IRS Collections During Coronavirus: Here’s What’s Happening

During the 2020 COVID-19 / CoronaVirus pandemic, the United States IRS is offering a special plan regarding collections […]

During the 2020 COVID-19 / CoronaVirus pandemic, the United States IRS is offering a special plan regarding collections […]

Here is what to do when you have 10 or more years of unfiled tax returns. Not all […]

Whether it’s for convenience, to seek professional help or any other reason one may have, there are those […]

If you are a taxpayer who owes back taxes, then you might have wondered at some point how […]

What is an NYS Wage Garnishment? An NYS Wage Garnishment or what is referred to as Income Execution […]

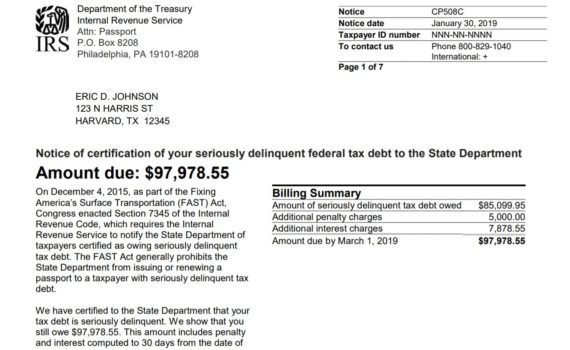

When the IRS sends you a CP508C Notice, it means that your unsettled tax debt has been reported […]

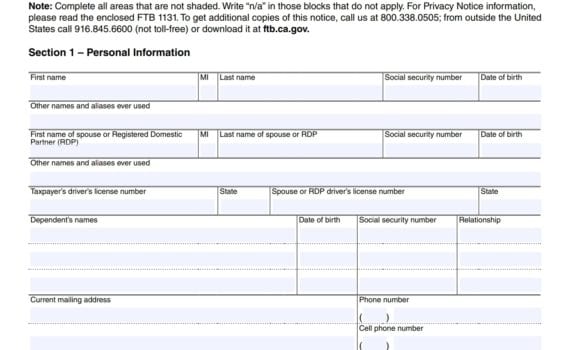

An FTB Wage Garnishment is an order issued by the California Franchise Tax Board if they see that […]

Getting constant reminders from the California Franchise Tax Board (FTB) of your unpaid tax debt is not something […]

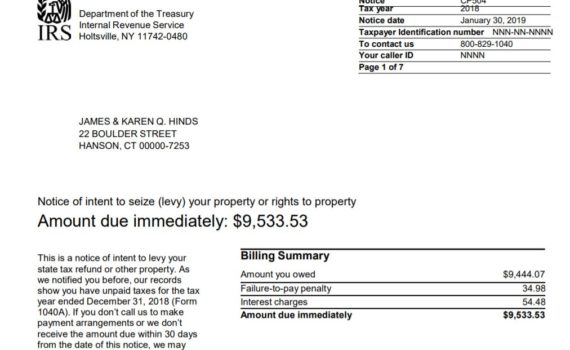

An IRS Demand Letter is a notice from the IRS stating that you owe them a certain amount […]