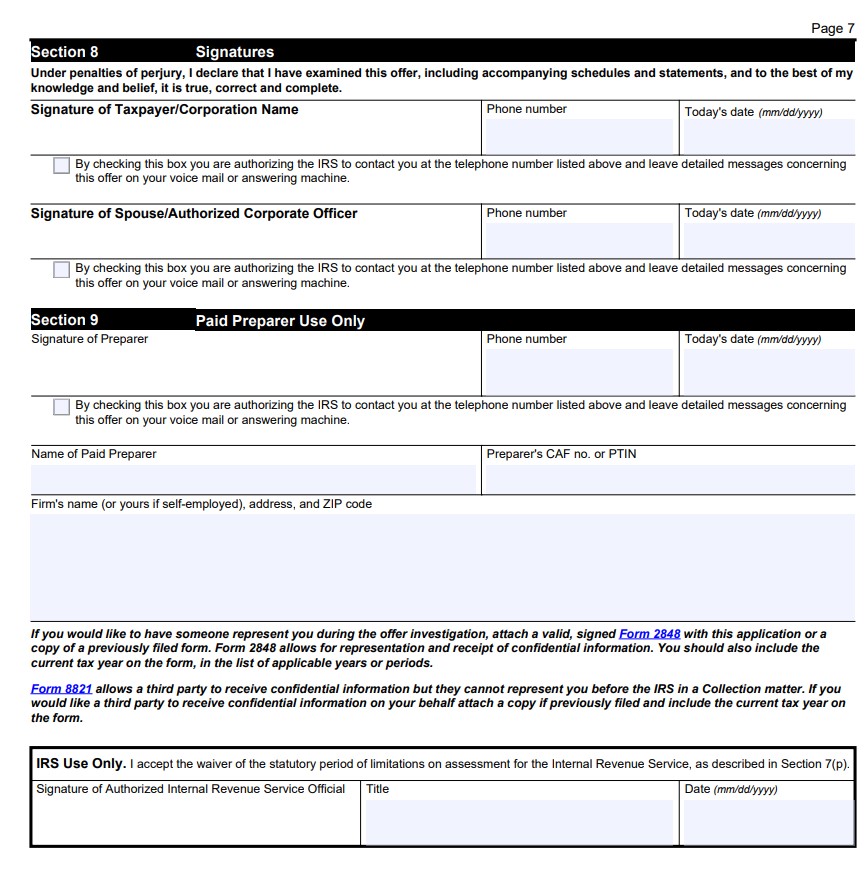

Section 8: Signatures

Sign, put in your phone number, and date. Have your spouse do the same if it’s a joint offer. Check the box so they can call you. If you have a tax attorney you do not need to check the call box. They will call your attorney instead.

Section 9: Paid Preparer Use

If you are self-preparing your Offer In Compromise leave this section alone. When we do it for you (or another tax professional), they put their information in there, sign, and date.

Two Checks

If you do not qualify for a Low-Income Certification, then you need to include two checks with your IRS Offer In Compromise.

Check One – Application Fee

Write out a check for $186 to the “US Department of Treasury.” Write in the memo line of your check your Social Security Number (Primary if a joint offer) and “OIC Processing Fee.” The format for the memo line should be: “SSN 555-55-5555, OIC Processing Fee.” Make sure the check also has your name, address, and phone number. Add these to the memo line if it does not.

Check Two – Down Payment

Write out a check for 20% of your total offer amount to the “US Department of Treasury.” Put in the memo line “OIC Down Payment” and your Social Security Number. The format for the memo line should be: “SSN 555-55-5555, OIC Down Payment” Make sure the check also has your name, address, and phone number. Add these to the memo line if it does not.

Pro Tip: Use a paperclip to attach the two checks to the front of the Offer In Compromise documentation. The IRS has lost checks before and will do it again.

Conclusion

Make sure you pair this form with IRS Form 433-A(OIC) and see our guide on filling out IRS Form 433-A(OIC). Add both forms together and see the rest of our Offer In Compromise guide to getting everything ready to send out!

Don’t want to deal with the IRS, got better things to do with your time, or does this just seem all too confusing? To have a free, no-obligation consultation with one of our expert tax attorneys, fill out our contact form or call us at (888) 515-4829 and we’ll get back to you quickly!