Michigan Offer In Compromise: The Easiest of The Bunch

Getting a Michigan Offer In Compromise (OIC) is in our opinion is the easiest state offer in compromise you can do. Our tax law firm is in Las Vegas, but we help people with tax problems nationwide. We have probably done more Michigan cases than most practitioners in Michigan! So we wrote this guide to help you do your own if you are unable to get representation and to help our clients better understand the process. This guide covers Michigan Individual OICs based on doubt as to collectibility. For doubt as to liability settlements, they are very case by case and it is even more strongly recommended to contact a tax attorney.

Below is a brief video explanation and you can keep reading on for written instructions.

Why are Michigan OIC’s easier than other states? Well, if you get an IRS Offer In Compromise accepted, Michigan will usually just accept one as well without that much additional paperwork. Michigan suspends collection activity when a case is in “pending” OIC status. They put it in pending once they get all the required documentation and payment from you.

Initial Requirements

Not everyone can apply for an Offer In Compromise. Here are the initial requirements to be eligible for consideration on your submission from the MI webpage (my suggestions in parenthesis). All of these must be true:

- The taxpayer must have been assessed for the tax liabilities specified in the proposed

offer in compromise. (You have to actually owe the money.) - All opportunities for the taxpayer to contest the assessed tax liability in the informal

conference and appeal the assessed tax liability to the Michigan Tax Tribunal or the

Court of Claims must have expired. (You owe the debt with no appeal rights.) - The taxpayer must have filed returns for all applicable taxes for all outstanding tax years. (All returns must be filed for by you for any years you are trying to settle.)

- The taxpayer must have no open bankruptcy proceedings. (You cannot be in a pending bankruptcy. If the tax debt is your largest debt, often bankruptcy is not the way to go. See our Bankruptcy or Offer In Compromise guide.)

Two Ways to A Michigan Offer In Compromise for Doubt as To Collectibility

With Michigan, there are two ways to submit an OIC based on your inability to pay. The first is to fill out a bunch of financials and send it into Michigan with all the required forms. The second, and easier way, is to submit information showing that your IRS OIC was accepted. Then Michigan typically responds in a few months with their own acceptance.

If your case is already in collections with Michigan you may want to submit a full OIC right away. But, if you have time to submit and have accepted an IRS OIC first, you can then submit the Michigan OIC that just requires you to prove an IRS OIC was accepted. This takes less time and is easier. Some people want to get it done faster or they owe taxes to Michigan and not the IRS, so they then have to do a full Michigan OIC.

In this guide, we are covering the easy way to do a Michigan Offer In Compromise. Most of our clients prefer this method but we give the option to do either. Please note it is not guaranteed that Michigan will accept an OIC because the IRS did. However, it’s way more often than not they do.

Michigan OIC Based on IRS OIC Acceptance

First, you need an IRS Offer In Compromise to be accepted. See our IRS Offer In Compromise Guide. You may also have found this guide if you hired a regular tax relief firm that did not address Michigan. If that is the case, make sure you have copies of all your paperwork.

The forms you will need are Form 5181, Form 5182 Schedule 1, and Form 5489 (Click to download them in one packet). These are the forms specifically used when you have an IRS OIC that has been accepted.

Filling Out Form 5181

Form 5181 Michigan Offer In Compromise

This is the equivalent of IRS Form 656. Mostly it contains basic information.

Part 1: Taxpayer Information

Here fill out your name, address, SSN, and all the data it asks for. This section is mostly self-explanatory. Skip the business taxpayer section.

Part 2: Reason For Offer

Check the first box that says “I have received an accepted federal offer in compromise.”

Check the fourth box that says “I have made an online payment of $100.00 or 20% of the offer, whichever is greater, at www.michigan.gov/collectionseservice” if you are paying online. Leave blank if paying by check.

Make the payment of $100 (or greater) online at www.michigan.gov/collectionseservice

Instead of making an online payment, you can not check the fourth box and instead include a check for $100. The check should be made out to the Michigan Department of Revenue. On the memo line of the check right your collections account number and “OIC Payment.” You need to make a payment greater than $100 if you are submitting a higher dollar offer amount. It has to be 20% of the total offer. We recommend in most cases going with a $100 offer. If Michigan wants more later that’s fine, but might as well go the cheapest upfront.

Part 3: Offer and Payment Terms

First Section

Put in $100 for the Total Offer Amount, then $100 in the text box, and $0 in the last box. If you are paying more than $100, fill it out accordingly.

Second Section

Select Lump Sum. All $100 offers are going to be a lump sum. If you are submitting more fill out accordingly. Skip installment plan of 6 months or more. There is almost no reason to fill that out unless you are working on an amended OIC with MI.

Part 4: Source of Funds

Michigan wants to know where the money came from. For most people, it is just going to be a “Bank account.” If something else, specify.

Part 5: Offer Terms and Conditions

Nothing to fill out here. Read this as it is the full terms of the settlement. Pretty much if you defraud them they can bring back the liability. If you have another debt later and do not pay, they can bring back the liability. They also publish the Offer In Compromise details on a website. They also can disclose your name to the public if the public is inspecting Offer In Compromises for Michigan.

Part 6: Taxpayer Certification

Here you write in your name, sign, and date. If a joint offer makes sure your spouse does it as well.

Part 7: Third-Party Designated Representative

This section is only filled out if someone is representing you. If they are, they should be filling out this and the entire form.

Filling Out Form 5182 Schedule 1

This form is used when you have an accepted IRS OIC.

This form is used when you have an accepted IRS Offer In Compromise and the type of Michigan Offer In Compromise we are going through in this guide.

At the top of the page, there is a checklist for the information that you need. I will go through each part of that first. The first part of the form is a checklist. This lists the information you will need to submit with your Offer In Compromise. On top, there are four check-boxes that are a list of information you need. The fourth box is only if you have a representative. If you do, they should be filling this out for you. Otherwise, check all the top three boxes and make sure you have that information available. Send copies not originals to MI. The information needed is: IRS Offer In Compromise (and any amended versions you sent in), a copy of the IRS Offer In Compromise acceptance letter, and IRS account transcripts for each tax year that was settled. See our guide on how to order IRS transcripts if you need that information.

Part 1: Taxpayer Information

Put in your name, SSN, address, and phone. If this is a joint offer put your spouse’s information as well.

Part 3: Certification

Sign and date. Have your spouse sign and date as well if joint. No need to put title since this is not a business settlement. It looks like this was intended to be Part 2, but Michigan instead put two Part 3’s, an error on their part.

Part 3: Michigan Assessments Affected by an Accepted Federal Offer In Compromise

First, on the top right corner of the page, write in the primary Social Security Number associated with the Offer. For Michigan, they will potentially settle all the debts that were also settled in the IRS OIC. If you have additional debts beyond those years to the State of Michigan, it is recommended to file a complete OIC with a financial statement. There are then three sections to fill out with details regarding your MI debts: Assessment Number, Tax Type, Tax Year/Period, and Balance Due.

Assessment Number

These can be found on your most recent Final Assessment bill or other collections notices. When we do these, we call MI collections and ask for each one to make sure we get it right. You can reach them at (517) 636-5265. Sometimes relying on just mail received, you might miss something. Generally though if you have an IRS debt for a year, good chance you have an MI debt as well.

Tax Type

For the type of case we are discussing here, type Individual Income. If you have payroll taxes that were personally assessed against you, you are best off contacting a tax attorney.

Tax Year/Period

The year for which the tax is due.

Balance Due

The amount due. Put this based on the last notice you received.

Total Balance Due

On the bottom right of the page put the totals of all the balances due in the.

Filling Out Form 5489

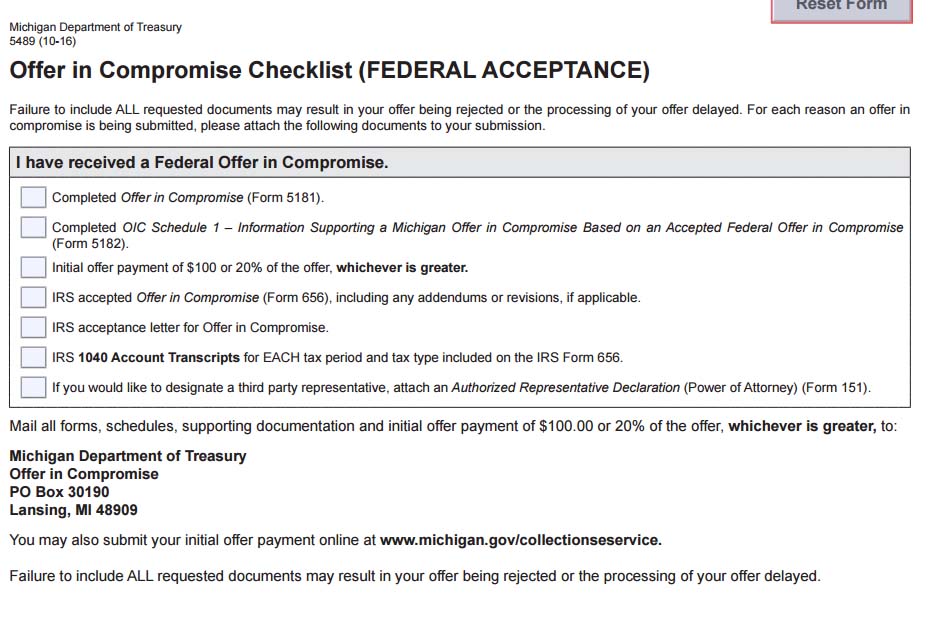

This is a checklist for your Michigan OIC.

This form is for your personal records. Go through it all and make sure you have everything ready to submit to Michigan. These are the items you need to send:

- Completed Offer in Compromise (Form 5181).

- Completed OIC Schedule 1 – Information Supporting a Michigan Offer in Compromise Based on an Accepted Federal Offer in Compromise (Form 5182).

- Initial offer payment of $100 or 20% of the offer, whichever is greater.

- IRS accepted Offer in Compromise (Form 656), including any addendums or revisions, if applicable (copy).

- IRS acceptance letter for Offer in Compromise (copy).

- IRS 1040 Account Transcripts for EACH tax period and tax type included on the IRS Form 656.

- If you would like to designate a third-party representative, attach an Authorized Representative Declaration (Power of Attorney) (Form 151). This is only if you have a representative. If you do, they should be doing all this for you.

Sending Out Your Michigan Offer In Compromise

Make a complete copy of the Michigan Offer In Compromise you are sending out and save it. Then mail your documents with wet signature and payment to:

Michigan Department of Treasury

Offer in Compromise

PO Box 30190

Lansing, MI 48909

It is strongly recommended to send it out by USPS certified mail with a return receipt.

Does this seem like too much of a headache to do your own Michigan Offer In Compromise? Let us do it for you! Fill out the contact form here or call us at (888) 515-4829.and we will call you back.